Wow: Robinhood’s 3% Money Again Credit score Card

Funding platform Robinhood is launching a bank card, and it virtually sounds too good to be true.

Particulars of the profitable Robinhood Gold Card

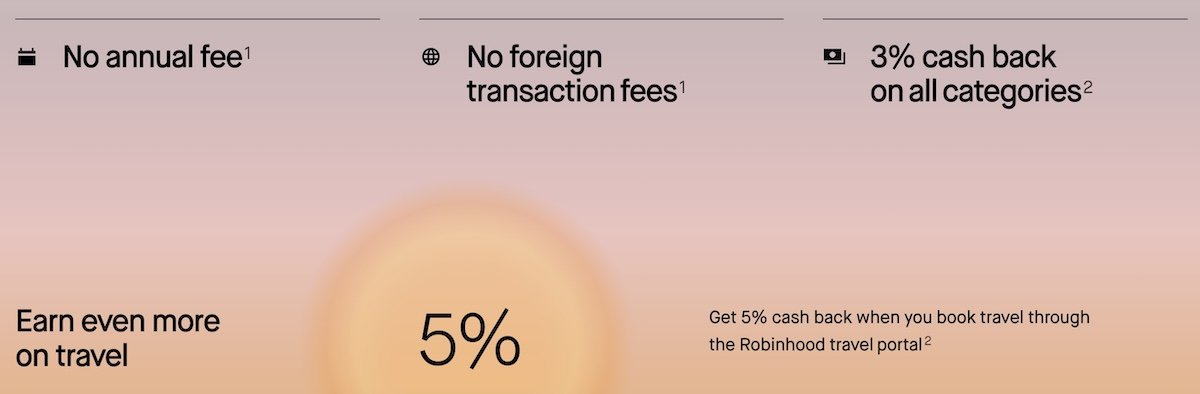

The Robinhood Gold Card will quickly be coming to market, issued as a Visa Signature Card. The cardboard isn’t but open for functions, however you possibly can add your self to the waitlist, with a launch anticipated later this 12 months. The cardboard has a quite simple worth proposition, as it’ll provide 3% money again on all purchases with no caps. That’s fairly actually unparalleled, and clearly sounds too good to be true.

To cowl some extra of the main points of the Robinhood Gold Card:

- The cardboard will provide 3% money again on all purchases, and 5% money again on journey booked by means of Robinhood’s journey portal, all with no overseas transaction charges

- The cardboard will allow you to redeem money again in quite a lot of methods, together with transferring the rewards to your Robinhood brokerage account, reserving journey by means of Robinhood’s journey portal, procuring with associate retailers, and extra

- The cardboard received’t have an annual charge, however you’ll must be a Robinhood Gold member to get the cardboard, with a membership costing both $5 per 30 days or $50 per 12 months

- The cardboard will weigh 17 grams and might be manufactured from stainless-steel; in the meantime when you refer 10 folks to Robinhood Gold, you’ll obtain a “restricted version Strong Gold Card”

- The cardboard will provide quite a lot of Visa Signature perks, together with journey interruption safety, auto rental collision injury waiver, prolonged guarantee safety, journey and emergency help, and extra

It’s fascinating to notice that final 12 months, Robinhood acquired bank card startup X1 for $95 million, and it seems that this bank card launch is basically primarily based on that idea.

Is the Robinhood Gold Card too good to be true?

Over time we’ve seen bank card rewards get richer and richer. Whereas there are many methods to earn journey rewards with bank cards, at a minimal you have to be incomes the equal of two% money again on all purchases, or else you’re leaving cash on the desk.

Nevertheless, the idea of a 3% money again bank card with no caps is unparalleled. That’s greater than the service provider charges, that means that Robinhood can be shedding cash on each single transaction, relatively than earning profits. Is there any world wherein a loss main bank card like that is sustainable?

On the one hand, there’s doubtlessly nonetheless fairly a little bit of upside for Robinhood:

- This may encourage folks to turn into Robinhood Gold members, which prices at the least $50 per 12 months, so consider that as an oblique annual charge

- Many bank cards provide large upfront sign-up bonuses, whereas I suppose one may argue that Robinhood is as a substitute allocating that funding into ongoing rewards

- This would definitely assist Robinhood construct large market share as an funding platform, since this can be a card that many individuals would in all probability be focused on

- Some folks will finance costs, which is one other approach that bank card corporations ordinarily earn cash

- The typical particular person isn’t spending a whole bunch of 1000’s of {dollars} per 12 months on bank cards, so the corporate’s per-person loss on the cardboard might be minimal for many prospects

Alternatively, this actually does sound too good to be true. I imply, you possibly can pay your federal revenue taxes by bank card with a charge of underneath 2%, so you would revenue greater than 1% in your tax funds.

Then once more, for these of us who’re savvy with utilizing bank cards, this card may not get us a better general return than we’ve got by utilizing a bank card portfolio that takes benefit of bonus classes. However for on a regular basis, non-bonused spending, this stage of return is unparalleled.

Let’s wait and see when this card launches, as I can’t assist however marvel if there is likely to be some surprises.

Backside line

Robinhood is planning on launching the Gold Card later in 2024, which can provide 3% money again on all purchases with no caps. That is an unparalleled return on on a regular basis spending, and Robinhood would lose cash on every transaction.

It’s fascinating to see an funding platform basically attempt to make a bank card a loss chief so as to get folks on the platform. I’ll reserve last judgment till the cardboard launches, however I certain am intrigued…

What do you make of the Robinhood Gold Card?