New Bilt Credit score Playing cards & Housing Rewards Launch, And Every little thing Adjustments

Hyperlink: Apply or improve your present card to the no annual price Bilt Blue Card, $95 annual price Bilt Obsidian Card, or $495 Bilt Palladium Card

Just a few weeks in the past, we discovered how main modifications are coming to Bilt, the platform that’s identified for letting individuals earn factors for paying hire, with out racking up any charges. We’ve identified that Bilt is discontinuing its one Wells Fargo bank card, and transitioning to having three Cardless bank cards. Not solely that, however the way in which that members are rewarded for paying hire is altering as nicely.

I’d like to supply an replace, as at this time is an enormous day, because the transition to the brand new Bilt Card 2.0 platform is underway. Nearly all the things is altering, from how housing funds are rewarded, to the rewards buildings and perks of the bank card(s). Let’s cowl all the things we all know.

Bilt’s new system for awarding factors for hire & mortgages

Earlier than we even speak concerning the particulars of the brand new bank cards, let’s focus on how rewards for hire are altering. I don’t need to bury the lede, so to place this as merely as attainable, no matter which bank card you could have, you’ll must spend a mean of 75% of your hire or mortgage quantity on the cardboard (give or take) with a view to earn 1x factors.

To debate that in a bit extra element, traditionally, these with the Bilt Card have been in a position to pay their hire with no price whereas incomes 1x factors on that spending, for as much as $50,000 in hire spending per 12 months. The one requirement was that you just needed to make 5 transactions per billing cycle on the Bilt Card with a view to unlock that.

The hope was that folks would shift loads of their spending to the Bilt Card. Nonetheless, as you may need guessed, that wasn’t at all times the case. As a substitute, many individuals would make 5 small transactions per billing cycle whereas incomes factors for hire, which wasn’t actually a sustainable mannequin.

With that in thoughts, this method has fully modified. Right here’s the excellent news:

- Members at the moment are in a position to earn factors for paying each hire and mortgages (mortgage rewards are new)

- Members at the moment are in a position to pay for a number of properties and earn factors (in comparison with being restricted to 1 property)

- There is no such thing as a longer a cap on the quantity that members will be rewarded yearly (beforehand there was a $50,000 annual cap)

As you’d anticipate, there’s a significant catch — you now must “earn” the flexibility to earn rewards on your housing funds. Particularly, this comes within the type of utilizing Bilt Money:

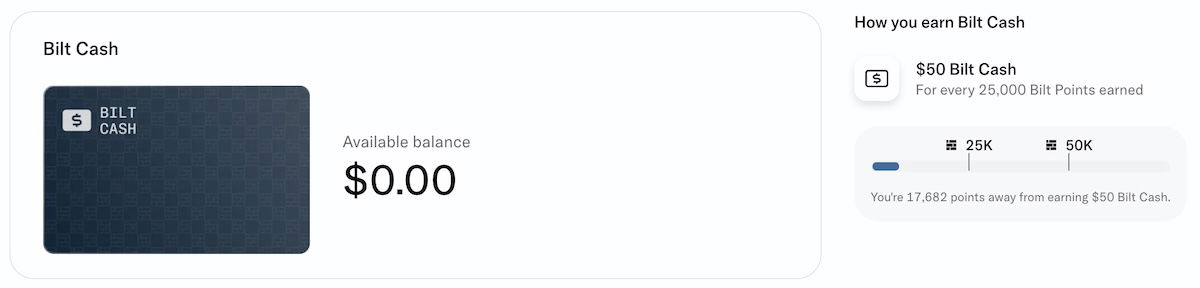

- All three Bilt bank cards supply 4% in Bilt Money on spending, along with the usual rewards construction (Bilt Money is a Bilt particular rewards foreign money)

- $3 in Bilt Money is price 100 Bilt factors in your complete hire and mortgage cost, on the price of 1x factors

- Bilt Money expires on December 31 of the 12 months wherein it’s earned, although $100 in Bilt Money will be rolled over to the subsequent 12 months

- It is advisable have the Bilt Money in your account on the time that you just attempt to make your hire or mortgage cost, so you’ll be able to’t pay after the very fact, or something like that

- Whereas incomes rewards on housing funds is without doubt one of the finest makes use of of Bilt Money, there are different methods to make use of these rewards as nicely, like for a spending accelerator, for improved Lease Day promotions, and extra

Okay, the way in which that is structured strikes me as unnecessarily sophisticated, because it looks as if the quantities ought to’ve been adjusted a bit, to be easier. However the thought is that you just earn 4% again in Bilt Money towards these funds in your spending, after which you’ll be able to earn rewards in your housing funds at a 4:3 ratio between your hire or mortgage value and your bank card spending.

Clearly this can be a main departure from the previous system. To elucidate it within the type of an instance:

- In case you spent $15,000 on a Bilt card, you’d earn $600 in Bilt Money (because you earn 4% again in Bilt Money on all spending on all playing cards)

- $600 in Bilt Money would will let you earn $20,000 in price free hire or mortgage funds, whereas incomes 1x factors

There’s one different main change that’s quietly being made right here. Underneath the brand new system, hire and mortgage quantities are not charged to your card, however as an alternative, are instantly deducted out of your account by way of ACH, and you then’re awarded factors. So that you not mainly get an curiosity free advance in your funds for a billing cycle. For that matter, it’s lower than excellent for many who simply don’t like having issues immediately debited from their checking account.

Particulars of the three new Bilt Cardless bank cards

Bilt is transitioning from having a single Wells Fargo bank card, to having three Cardless bank cards. The merchandise are at very totally different value factors, so let’s cowl the small print of these, as they’re launching as of at this time (February 7, 2026). Individually, I’ve reviewed the three playing cards, and have in contrast them.

Earlier than I do, let me be aware that the sign-up bonuses talked about under can be found for a restricted time, and can be found for each new and transitioning prospects. Moreover, you’ll be able to solely be the first cardmember on one Bilt bank card, so that you couldn’t apply for a number of of those playing cards.

No annual price Bilt Blue Card particulars

The no annual price Bilt Blue Card is essentially the most fundamental card within the portfolio, and the least thrilling. It basically provides you entry to the flexibility to earn rewards for hire and mortgage funds with Bilt, with out many frills. It has the next perks and rewards construction:

- A welcome bonus of $100 in Bilt Money upon approval

- 1x factors + 4% again in Bilt Money on on a regular basis purchases, with no overseas transaction charges

- Limitless 1x factors on hire and mortgage funds (funded with Bilt Money)

- World Elite Mastercard advantages

$95 annual price Bilt Obsidian Card particulars

The $95 annual price Bilt Obsidian Card is the mid-range card within the portfolio, and it provides expanded spending multipliers, and a journey portal credit score that may probably offset the annual price. It has the next perks and rewards construction:

- A welcome bonus of $200 in Bilt Money upon approval

- 3x factors in your selection of eating or groceries (eating is uncapped, groceries is capped at $25K of spending per 12 months), 2x factors on journey, 1x factors on all different purchases, and 4% again in Bilt Money on all purchases, with no overseas transaction charges

- A $100 Bilt journey portal lodge credit score each calendar 12 months ($50 semi-annually, two-night minimal keep)

- Limitless 1x factors on hire and mortgage funds (funded with Bilt Money)

- World Elite Mastercard advantages

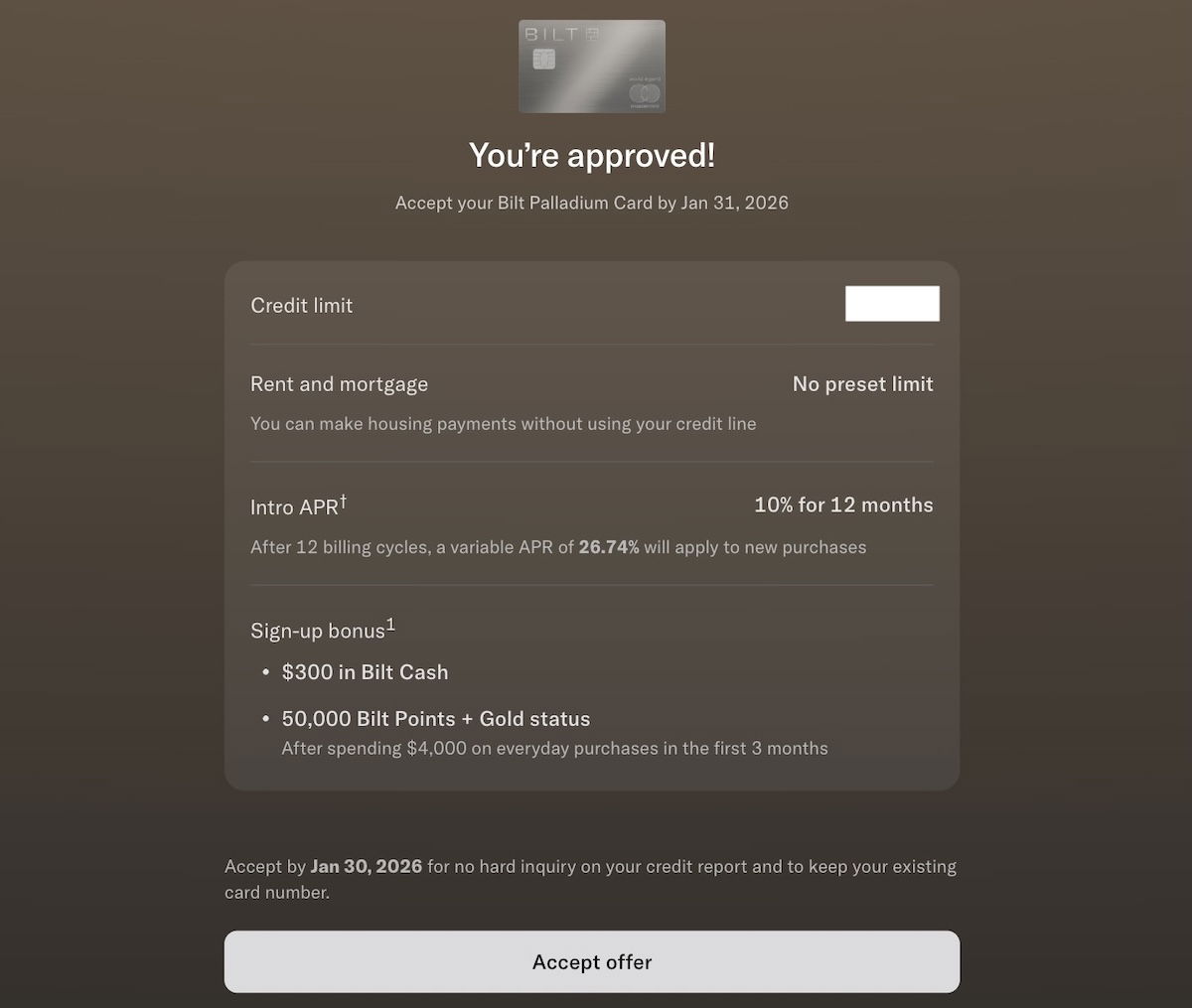

$495 annual price Bilt Palladium Card particulars

The $495 annual price Bilt Palladium Card is essentially the most premium card within the portfolio, and it provides what may simply be an unequalled return on on a regular basis spending. It has the next perks and rewards construction:

- A welcome bonus of fifty,000 bonus factors and Bilt Gold standing after spending $4,000 inside three first three months (on non-housing purchases), plus $300 Bilt Money upon approval

- 2x factors + 4% again in Bilt Money on on a regular basis purchases, with no overseas transaction charges

- A $400 Bilt journey portal lodge credit score each calendar 12 months ($200 semi-annually, two-night minimal keep)

- $200 in Bilt Money yearly, deposited at first of every 12 months, together with with account opening

- Limitless 1x factors on hire and mortgage funds (funded with Bilt Money)

- A Precedence Go membership, with as much as two company allowed (approved customers will be added for $95 every, and in addition obtain a membership); this membership doesn’t supply credit at Precedence Go eating places, unsurprisingly

- World Legend Mastercard advantages

How the Wells Fargo to Cardless transition works

Over the previous few weeks, Bilt opened “pre-order” for the brand new card portfolio, whereby cardmembers might select to transition to the brand new playing cards, to make the method seamless. Now we’re seeing the brand new card portfolio launch as of at this time, February 7, 2026:

- Bilt is transitioning from Wells Fargo to Cardless, and present cardmembers are being moved to the brand new platform, with the cardboard numbers staying the identical, digital wallets auto-updating, and no onerous credit score inquiries

- Those that select to transition to a brand new Bilt bank card are in a position to switch any stability from their previous account, with a tender credit score pull; be aware that if you transfer from Wells Fargo to Cardless, your credit score restrict could change

- Through the transition course of, you’ll be able to resolve whether or not you need to hold your Wells Fargo account open, wherein case the cardboard grow to be sthe Autograph Visa card with a special card quantity; you’ll be able to hold this even should you resolve to open a Bilt product with Cardless

- There are some stories of present Wells Fargo cardmembers being denied for a Cardless product, which is… type of not excellent

In a separate submit, I shared my expertise transitioning to the Bilt Palladium Card.

My tackle these Bilt bank card & rewards modifications

It goes with out saying that these Bilt modifications are large, and it’s now a totally totally different ballgame. Prior to now, one might have the Bilt Card, make 5 tiny transactions every billing cycle on the cardboard, after which earn hundreds of factors in month-to-month hire funds. Clearly that mannequin merely wasn’t sustainable, from a profitability perspective.

For the common shopper, particularly for many who aren’t large bank card spenders (notably in non-bonused classes) these modifications are unfavourable. The brand new no annual price card isn’t practically as rewarding because the previous no annual price card. Moreover, you now must spend a mean of not less than 75% as a lot as your hire cost with a view to earn rewards for that quantity. These modifications aren’t shocking, however they’re tough.

That being mentioned, I really feel like the true candy spot right here is the $495 annual price Bilt Palladium Card, and it’s the cardboard that I’ve determined to use for. It’d simply be the brand new finest premium card for on a regular basis spending:

- The cardboard really has a welcome bonus, which the previous Bilt Card by no means formally had, which suggests it’s not less than price giving the cardboard a strive

- Incomes 2x factors on on a regular basis spending is superior, particularly given Bilt’s switch companions, like Alaska Atmos Rewards and World of Hyatt; nonetheless, frustratingly, the phrases counsel you’ll be able to’t earn factors on issues like tax funds, which completely counters the trade norm

- In case you do spend a big quantity on bank cards, then there’s a ton of upside in with the ability to earn factors for paying your hire, mortgage, and so on., together with on a number of properties (if relevant), with no caps

In fact the difficulty is the annual price, and the final bank card fatigue that many people have. I believe most of us have already got a Precedence Go membership, so don’t worth an incremental membership that a lot. The $400 Bilt journey credit score helps with offsetting the $495 annual price, however both manner, this isn’t a card the place you’re prone to come out forward solely based mostly on the advantages and credit, and there’s a really actual value to holding onto the product.

As I see it, the candy spot with maximizing worth with Bilt has mainly reversed. Bilt was nice for many who weren’t large spenders and who had a no annual price card, because the hire rewards have been disproportionate. In the meantime below the brand new system, Bilt is nice for many who are large spenders, and who’ve large hire or mortgage funds (the truth that there at the moment are additionally rewards for mortgages is thrilling for a lot of!).

I might guess that with these modifications, the variety of individuals paying their hire by means of Bilt can be lowering considerably. Nonetheless, maybe the quantity that persons are charging to Bilt playing cards will enhance, since there’s lastly an incentive to spend on one of many playing cards… should you’re keen to pay $495 per 12 months. Sadly the rewards buildings on the 2 extra fundamental playing cards are considerably much less attention-grabbing, should you ask me.

I believe there’s one different probably attention-grabbing angle right here. Bilt and Alaska Atmos Rewards even have a partnership. This enables individuals to earn 3x factors on hire funds on the Atmos™ Rewards Ascent Visa Signature® bank card (overview) and Atmos™ Rewards Summit Visa Infinite® Credit score Card (overview), in alternate for a 3% price, which might’t be paid with Bilt Money.

Some individuals may nonetheless discover that to be worthwhile, particularly since you’ll be able to then redeem Bilt Money for different issues, like a further factors accelerator on spending.

Backside line

As of at this time (February 7, 2026), Bilt is transitioning its bank card portfolio from Wells Fargo to Cardless. Nearly all the things is altering, from the cardboard particulars, to how housing funds are rewarded.

Lengthy story quick, cardmembers are in a position to earn factors for hire and mortgage funds, with no caps. The catch is that they’ll basically must spend 75% of their hire or mortgage quantity on the cardboard with a view to earn rewards.

Bilt has three bank cards, incuding a fundamental no annual price card, a $95 annual price card with a few bonus classes and a lodge credit score, and a $495 annual price card that provides 2x factors on all purchases, plus a lodge credit score.

These all symbolize large modifications, and there’s no denying that Bilt not has the mass enchantment it as soon as had, the place you would mainly earn rewards on hire for subsequent to nothing. Bilt continues to be worthwhile for some, and specifically, the Bilt Palladium Card is fairly compelling.

However that is definitely a totally new idea that’s going to have lots of people rethinking their technique. And critically, what number of $400-900 annual price playing cards can all of us moderately have earlier than we are saying “sufficient already?”

What do you make of those Bilt modifications? How will they influence your technique?

Supply hyperlink