My Citi Strata Elite Card Software Approval Expertise

Hyperlink: Apply now for the Citi Strata Elite℠ Card

The Citi Strata Elite℠ Card (evaluation) is Citi’s new premium enterprise card. Whereas the cardboard has a steep $595 annual price, there are many causes to think about selecting up this card. I made a decision to use for this new product, and wish to report again with my expertise.

Whereas this card isn’t some wonderful slam dunk that’s too good to be true, I feel the cardboard is price giving a shot, particularly with the welcome provide out there.

Primary Citi Strata Elite software restrictions

As a reminder, there’s a portfolio of three private Citi Strata merchandise. Along with the Citi Strata Elite, there’s additionally the $95 annual price Citi Strata Premier® Card (evaluation) and no annual price Citi Strata℠ Card (evaluation).

Eligibility for the three Citi Strata merchandise is taken into account independently, together with with regards to the welcome bonuses, in order that’s nice for customers. Which means having the Citi Strata Premier doesn’t preclude you from getting the Citi Strata Elite, and vice versa.

An important factor to know is Citi’s 48-month rule, which is that the welcome bonus on a selected card isn’t out there to those that have obtained a brand new cardmember bonus on that precise card up to now 48 months. The 48 months relies on whenever you obtained the bonus on a card, relatively than primarily based on whenever you opened the cardboard.

Additionally keep in mind Citi’s normal software restrictions, together with that on a rolling foundation, you possibly can typically solely be accredited for at most one Citi card each eight days, and at most two Citi playing cards each 65 days.

Citi Strata Elite software & approval expertise

You will have two choices with regards to making use of for the Citi Strata Elite:

- You possibly can apply straight on-line, and obtain a welcome bonus of 80,000 ThankYou factors after spending $4,000 inside three months

- You possibly can apply at a Citi department, and obtain an unique welcome bonus of 100,000 ThankYou factors after spending $4,000 inside three months

Maybe towards my very own brief time period self pursuits, I after all encourage you to get the very best provide for your self, and in case you dwell close to a Citi department, it’s in all probability price making use of that method. In the meantime in case you simply wish to help your favourite (or fifth favourite, or least favourite) blogger, you possibly can after all apply on-line.

I dwell close to a Citi department, so I figured I’d try the in-branch software expertise. So let me share the 2 software processes.

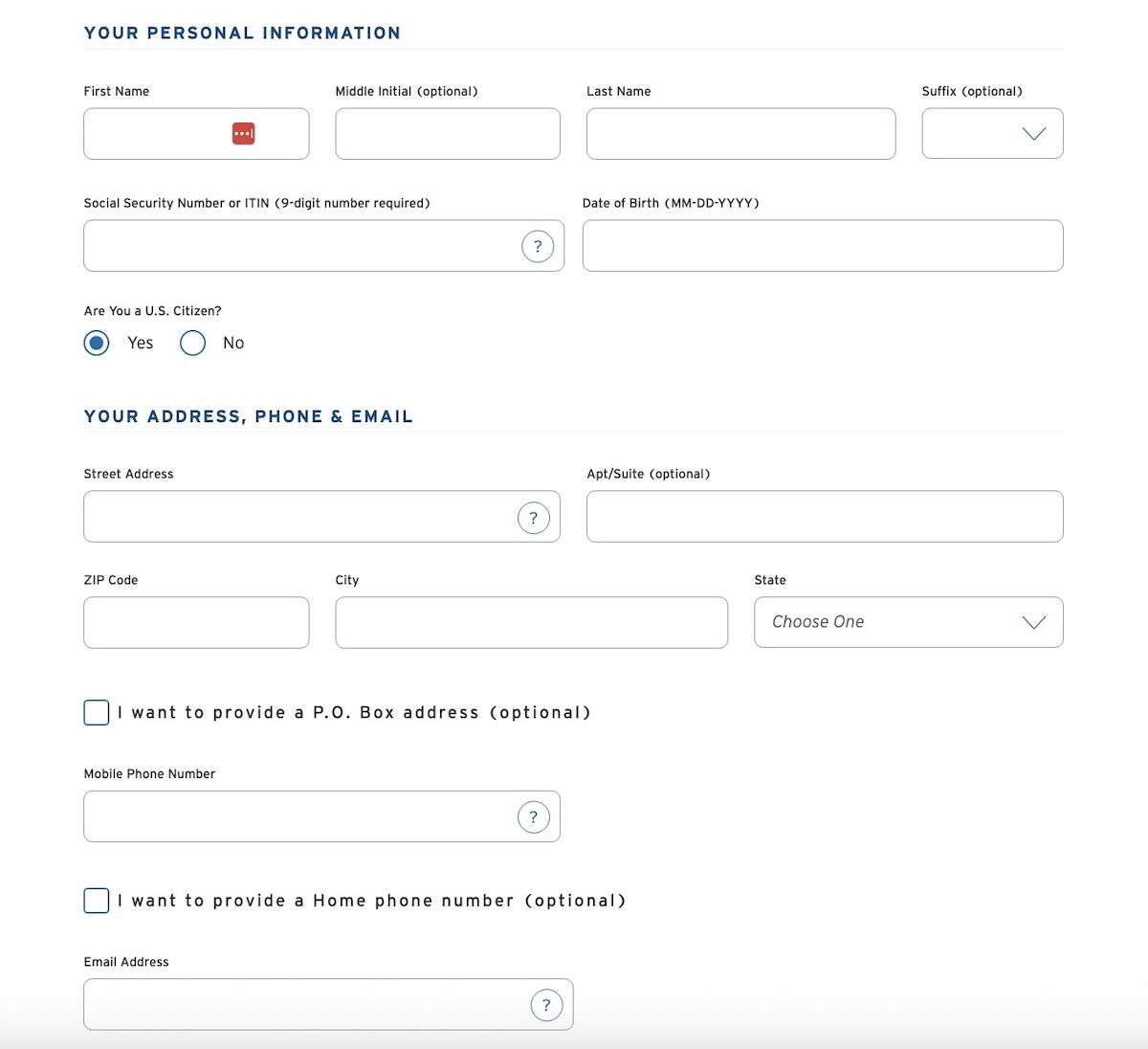

Citi Strata Elite on-line software fundamentals

The Citi Strata Elite on-line software course of is admittedly easy, and consists of only one brief web page. It simply asks for private particulars — title, date of start, social safety quantity, tackle, cellphone quantity, earnings, and many others.

On the finish of the applying, you’ll be requested on your American AAdvantage quantity, when you’ve got one. The explanation you’ll wish to embrace it is because that is the place the Admirals Membership day passes can be deposited, as these are an ongoing card perk.

Citi Strata Elite in-branch software fundamentals

Any Citi banker at a department may also help you apply for the Citi Strata Elite in particular person. Up to now, I haven’t had nice experiences with getting Citi in-branch appointments, not to mention even getting particular person Citi branches to choose up the cellphone.

So I used to be delighted when a banker answered after only some rings, and stated he’d be out there any time. I headed over to the department, and the applying took all of 10 minutes.

This was my first time in years visiting a financial institution department for an appointment, and some issues stood out to me. For one, it was type of odd how my social safety quantity was stated out loud for affirmation, and the way I needed to state my earnings, and many others. Fortuitously the department was empty, however in any other case it looks like there must be a greater method, like asking folks to enter it on a keypad or one thing, no?

Subsequent, admittedly I’m an enormous introvert, however the small discuss was kind of painful, and looking back, maybe I’d’ve paid 20,000 ThankYou factors simply to get out of that:

“The place is your final title from?”

“It’s German(ish).”

“Oh, are you German?”

“Yeah, my mother and father are each from Germany, and all my different relations dwell there.”

“Oh, Germany is a stupendous nation.”

“Sure it’s, have you ever been?”

“No… however you’re fortunate, now you’re dwelling within the best nation on earth.”

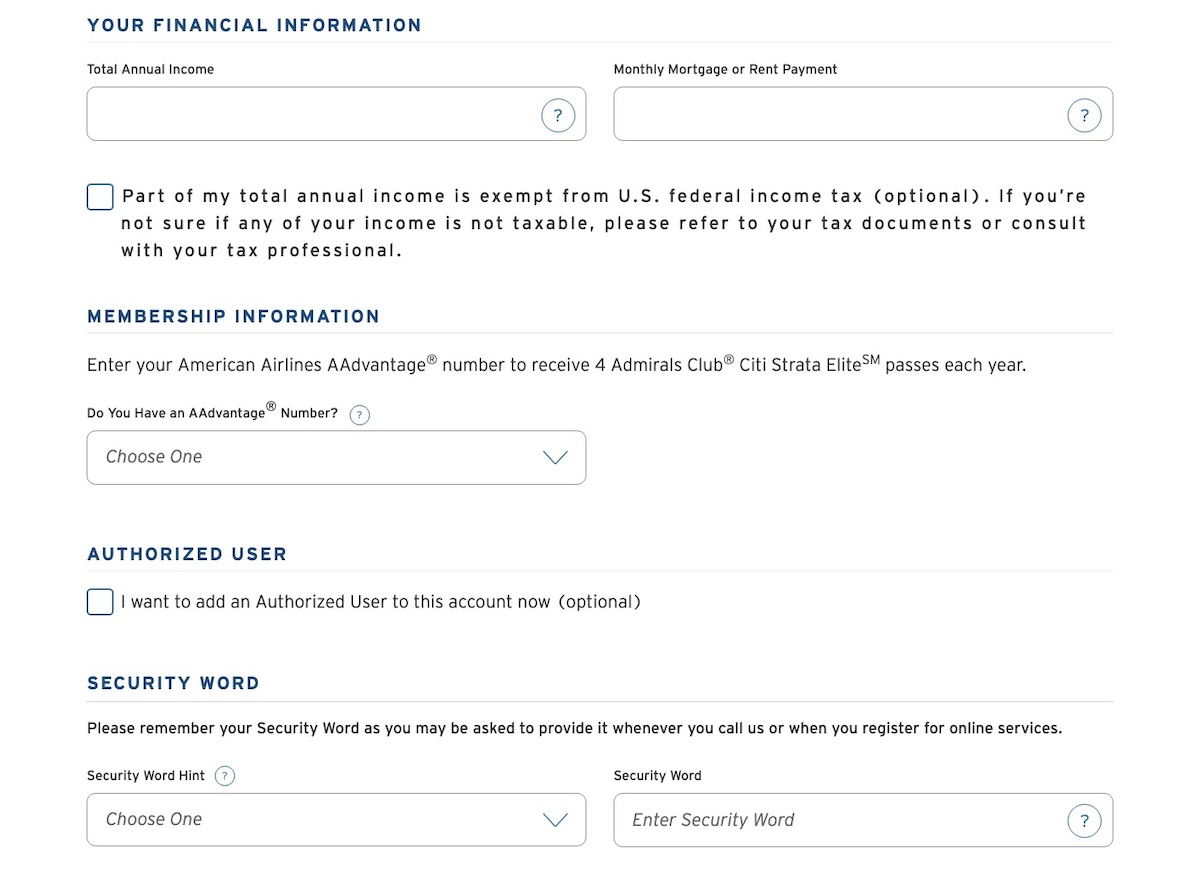

Erm, can we simply proceed with the applying, please? Anyway, my software was immediately accredited, although with a really low credit score line (in all probability as a result of I’ve just a few open Citi playing cards with excessive credit score strains, and there’s solely a lot credit score banks will prolong to customers).

The banker by no means requested me if I had an AAdvantage quantity. That’s type of irritating, as a result of as quickly as my card was accredited, I obtained an e mail indicating I had a brand new AAdvantage account, and my Admirals Membership passes have been deposited there. So now I’ll have the pleasure of getting on the cellphone to try to repair that, I assume.

My long run Citi Strata Elite technique

Now that I’ve the Citi Strata Elite, what’s my technique? I feel this can be a stable card, although it’s not essentially a card the place the maths is that overwhelmingly thrilling (then once more, playing cards with that type of math are likely to get devalued fairly rapidly). I do suppose there’s big advantage to selecting up the cardboard and taking it for a spin, given the welcome provide.

The cardboard has a $595 annual price, and since I’m a Citigold member, I get a $145 discount on that yearly, which means the cardboard will value me $450 on an ongoing foundation.

The best way I view it, the cardboard’s $200 annual “Splurge” credit score is principally good as money, since that can be utilized to buy American Airways tickets. It’s even provided each calendar 12 months, in order that’s significantly rewarding along with your card’s first annual price.

The opposite credit are ones the place I’ll must see over time how a lot I worth them, and that can decide whether or not I preserve the cardboard in the long term. Particularly, I’m speaking about:

- There’s an as much as $300 annual lodge credit score, legitimate for lodge bookings of at the very least two nights by way of Citi Journey; in case you can keep for 2 nights at a lodge costing simply over $150 per night time, that’s simple sufficient to maximise

- There’s an as much as $200 annual Blacklane credit score, within the type of a $100 credit score semi-annually; Blacklane is much more costly than Uber, so I’ll want to provide this world chauffeur service one other attempt, and resolve how a lot I worth that

Then there’s the Precedence Go membership and 4 annual American Admirals Membership passes. Whereas these perks can be good for some, I have already got a number of playing cards that supply Precedence Go, and I even have an Admirals Membership membership with the Citi® / AAdvantage® Govt World Elite Mastercard® (evaluation). So for me, the incremental worth there’s restricted.

Backside line

The Citi Strata Elite is Citi’s model new premium bank card. The cardboard is providing an enormous welcome bonus, and has some stable perks that will curiosity many. With Citi ThankYou factors now being transferable to American AAdvantage, maybe probably the most thrilling element is having the ability to use this card to rack up American miles, together with with the welcome bonus.

In case you’re taken with making use of for the cardboard, the excellent news is that eligibility is unrelated to having another Citi card, so plenty of folks ought to qualify.

In case you’ve utilized for the Citi Strata Elite, what was your expertise like?

Supply hyperlink