My Citi AAdvantage Enterprise Card Approval Expertise

Hyperlink: Apply now for the Citi® / AAdvantage Enterprise™ World Elite Mastercard®

I’ve simply been accredited for my newest bank card, the Citi® / AAdvantage Enterprise™ World Elite Mastercard® (overview). On this submit I wished to clarify why I utilized, speak in regards to the utility restrictions, and share my expertise getting accredited.

Why I utilized for the Citi Enterprise AAdvantage Card

For the time being, the Citi AAdvantage Enterprise Card has a restricted time welcome provide of 75,000 AAdvantage miles after spending $5,000 throughout the first 5 months. This is a superb bonus, among the many finest we’ve seen on the cardboard. There are many nice makes use of of AAdvantage miles, and you may by no means have sufficient of them.

There are various causes to contemplate selecting up this card. In my case, it got here down the bonus miles, plus the advantages that having this card presents together with the AAdvantage Enterprise program. The AAdvantage Enterprise program permits you to earn bonus miles in your small enterprise journey, and it’s simpler to really money out these miles in case you have the Citi AAdvantage Enterprise Card (in any other case there are limits on how many individuals must be in your account, and the way a lot they should spend).

Lastly, selecting up the cardboard is about as low danger because it will get, as the cardboard’s $99 annual payment is even waived for the primary 12 months. You’ll be able to’t beat that!

The fundamentals of Citi’s card utility restrictions

In the case of getting accredited for the Citi AAdvantage Enterprise Card, there are only a couple of primary restrictions to pay attention to:

- In step with Citi’s basic utility restrictions, you may usually be accredited for at most one Citi card each eight days, and at most two Citi playing cards each 65 days

- In step with Citi’s 48-month rule, you may solely earn the welcome bonus on this card in the event you haven’t acquired a welcome bonus on this precise card up to now 48 months (that timeline is predicated on once you acquired the bonus, and never primarily based on once you opened or closed the cardboard)

For what it’s price, I haven’t had this precise card since July 2019, and that’s after I closed the cardboard, fairly than after I earned the bonus. So I used to be within the clear for selecting up this card once more, and being eligible for the bonus.

By the way in which, let me share one different consideration I had. I’m attempting to remain beneath Chase’s 5/24 restrict (though there are combined reviews as as to if it’s nonetheless enforced). Fortuitously making use of for Citi enterprise playing cards doesn’t rely as an extra card towards that restrict.

My expertise making use of for the Citi Enterprise AAdvantage Card

As I began my Citi AAdvantage Enterprise Card utility, I wasn’t certain what the end result could be. My final Citi utility was roughly a 12 months in the past, and I used to be outright denied, which was my first card denial in a few years. I used to be apprehensive that may occur once more. Nonetheless, that was a private card, whereas it is a enterprise card, and people can usually result in very totally different outcomes.

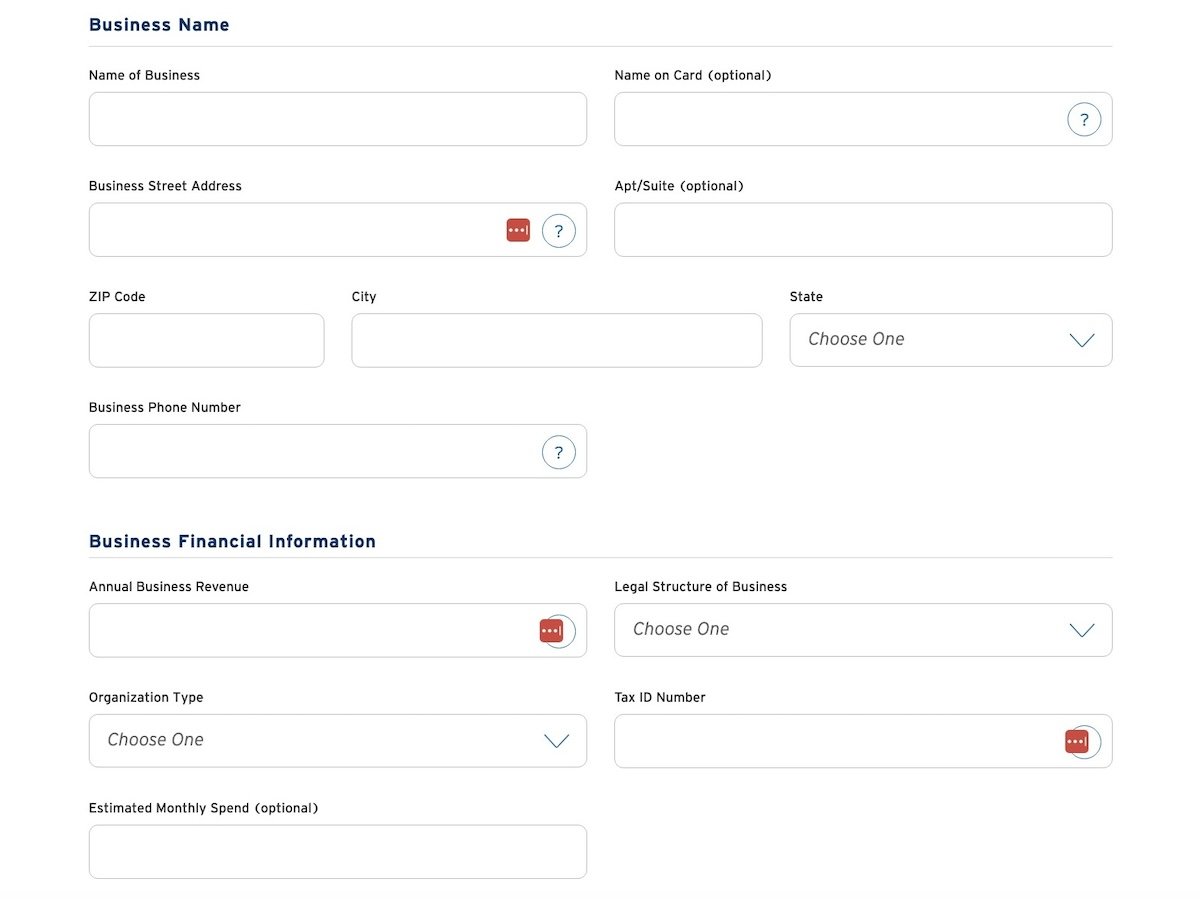

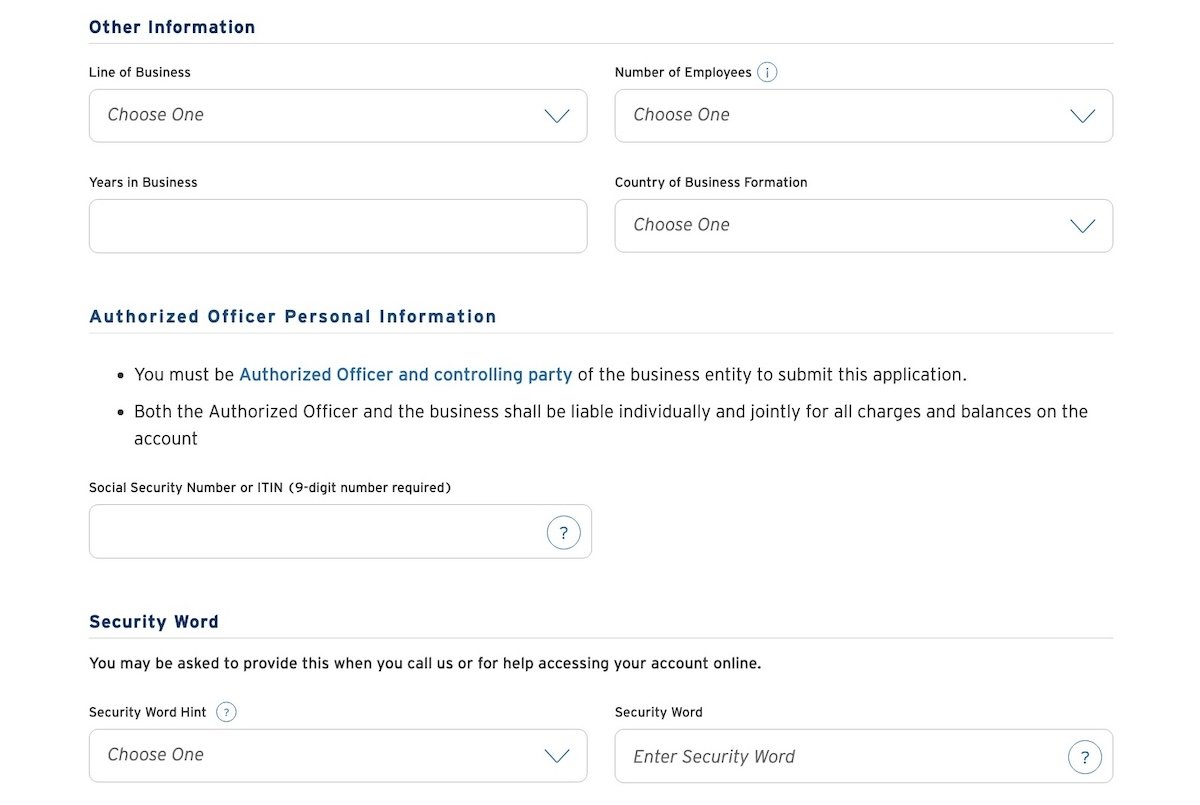

I discovered the Citi utility expertise to be simple. I simply needed to enter some primary enterprise data, after which additionally some primary private data.

I used to be pleasantly shocked that upon submitting my utility, I acquired instantaneous approval!

Discuss a simple 75,000 AAdvantage miles with the annual payment waived the primary 12 months, plus no affect towards the 5/24 restrict. I’ll take it!

Backside line

I’ve been that means to use for the Citi AAdvantage Enterprise Card as a result of restricted time welcome provide that’s at present out there. I lastly submitted an utility, and was comfortable to be taught that I used to be immediately accredited, particularly given my earlier denial with Citi.

I’m thrilled to have been accredited for the cardboard, getting me 75,000 AAdvantage miles plus unlocking extra worth from the AAdvantage Enterprise program. So in the event you’ve been on the fence about making use of for this card, right here’s at the very least one optimistic information level about getting accredited…

In the event you’ve utilized for the Citi AAdvantage Enterprise Card, what was your expertise like?