Maximizing The Amex Platinum Card $600 Resort Credit score: This is My Technique

Hyperlink: Be taught extra about The Platinum Card® from American Categorical or The Enterprise Platinum Card® from American Categorical

The Platinum Card® from American Categorical (overview) is one among Amex’s most premium playing cards, and it just lately underwent a full refresh. Whereas the cardboard now has an $895 annual charge (Charges & Charges), it gives advantages that may greater than assist offset that for a lot of, and I’d argue the worth proposition is healthier than ever earlier than.

The cardboard probably gives hundreds of {dollars} in advantages and credit, and on this publish, I’d like to try one of many single greatest potential credit provided by the cardboard, which is an annual lodge credit score of as much as $600. As you’d anticipate, enrollment is required, and there are phrases to concentrate on, so let me share how the credit score works, and my technique for maximizing it.

For what it’s price, this identical credit score additionally applies on The Enterprise Platinum Card® from American Categorical (overview), which can also be a card price contemplating.

Fundamentals of the Amex Platinum Card $600 lodge credit score

The Amex Platinum Card and Amex Enterprise Platinum Card supply as much as $600 per yr in lodge credit. To make the most of this, you simply must guide a pay as you go lodge by Amex Tremendous Motels + Resorts® (no minimal keep) or The Resort Assortment (two-night minimal keep) by American Categorical Journey®. As you’d anticipate, there are some phrases to concentrate on:

- This can be a semi-annual credit score, so that you obtain one $300 credit score in January by June, and one $300 credit score in July by December; that timeline relies on if you make your reserving and never if you keep, so in concept you may have a number of qualifying stays in both the primary or second half of the yr

- The credit score is as much as $300, so that you don’t must spend $300+, although for those who spend lower than that quantity, you’d solely be reimbursed as a lot as you spent on the lodge reserving

- That is accessible on each the private and enterprise model of the cardboard issued in the USA, and it may be utilized by the first cardmember or approved customers (although approved customers don’t get incremental credit)

- There’s no registration required to make the most of this, so long as you have got a card in good standing

- An eligible lodge keep will be booked by the Amex Journey web site, Amex Journey app, or by calling the quantity on the again of your eligible card

- Solely pay as you go bookings qualify for this perk (known as “Pay Now” bookings); this doesn’t imply the keep is non-refundable, however as an alternative, simply that you simply pay on the time of reserving

- Assertion credit will usually publish inside just a few days, although in some circumstances it might take as much as 90 days for credit to publish

Amex Tremendous Motels + Resorts® & The Resort Assortment fundamentals

For these not accustomed to Amex Tremendous Motels + Resorts® or The Resort Assortment, these are packages that these with the Amex Platinum Card and Amex Enterprise Platinum Card can make the most of. The credit particularly have for use with one among these two packages.

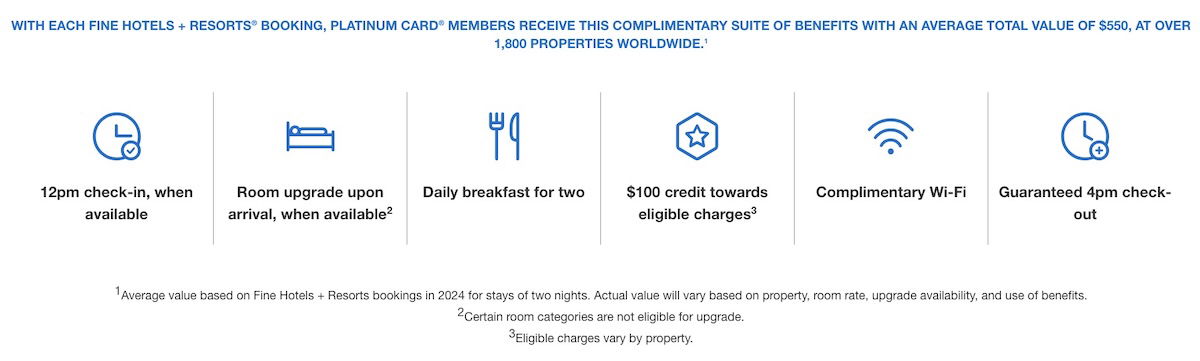

Amex Tremendous Motels + Resorts® is a program that offers you entry to a number of 1,800+ luxurious resorts across the globe. You’ll usually pay the identical because the versatile price charged straight by the lodge, and can obtain further perks, together with complimentary breakfast, a room improve topic to availability, a lodge credit score, assured 4PM check-out, and extra.

The Resort Assortment is one other program by Amex, giving entry to a number of 1,300+ resorts across the globe. These are additionally usually luxurious properties, however a tier down from Tremendous Motels + Resorts®. You’ll usually pay the identical because the versatile price charged straight by the lodge, and can obtain further perks, together with a room improve topic to availability, a lodge credit score, and extra.

There are two different factors price clarifying:

- Whereas you should guide a pay as you go reservation to make the most of the lodge credit score, that doesn’t imply the keep is non-refundable; as an alternative, it simply means you’re paying upfront, but it surely’s typically potential to nonetheless cancel for a full refund, in step with a property’s typical versatile cancellation coverage (you’ll wish to test the phrases if you guide)

- You possibly can normally nonetheless earn factors and obtain perks together with your most well-liked lodge loyalty program if reserving stays by these packages, as they’re normally thought of “qualifying” stays for these functions, in contrast to most different third occasion bookings

My Amex Platinum Card $600 lodge credit score maximization technique

Whereas the Amex Platinum Card and Amex Enterprise Platinum Card supply a number of perks, the reality is that there are hurdles to utilizing most of the credit. Usually the credit are issued month-to-month, registration is required, and so on. Personally, I discover the lodge credit score to be one of many simpler perks to make use of (together with the $400 Resy eating credit score on the private card, for which enrollment is required).

That’s as a result of this isn’t a profit that you should use month-to-month (like another Amex credit), however relatively you’ll be able to extract massive worth from it as soon as each six months. There are lots of methods to get worth from this perk, although my method is fairly easy.

I exploit this profit for Amex Tremendous Motels + Resorts®, since there’s no minimal keep, and there’s an ideal assortment of resorts. Sure, there are many Amex Tremendous Motels + Resorts® properties that value hundreds of {dollars} per evening, however there are additionally some fairly priced ones.

There are many eligible properties that value within the $200-400 vary, and generally even much less. The worth right here is solely glorious. Not solely are you able to get an as much as $300 assertion credit score utilized to such a keep, however you can even make the most of the Amex Tremendous Motels + Resorts® perks, together with complimentary breakfast, a $100 property credit score, and extra. Better of all, for those who’re staying with a lodge belonging to a significant lodge program, you’ll be able to even earn factors.

With my travels, I typically have one-night stays in some cities, and there’s one thing good about staying one evening at a luxurious property whereas paying near nothing, and getting tremendous beneficial perks. For instance, I’ve used these lodge perks for stays at properties just like the Raffles Europejski Warsaw and the Waldorf Astoria Kuwait. Each resorts have been phenomenal, and I acquired an incredible deal because of a mixture of perks plus the credit score.

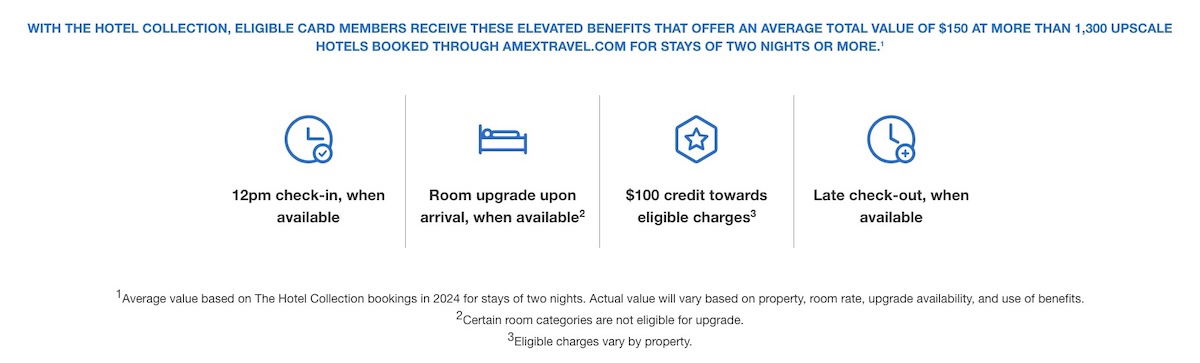

Simply to present some completely random examples of Amex Tremendous Motels + Resorts® bookings (clearly charges range by evening), you may spend an evening on the Waldorf Astoria Doha West Bay for $246.89, so the $300 credit score would greater than cowl that.

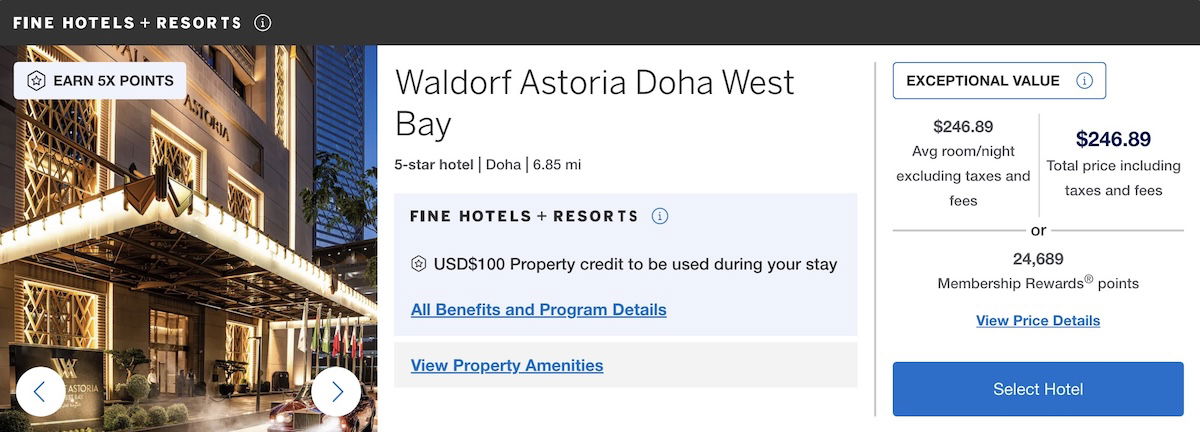

Or you probably have an in a single day in Frankfurt, you may guide the Steigenberger Icon Frankfurter Hof for $269.01, additionally greater than lined by the $300 credit score.

Or you may guide the 4 Seasons Jakarta for $214.17 per evening, lined by the credit score, with even fairly some residual worth.

Or the St. Regis Kuala Lumpur will be booked for $307.61, so if you subtract $300, you’re taking a look at paying $7.61.

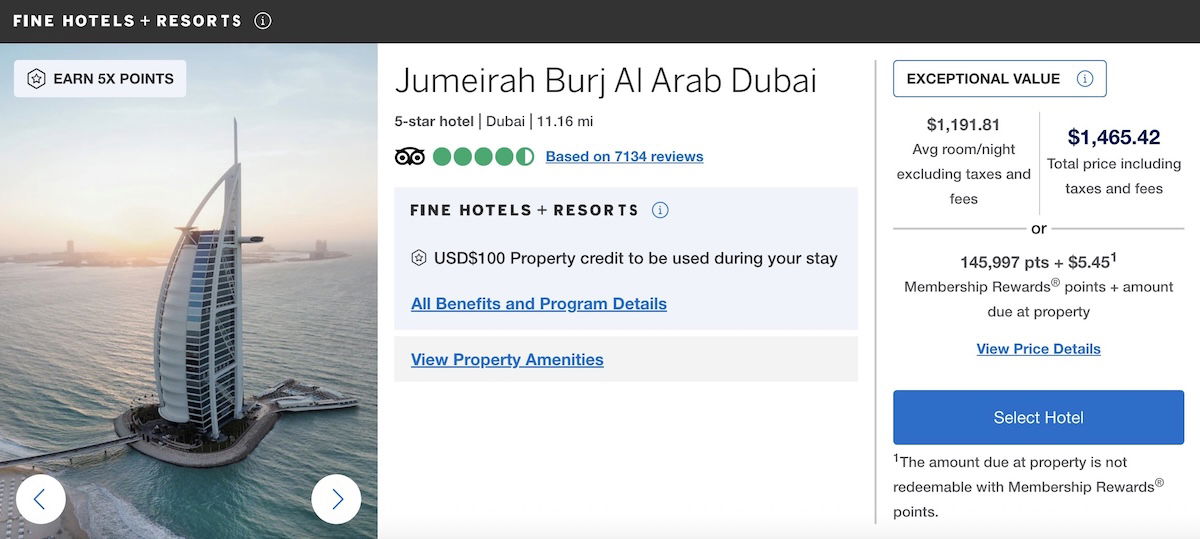

I’m going to argue that the Burj Al Arab Dubai is an unimaginable lodge that’s price staying directly, for those who can swing it. Whereas it’s dear, a $300 credit score helps slightly bit with offsetting the price of that.

The Amex Platinum Card $600 lodge credit score economics

I do know some persons are curious concerning the economics of card advantages, so how does Amex justify giving as much as $600 in lodge credit per yr to these with the Amex Platinum Card and Amex Enterprise Platinum Card? Who’s funding this?

This perk is fairly straightforward to make sense of. All the most important card issuers are attempting to massively enhance the quantity of bookings on their journey platforms, primarily taking up the most important on-line journey businesses. In any case, there’s some huge cash to be made there.

Usually talking, on-line journey businesses get vital commissions on lodge bookings, so Amex’s logic right here is to make use of this profit to get folks to modify their lodge bookings to Amex’s journey portal.

The purpose, in fact, is that this profit will rework how folks guide resorts. Amex hopes {that a} $300 semi-annual credit score will get you to strive Amex Journey, and to then maintain reserving that means.

For instance, Amex could be making some huge cash on this perk for those who guide a $10,000 lodge keep in Paris with this profit, because the fee could be means larger than the credit score provided. In the meantime for those who’re good at maximizing and guide a lodge that prices near $300, Amex would virtually definitely lose cash on that.

Nonetheless, I think about the expectation is that this balances out, and that between the direct commissions and the elevated bookings by the platform, the profit will work out properly for Amex.

Backside line

The Amex Platinum Card and Amex Enterprise Platinum Card supply a number of perks, and I’d argue that probably the most beneficial advantages is the as much as $600 lodge credit score. Whereas there are some phrases to concentrate on, I anticipate to simply get near full worth out of this annually, going a protracted option to making this a “worthwhile” card for me.

My major technique is to simply use this profit for 2 one-night lodge stays annually at luxurious properties bookable by Amex Tremendous Motels + Resorts®, the place the perks on such a brief keep are particularly good. Ideally they’ll even be at properties belonging to main loyalty packages, in order that I can double dip and earn factors.

What’s your tackle the Amex Platinum Card $600 annual lodge credit score?

The next hyperlinks will direct you to the charges and charges for talked about American Categorical Playing cards. These embrace: The Platinum Card® from American Categorical (Charges & Charges).

Supply hyperlink