Marriott Bonvoy Sensible Card $300 Restaurant Credit score: How It Works

Hyperlink: Apply now for the Marriott Bonvoy Sensible® American Categorical® Card

The Marriott Bonvoy Sensible® American Categorical® Card (evaluate) is Marriott’s most premium co-branded bank card, and there are every kind of causes to contemplate selecting it up, together with an important welcome supply.

Whereas the cardboard has a steep $650 annual charge (Charges & Charges), I discover that to be simple to justify, due to advantages like Marriott Bonvoy Platinum standing, 25 elite nights towards standing yearly, an annual free evening award, a $300 annual restaurant credit score, and extra.

On this publish, I need to take a better take a look at how the cardboard’s $300 annual restaurant credit score works. Whereas this profit (annoyingly) must be used month-to-month, I discover it fairly simple to maximise, so let’s go over the small print.

Particulars of the Marriott Bonvoy Sensible Card $300 restaurant credit score

The Marriott Bonvoy Sensible Card affords as much as $300 in restaurant credit each calendar yr, within the type of a $25 month-to-month credit score. As you’d count on, there are some phrases to pay attention to:

- The $300 credit score is damaged down right into a $25 month-to-month credit score, so you may obtain a press release credit score for as much as $25 every calendar month

- The credit score applies towards restaurant purchases worldwide, so it’s not restricted to purchases in america

- The credit score isn’t legitimate for the acquisition of present playing cards or merchandise, or for purchases at non-restaurant retailers, together with nightclubs, comfort shops, grocery shops, and supermarkets

- Whether or not a purchase order qualifies for the credit score depends upon how the service provider categorizes themselves

- It could take 8-12 weeks after an eligible buy for the assertion credit score to publish, although in follow they’ll sometimes publish quicker than that

- Eligible purchases might be made by both the fundamental card member or a licensed person, although you continue to solely get a complete of as much as $300 in credit per yr

- There’s no registration required to benefit from this, so long as you make the right eligible purchases with the cardboard

Anecdotally, any buy that’s coded as restaurant or eating spending would qualify. I do know many individuals have had luck utilizing this credit score on meals supply providers as properly, assuming the service provider codes these purchases as such.

How I take advantage of the Marriott Bonvoy Sensible Card $300 restaurant credit score

Amex playing cards are identified for having credit which are damaged up month-to-month, quarterly, or semi-annually. Presumably that is partly supposed to extend pockets share, by constantly reminding customers to make use of a specific card. After all breakage can also be a significant component.

Now, personally I don’t desire to make use of the Marriott Bonvoy Sensible Card for many of my restaurant spending, since there are way more rewarding playing cards for eating, by way of the bonus factors provided. So I don’t need to put $1,000 per thirty days in restaurant spending on a card, solely to obtain a $25 assertion credit score, however then miss out on numerous rewards.

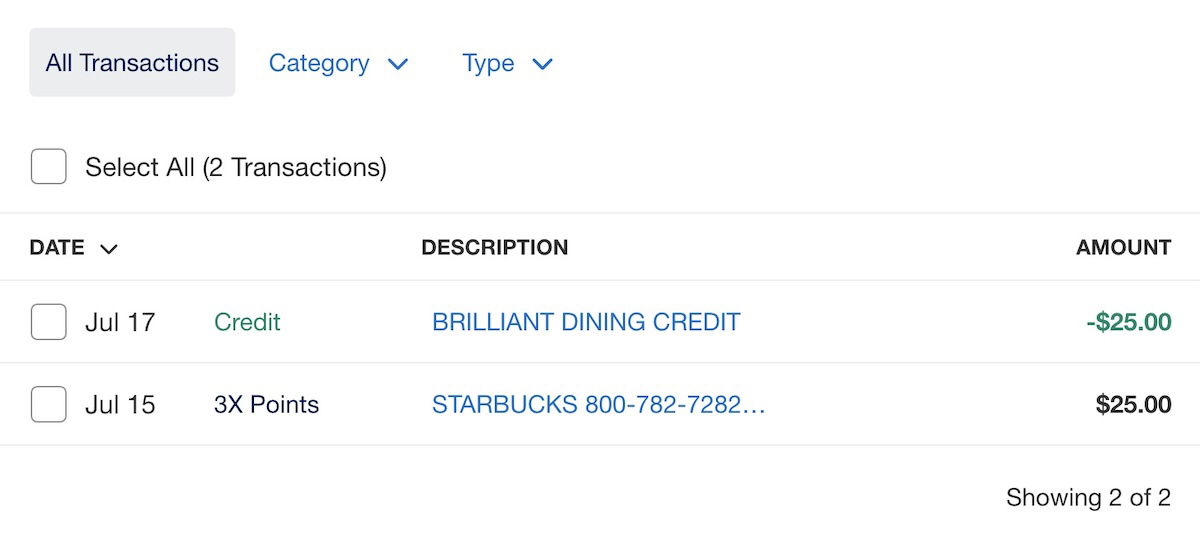

As a substitute, my strategy is that I load $25 onto my Starbucks account each month by way of the Starbucks app, after which I constantly obtain a press release credit score for that quantity a few days later. I think about this may work equally with different retailers within the restaurant class (by way of how they’re categorized with their service provider settlement).

The way in which I view it, this card will get me $300 in spending with Starbucks yearly. Whereas I’m not at all an enormous Starbucks fan (there’s significantly better espresso), stopping at a Starbucks is at all times helpful on a highway journey, and my Starbucks stability by no means will get too excessive, so I suppose it really works out.

To me, this is without doubt one of the perks that helps justify the $650 annual charge on the cardboard. I’d contemplate the restaurant credit score to roughly be value face worth, so to me, the cardboard actually “prices” me round $350 per yr. Personally I’d pay $350 for the annual free evening certificates alone (because it’s legitimate at a property costing as much as 85,000 factors), after which the remainder of the perks are the icing on the cake.

Backside line

The Marriott Bonvoy Sensible Card affords many priceless advantages, and amongst these is a $300 annual restaurant credit score. It is a month-to-month credit score, so that you rise up to a $25 assertion credit score each month that may be utilized towards an eligible restaurant buy worldwide.

Utilizing the credit score is straightforward, however to me the bottom line is doing so with out a lot alternative value. When you ask me, the simplest approach to do that is to reload your Starbucks stability $25 every month, so that you simply’re spending precisely as a lot because the credit score. To me, this offsets the annual charge on the cardboard by almost 50%.

What has your expertise been with utilizing the Marriott Bonvoy Sensible Card $300 restaurant credit score?

The next hyperlinks will direct you to the charges and costs for talked about American Categorical Playing cards. These embrace: Marriott Bonvoy Sensible® American Categorical® Card (Charges & Charges).

Supply hyperlink