Learn how to discover the very best pre-qualified bank card presents

With every issuer utilizing its personal approval standards for functions, it may be arduous to know which bank card presents you might be seemingly eligible to obtain. This may be particularly tough if you do not have an extended credit score historical past or a great credit score rating.

That is the place pre-qualified presents — and the instruments you employ to search out them — can turn out to be useful. Not solely do pre-qualified presents assist you determine which playing cards you might be probably to be accredited for, however they will additionally assist you to discover focused presents that are not accessible to each applicant.

At the moment, we’ll stroll you thru how pre-qualified presents work and the way you should use instruments similar to CardMatch to search out elevated bonuses and different particular presents.

What’s a pre-qualified supply?

If you obtain a pre-qualified bank card supply, an issuer has reviewed your fundamental monetary data and decided you’re a good candidate for a particular bank card. Generally, issuers ship out pre-qualified and even preapproved presents through snail mail, however it’s also possible to request pre-qualified presents utilizing completely different on-line instruments.

A pre-qualified supply differs from being accredited for a bank card upon filling out an utility. Whereas issuers will usually take a look at an outline of your creditworthiness, they do not pull your full credit score report if you undergo a pre-qualification course of.

As an alternative, a pre-qualified supply is just meant to point that you’re a sturdy candidate for approval in case you had been to use formally. To open a brand new line of credit score, you’ll have to truly undergo an official utility course of.

In different phrases, simply because you got a pre-qualified supply does not routinely imply you are assured approval for a particular card.

There are a number of methods so that you can get a pre-qualified bank card supply. As annoying as mail presents might be once they crowd your mailbox, do not be too fast to shred all of them. You may get nice customized presents with elevated bonuses, prolonged low-interest introductory intervals and extra.

Many issuers even have a pre-qualification device on their web site, together with Capital One.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

These instruments may help these with midrange credit score scores decide which playing cards they’re probably to be accredited for with out having to submit functions that would briefly ding their credit score rating.

Utilizing CardMatch to search out pre-qualified presents

Probably the greatest sources for pre-qualified presents is the CardMatch device. This may help you filter and examine pre-qualified presents for playing cards just like the Capital One Enterprise X Rewards Credit score Card, The Platinum Card® from American Specific and the American Specific® Gold Card — and in some circumstances, these are even larger than the usual public supply.

Examine the CardMatch device to see which card you pre-qualify for. Be mindful these presents are focused and topic to alter at any time.

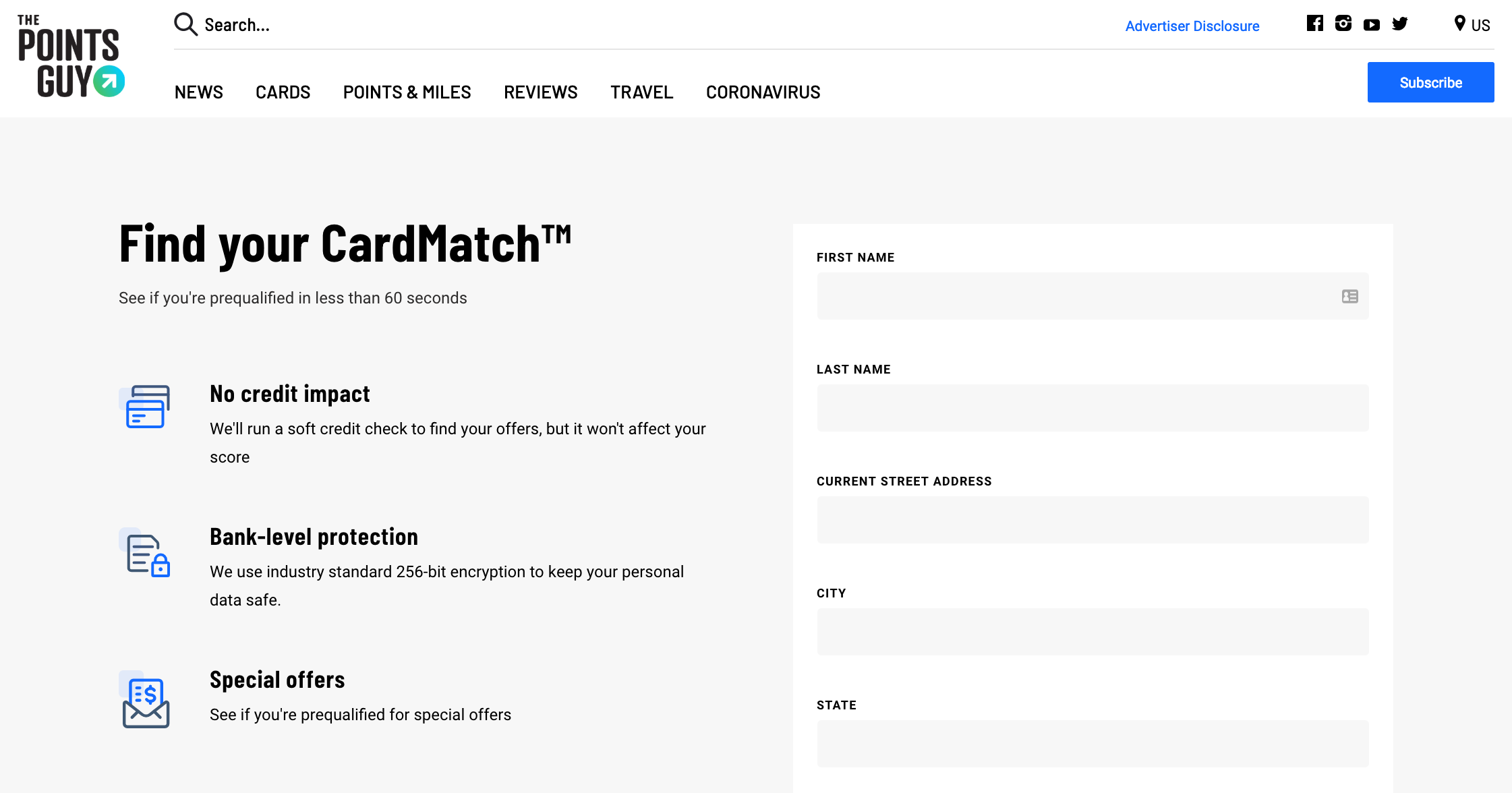

Learn how to use the CardMatch device

First, you fill out your data inside the CardMatch device.

From there, you may be taken to a outcomes web page with the related presents. Your outcomes will, in fact, be catered to you, and this all occurs with no formal arduous inquiry towards your credit score report.

We have seen presents as excessive as 175,000 Membership Rewards factors for the Amex Platinum and 90,000 factors for the Amex Gold after assembly minimal spending necessities.

Evaluate that to their publicly accessible welcome presents: the Amex Gold card is at present 60,000 factors after spending $6,000 in purchases within the first six months of card membership, whereas the Amex Platinum is at present providing a public welcome supply of 80,000 Membership Rewards Factors after you spend $8,000 on purchases inside the first six months of card membership.

Associated: Examine to see in case you’re focused for an elevated Amex Platinum or Amex Gold supply through CardMatch

Issuer pre-qualification instruments

Many issuers present their very own pre-qualification instruments to assist potential candidates perceive whether or not they’re prone to be accredited for sure playing cards. Usually talking, chances are you’ll not discover the greatest welcome presents by means of this methodology. Nevertheless, with restricted credit score histories and less-than-stellar credit score scores can make the most of these instruments to see which playing cards they can get.

Capital One pre-qualification

Capital One presents a device to see if you’re pre-qualified for a number of bank cards, together with:

At present, you possibly can’t use this device to see if you’re certified for Capital One’s premium product — the Capital One Enterprise X Rewards Credit score Card — nevertheless it shows your odds of approval at many different of the issuer’s playing cards.

The pre-qualification utility is brief, however you should present your annual earnings, Social Safety quantity, tackle and housing state of affairs.

I used to be pre-qualified for the Quicksilver, SavorOne and Platinum playing cards. As an apart, I’m at present a cardholder of the Enterprise Rewards card.

The data for the Capital One Savor Money Rewards Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: Greatest Capital One bank cards

Uncover pre-qualification

Uncover additionally has an on-site pre-qualification device you possibly can make the most of.

Once I went by means of the method, I used to be pre-qualified for the Uncover it Miles and the Uncover it Money Again playing cards. I’ve by no means owned a Uncover card, probably explaining why (and the way) I certified for these “high” Uncover playing cards.

The data for the Uncover it Miles and the Uncover it Money Again has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: Greatest Uncover bank cards

Credit score One Financial institution pre-qualification

Credit score One Financial institution presents a number of bank card choices. Nevertheless, this issuer actually is not wherever close to the extent of Chase or Amex by way of advantages provided or potential rewards earned.

On the time of writing, Credit score One Financial institution requires new clients to pre-qualify for all new bank cards earlier than making use of.

I truly went by means of this course of and was solely pre-qualified to use for the Credit score One Financial institution® Platinum Visa® for Rebuilding Credit score. This may very well be as a result of I lately opened one other bank card inside the previous few months.

Observe that Credit score One Financial institution lists its full bank card lineup as potential choices for pre-qualification (not like Capital One, which solely checks pre-qualification for choose playing cards).

The data for the Credit score One Financial institution Platinum Visa for Rebuilding bank card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: One of the best Credit score One bank cards

Does a pre-qualified supply trigger a tough pull on my credit score report?

Whereas the knowledge gathered at this stage may give a financial institution a stable image of whether or not you’ll be accredited based mostly on sure standards, your full report is not pulled.

Pre-qualified presents aren’t the identical as official functions. Should you resolve to use for a brand new line of credit score, that can end in a tough inquiry in your credit score report, no matter whether or not you went by means of the pre-qualification course of. And receiving a pre-qualified supply does not assure you may be accredited for a brand new account.

Associated: What’s the distinction between a tough and delicate pull in your credit score report?

What is the distinction between pre-qualified and preapproved?

Although some issuers use these phrases interchangeably, there’s a distinction between pre-qualified and preapproved presents.

A pre-qualified supply relies on a delicate pull performed in your credit score report the place you’ve got met sure standards that might make you eligible for a sure card or supply. Usually, a pre-qualification supply outcomes from a client submitting a pre-qualification utility (separate from an official credit score utility).

Alternatively, a preapproved supply is often a prescreened supply that’s focused to you. If you settle for a preapproval supply and apply, the issuer should honor the supply it despatched it’s best to you be accredited for the cardboard.

These are extra widespread through unsolicited mail, both by means of electronic mail or snail mail. Issuers with a pre-qualification portal will typically have a piece the place you possibly can enter an ID or invitation quantity from a mail-in supply to establish your focused supply inside the system.

Neither preapproved nor pre-qualified presents will harm your credit score rating as a result of they end result from a delicate pull in your credit score report.

Nevertheless, in case you resolve to go ahead with an utility after both of a lot of these presents, it would end in a tough inquiry when you formally apply and provides the credit score issuer permission to tug your full report.

Associated: ‘Tender pull’ bank cards: Are they value it?

Are you able to be denied if you’re preapproved?

Neither a preapproved nor a pre-qualified supply counts as an official approval for a card. Whereas it would imply that your credit score profile is extra prone to be accredited, there isn’t a assure.

There’s a chance that you possibly can nonetheless be denied a bank card for a number of causes. The one solution to discover out if you’re formally accredited for a bank card is to use formally.

Equally, simply since you aren’t pre-qualified for a suggestion doesn’t suggest you would not be accredited for a sure card in case you formally utilized.

Associated: Denied for a bank card? Here is what to do when it occurs

Backside line

Whether or not you are on the lookout for the best-targeted presents or just need a greater concept of which playing cards you might be prone to be accredited for, there may be numerous worth in trying to find pre-qualified presents. Generally, like with the Amex Platinum supply by means of CardMatch, you possibly can even discover profitable sign-up bonuses or welcome presents that you simply in any other case would miss out on.

Each time I am contemplating a brand new bank card, I all the time test CardMatch and different pre-qualification instruments to ensure I am getting the very best supply accessible.

Examine the CardMatch device to see which playing cards you pre-qualify for. Be mindful these presents are topic to alter at any time.