Citi Strata Elite Card $200 Annual Splurge Credit score: How Can It Be Used?

Hyperlink: Apply now for the Citi Strata Elite℠ Card

The Citi Strata Elite℠ Card (evaluation) is Citi’s new premium bank card. The cardboard has a giant welcome bonus — many individuals needs to be eligible for the product, and it’s a card that I lately utilized for. There’s seemingly a selected curiosity on this card since Citi ThankYou factors might be transfered to American AAdvantage.

The cardboard has a $595 annual payment, however presents a wide range of perks that may assist justify that. I’d wish to cowl among the particulars of the particular advantages of the cardboard, and on this put up, I’d like to try the $200 annual “Splurge Credit score” supplied by the cardboard. There’s clearly some confusion as to how this workw or what that entails.

I’d argue that this profit is mainly good as money, so let’s cowl the small print…

Particulars of the Citi Strata Elite Card Splurge Credit score

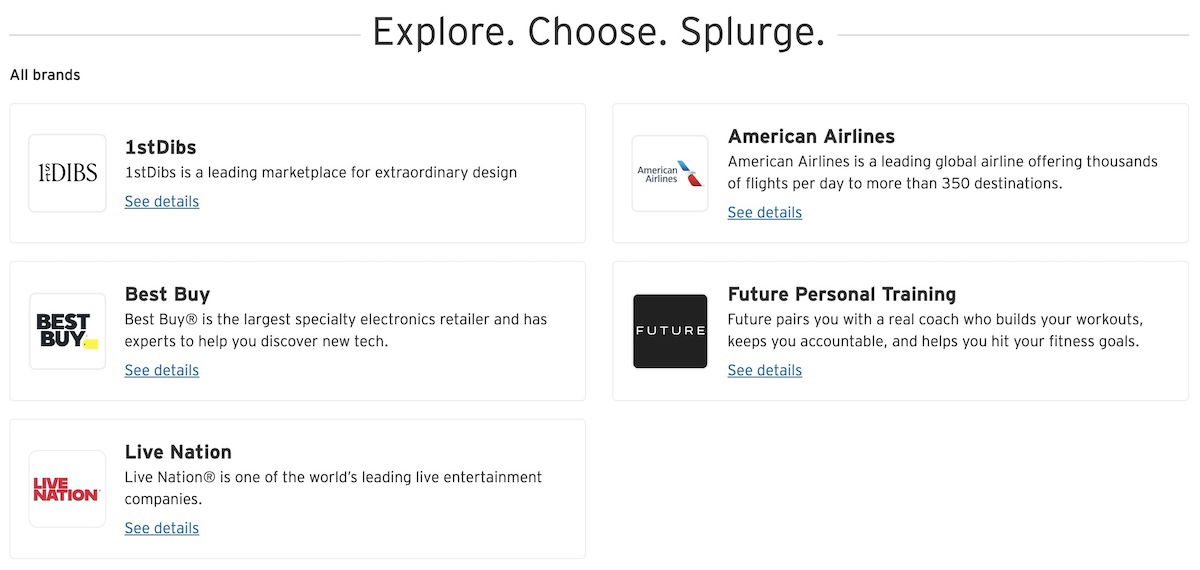

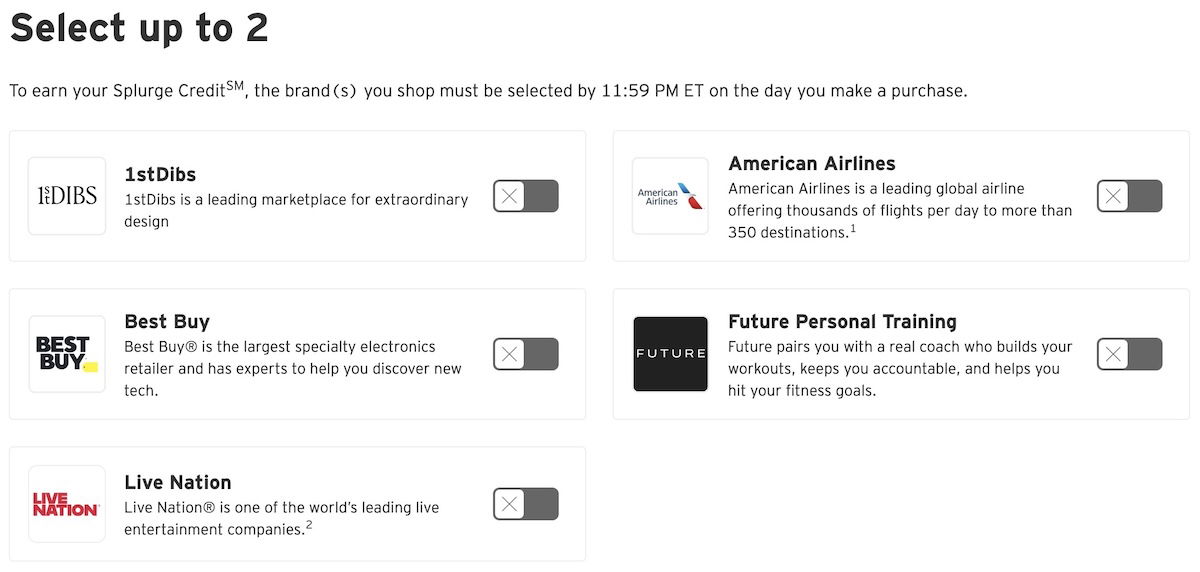

The Citi Strata Elite Card presents a $200 Splurge Credit score yearly. The best way this works, you obtain a credit score of as much as $200 that you need to use with a wide range of retailers, together with 1stDibs, American Airways, Finest Purchase, Future Private Coaching, and Dwell Nation. As you’d anticipate, there are some phrases to concentrate on:

- The Splurge Credit score is obtainable per calendar 12 months somewhat than per cardmember 12 months, so that you’ll obtain the $200 credit score to make use of between January 1 and December 31 of every 12 months

- The Splurge Credit score might be redeemed throughout a number of transactions, till it’s totally used

- Previous to utilizing your Splurge Credit score, it’s essential to register at this hyperlink, and through that course of, you may choose as much as two retailers at a time that you simply need to use this credit score for

- When you choose the retailers you need to select the Splurge Credit score for, that choice applies as of 12AM ET on the day the service provider is chosen; in different phrases, this might even apply barely retroactively, as a result of in case you made a purchase order at 1AM and solely registered at 8AM the identical day, that buy could be eligible

- Purchases made by the first cardmember or approved customers can rely towards the Splurge Credit score, although the credit score is a most of $200 per main cardmember account

- It could actually take one to 2 billing cycles for the Splurge Credit score to seem in your assertion

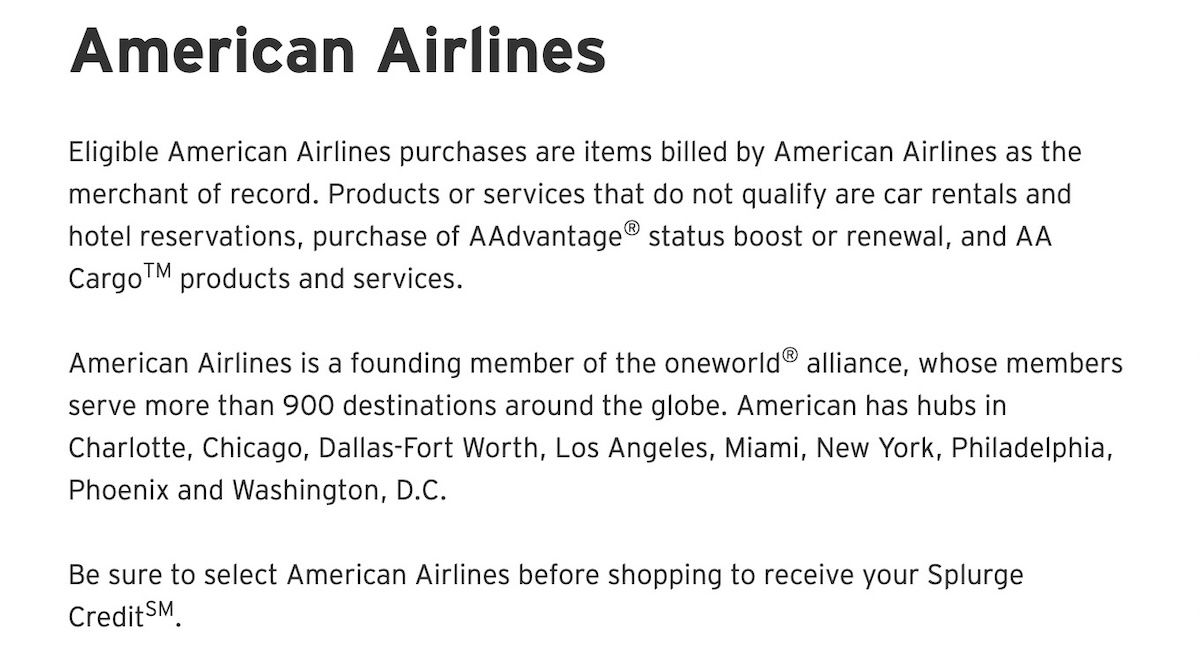

- To qualify for the American Airways Splurge Credit score, the acquisition have to be billed by American or American Airways Holidays; automotive leases, lodge reservations, purchases of AAdvantage standing increase or renewal, and AA Cargo services and products, don’t qualify

- To qualify for the Dwell Nation Splurge Credit score, a purchase order have to be made instantly on livenation.com or ticketmaster.com for occasions or venues inside the USA; the acquisition have to be fulfilled by Dwell Nation or Ticketmaster, and never by a 3rd celebration service

Logistics of the Citi Strata Elite Card Splurge Credit score

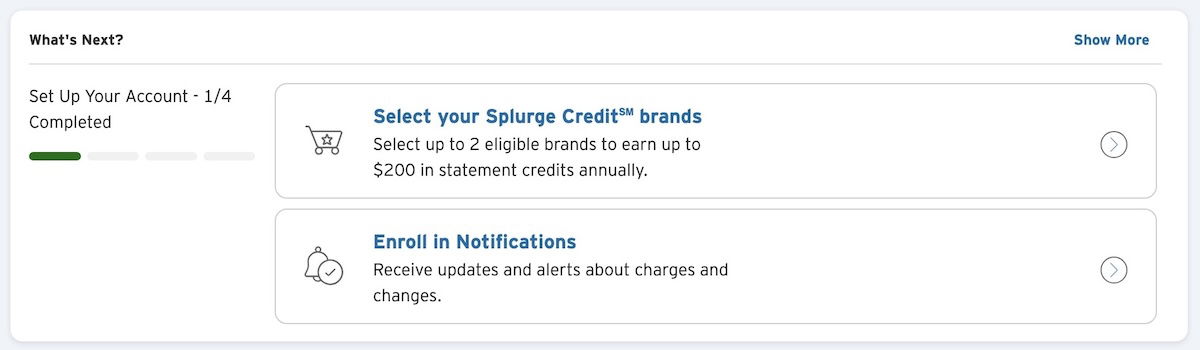

Since I lately utilized for the Citi Strata Elite Card, let me share my expertise with the logistics of this perk. When you arrange your account, you may both go to this hyperlink, or just go to your essential account administration web page, the place you’ll see the choice to pick your Splurge Credit score manufacturers.

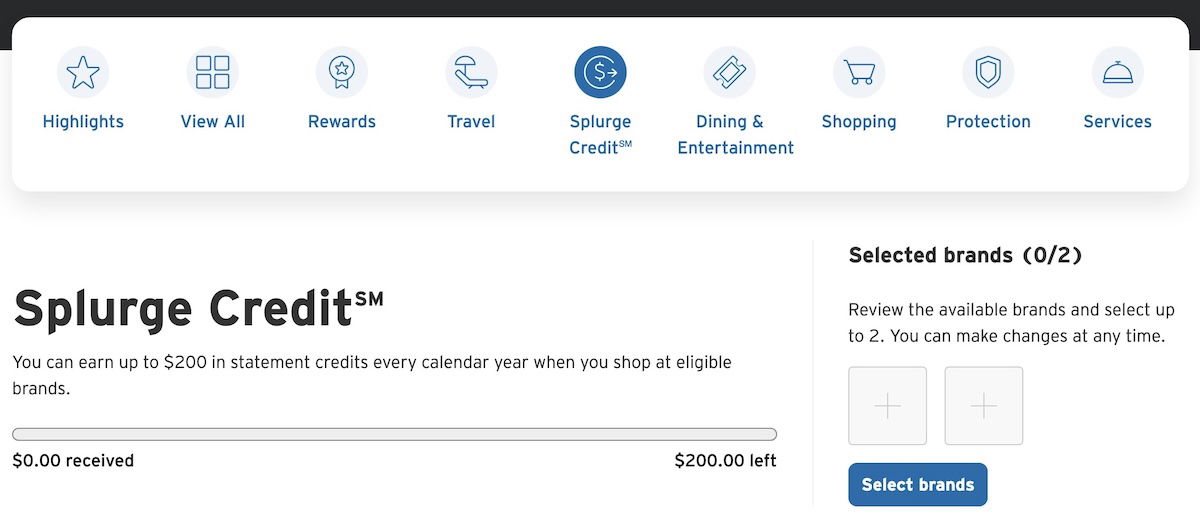

While you observe that hyperlink, you’ll see the choice to pick manufacturers, and also you’ll additionally see how a lot of your Splurge Credit score you’ve used up to now.

The web page additionally lists all of the manufacturers you may select from, and in case you click on on the “See particulars” buttons, you’ll see the phrases related to every service provider.

For instance, beneath is the web page about utilizing your Splurge Credit score for American purchases.

Then in case you click on the “Choose manufacturers” button, you’ll be dropped at the web page the place you may choose which service provider you need to activate.

The Citi Strata Elite Card Splurge Credit score is simple to make use of

The worth proposition of premium bank cards is fairly constant, within the sense that the playing cards have steep annual charges, however then provide credit and different advantages that may assist offset these charges. Among the many advantages supplied by the Citi Strata Elite Card, I’d argue that the Splurge Credit score is the only perk that’s closest to being “good as money.”

The very first thing value mentioning is that this presents disproportionate worth in your first 12 months of card membership, since you may obtain two of these credit along with your first annual payment. That’s as a result of the Splurge Credit score relies on the calendar 12 months, whereas the annual payment relies on the cardmember 12 months.

For me, the worth of the Splurge Credit score is fairly simple — I’ll merely spend at the least $200 per 12 months on American with this card as a way to maximize the Splurge Credit score. That’s tremendous simple.

I’d say the subsequent most suitable choice is to only make a purchase order with Finest Purchase. Finest Purchase sells every kind of merchandise, together with reward playing cards for third celebration retailers, in order that needs to be very easy to maximise.

My level is just to say that this profit needs to be value very near face worth. Or put one other manner, in case you can’t get near full worth out of this credit score, then this card most likely isn’t for you.

Backside line

The Citi Strata Elite Card presents a number of useful advantages, and amongst these is a $200 annual Splurge Credit score. That is fairly simple, as you simply must register along with your alternative of 5 retailers, after which any eligible spending counts towards that credit score.

I feel that American and Finest Purchase are most likely the 2 most simple companions right here — with American you may simply purchase tickets, whereas with Finest Purchase you should purchase every kind of merchandise, together with reward playing cards. Since this credit score is issued per calendar 12 months somewhat than per cardmember 12 months, you are able to do particularly effectively with this in your first annual payment.

What’s your tackle the Citi Strata Elite Card $200 Splurge Credit score?

Supply hyperlink