Citi AAdvantage Globe Card $100 Annual Splurge Credit score: How Can It Be Used?

Hyperlink: Be taught extra in regards to the Citi® / AAdvantage® Globe™ Mastercard®

The Citi® / AAdvantage® Globe™ Mastercard® (evaluation) is American Airways’ new premium bank card. The cardboard has an enormous welcome bonus, which makes it value contemplating, and it’s one of many causes I already utilized for the cardboard.

Whereas the cardboard has a steep $350 annual payment, it affords a number of perks that may assist offset that, whether or not you’re an occasional or frequent flyer on American. On this publish, I’d like to check out the as much as $100 annual “Splurge Credit score” supplied by the cardboard.

How precisely does this perk work, and the way helpful is it? That is modeled after an identical perk on the Citi Strata Elite℠ Card (evaluation), although sadly I discover this one to be significantly much less helpful, sadly. That’s to not say it isn’t value something, although!

Particulars of the Citi AAdvantage Globe Card Splurge Credit score

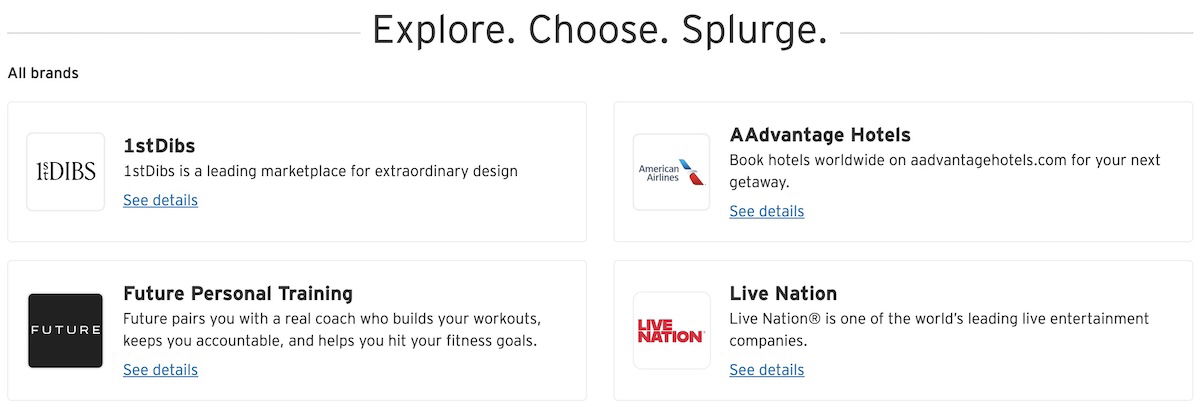

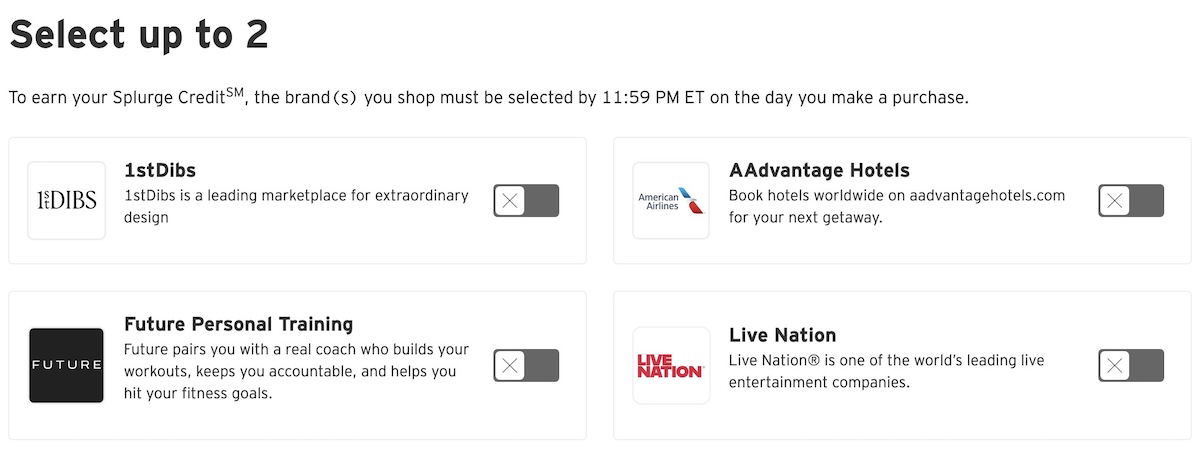

The Citi AAdvantage Globe Card affords a $100 Splurge Credit score yearly. The best way this works, you obtain a credit score of as much as $100 that you need to use together with your alternative of 4 retailers, together with 1stDibs, AAdvantage Motels, Future Private Coaching, and Stay Nation. As you’d anticipate, there are some phrases to concentrate on:

- The Splurge Credit score is obtainable per calendar yr relatively than per cardmember yr, so that you’ll obtain the $100 credit score to make use of between January 1 and December 31 of every yr

- The Splurge Credit score might be redeemed throughout a number of transactions, till it’s absolutely used

- Previous to utilizing your Splurge Credit score, that you must register at this hyperlink, and through that course of, you possibly can choose as much as two retailers at a time that you simply wish to use this credit score for

- When you choose the retailers you wish to select the Splurge Credit score for, that choice applies as of 12AM ET on the day the service provider is chosen; in different phrases, this might even apply barely retroactively, as a result of should you made a purchase order at 1AM and solely registered at 8AM the identical day, that buy can be eligible

- Purchases made by the first cardmember or licensed customers can depend towards the Splurge Credit score, although the credit score is a most of $100 per main cardmember account

- It will possibly take one to 2 billing cycles for the Splurge Credit score to seem in your assertion

- To qualify for the Stay Nation Splurge Credit score, a purchase order should be made immediately on livenation.com or ticketmaster.com for occasions or venues inside america; the acquisition should be fulfilled by Stay Nation or Ticketmaster, and never by a 3rd get together service

Logistics of the Citi AAdvantage Globe Card Splurge Credit score

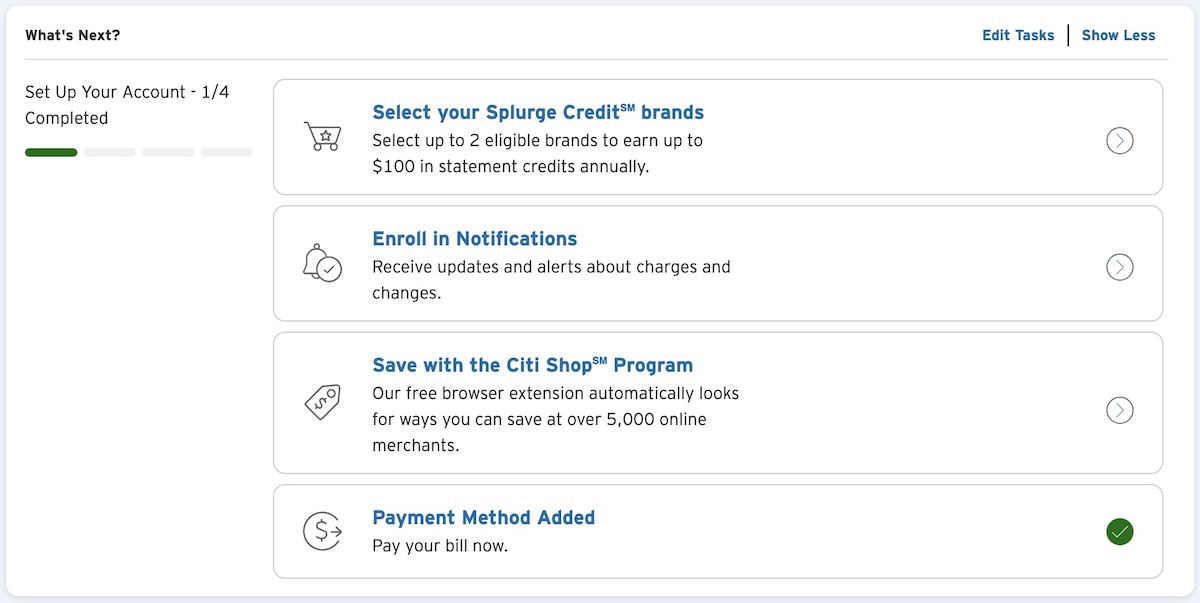

Since I just lately utilized for the Citi AAdvantage Globe Card, let me share my expertise with the logistics of this perk. When you arrange your account, you possibly can both go to this hyperlink, or just go to your primary account administration web page, the place you’ll see the choice to pick your Splurge Credit score manufacturers.

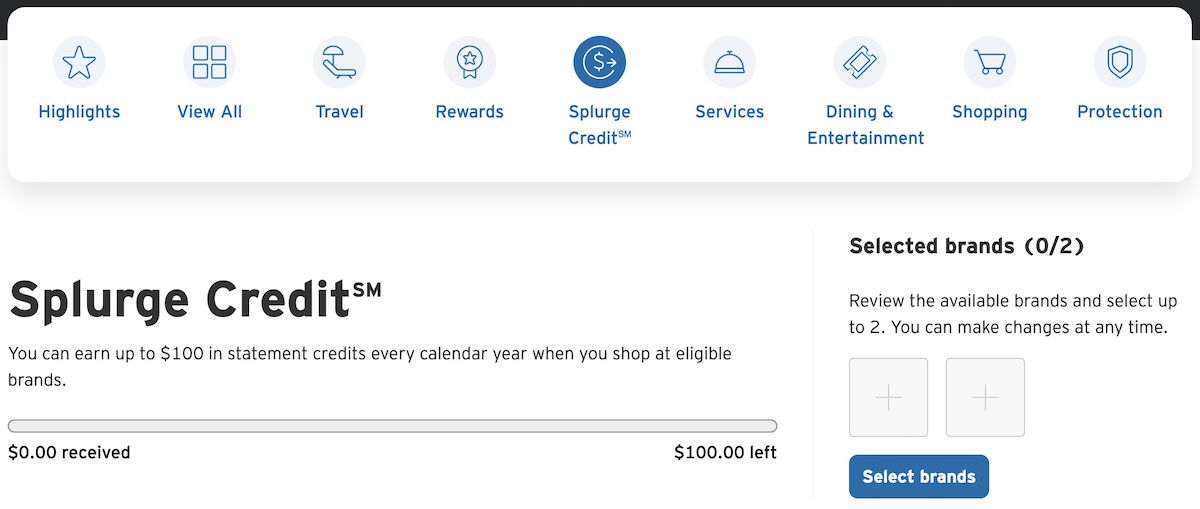

Once you observe that hyperlink, you’ll see the choice to pick manufacturers, and also you’ll additionally see how a lot of your Splurge Credit score you’ve used to date.

The web page additionally lists all of the manufacturers you possibly can select from, and should you click on on the “See particulars” buttons, you’ll see the phrases related to every service provider, if there are any.

For instance, under is the web page about utilizing your Splurge Credit score for AAdvantage Motels.

Then should you click on the “Choose manufacturers” button, you’ll be delivered to the web page the place you possibly can choose which service provider you wish to activate.

How helpful is the Citi AAdvantage Globe Card Splurge Credit score?

As talked about above, the $100 annual Splurge Credit score on the Citi AAdvantage Globe Card is modeled after the $200 credit score on the Citi Strata Elite Card. Nevertheless, it’s not fairly as helpful for 2 causes (although admittedly the annual payment additionally isn’t as excessive):

- The credit score is for $100 relatively than $200

- The Citi Strata Elite affords a credit score with American Airways and Greatest Purchase, and that provides you much more flexibility; American is tremendous helpful since you possibly can simply e book flights, whereas Greatest Purchase sells present playing cards with all types of outlets

With that in thoughts, are there any inventive methods to make use of the Citi AAdvantage Globe Card Splurge Credit score? I’m not noticing any actual tips right here, although just a few ideas. Should you ask me, 1stDibs and and Future Private Coaching appear actually area of interest, except you’re already a buyer of these firms. In the meantime Stay Nation is helpful for individuals who prefer to attend reside occasions (not me!). Subsequently I feel that makes AAdvantage Motels essentially the most helpful redemption possibility.

Many individuals like AAdvantage Motels as a result of it enables you to earn AAdvantage miles and Loyalty Factors for lodge stays, and in some circumstances, the rewards construction is definitely fairly profitable. So at a minimal, it looks as if it might be value utilizing this credit score for any keep of round $100 or so (or as near it as attainable).

Not solely would you get the assertion credit score, however you’d additionally earn AAdvantage miles and Loyalty Factors, plus the cardboard earns a further 6x AAdvantage miles per greenback spent with AAdvantage Motels. In order that lodge keep may shortly develop into rewarding. It’s not essentially the most thrilling factor on earth, but it surely must be attainable to get some materials worth out of this profit.

Backside line

The Citi AAdvantage Globe Card affords a number of useful advantages, and amongst these is a $100 annual Splurge Credit score. You simply need to register together with your alternative of 4 retailers, after which any eligible spending counts towards that credit score.

Sadly the retail companions are a bit random, and I wouldn’t take into account this credit score to be value near face worth. Personally I feel AAdvantage Motels might be the most suitable choice, as you possibly can primarily get a credit score of $100 towards a lodge, all whereas incomes AAdvantage miles and Loyalty Factors in your keep. Many American flyers use AAdvantage Motels anyway, so for these folks, this credit score is value fairly near face worth.

Personally I’d take into account among the different perks of the cardboard to be extra useful, just like the Flight Streak Loyalty Factors bonus, as much as $100 annual inflight credit score, the 4 annual Admirals Membership passes, and extra.

What’s your tackle the Citi AAdvantage Globe Card $100 Splurge Credit score?

Supply hyperlink