Citi AAdvantage Enterprise Card Approved Person Rewards Defined

Hyperlink: Apply now for the Citi® / AAdvantage Enterprise™ World Elite Mastercard®

The Citi® / AAdvantage Enterprise™ World Elite Mastercard® (assessment) is the co-branded Citi and American Airways enterprise card. The cardboard affords a number of helpful perks, and in addition has a superb welcome bonus in the intervening time, making it an excellent time to use.

Nevertheless, in terms of really spending cash on the cardboard, there’s one factor that works very otherwise than on many different enterprise bank cards. I need to focus on that in a bit extra element on this submit, because it’s one thing that causes confusion… however you can also make it work to your benefit!

American’s enterprise card rewards licensed customers

On a overwhelming majority of non-public and small enterprise bank cards, the first cardmember is absolutely rewarded for the spending of licensed customers. So simply as the first cardmember is on the hook for paying the invoice, additionally they profit by incomes the rewards.

That’s not at all times the case, as some company playing cards do incentivize the person workers, nevertheless it’s uncommon on small enterprise playing cards. Now, I think about that many people who find themselves licensed customers on enterprise playing cards want they had been incomes the rewards for their very own spending.

That’s why there’s an attention-grabbing element of the Citi AAdvantage Enterprise Card that’s value being conscious of, because it additionally ties into the AAdvantage Enterprise program, which is American’s small enterprise rewards program. On the Citi AAdvantage Enterprise Card:

- Redeemable AAdvantage miles earned from a certified person’s card might be allotted to the AAdvantage Enterprise account, which the first cardmember has management over (and might then allocate nevertheless they’d like)

- Loyalty Factors earned by licensed customers are posted to the AAdvantage account of the licensed person, and to not the AAdvantage account of the first cardmember

- Word that spending from each the first cardmember and licensed customers counts towards the welcome bonus and any spending necessities; nevertheless, a few of the card perks (like a primary free checked bag) are solely accessible to the first cardmember

One of many most important causes that individuals spend on American bank cards is to have the ability to earn Loyalty Factors, as that is the metric by which you earn elite standing, and qualify for Loyalty Level Rewards. It’s attainable to earn elite standing completely by bank card spending.

So when you’re a major cardmember on this card, remember that the spending of licensed customers typically gained’t enable you to qualify for elite standing.

Is rewarding licensed customers an excellent coverage?

It goes with out saying that when you’re a small enterprise proprietor and wish to be rewarded for the spending of your workers, this rewards construction isn’t perfect, and offers a robust incentive to make use of one other card.

In any case, one of many most important causes to spend on American’s co-branded playing cards is for the Loyalty Factors, and that’s not one thing you’re benefiting from right here, at the least on an ongoing foundation. You’re on the hook for the bills, however aren’t receiving the rewards.

Nevertheless, there are additionally some small enterprise house owners who like their workers to be rewarded for his or her spending, and it’s one thing that isn’t unusual on company accounts. In that sense, the cardboard affords lots of flexibility — your licensed customers not solely earn Loyalty Factors, however you possibly can then allocate the redeemable AAdvantage miles to whichever account you’d like, instantly from the central AAdvantage Enterprise account. You would even use this as a part of some form of an incentive program for your online business.

Personally I believe most individuals gained’t be a fan of this coverage, so it’s value being conscious of this, as that is the one co-branded airline bank card in america I do know of that allocates rewards on this approach.

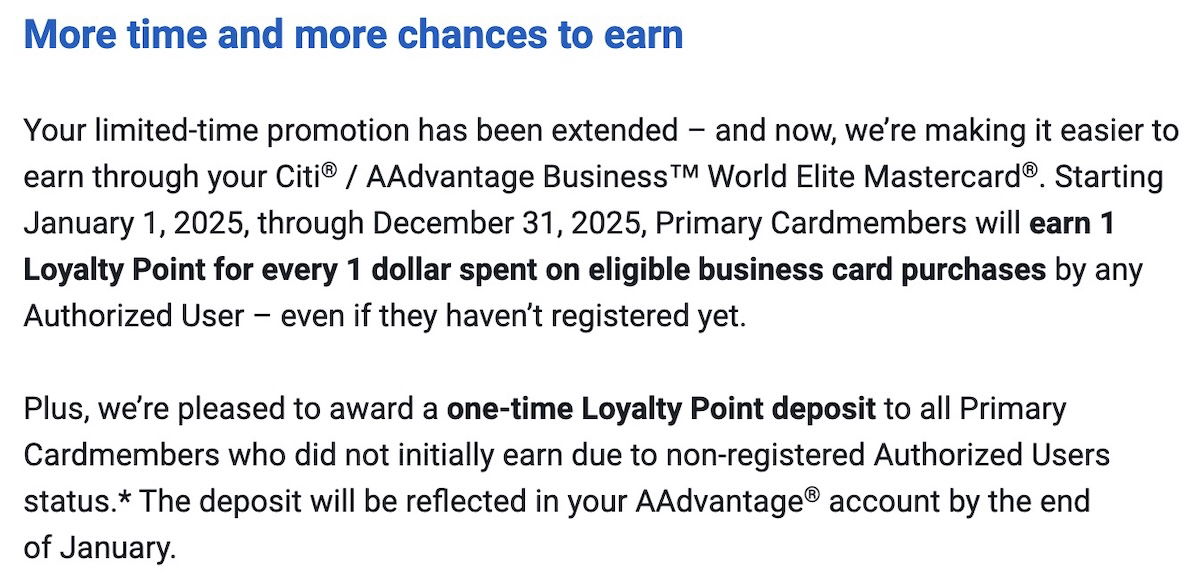

Double dip Loyalty Factors for a restricted time

It’s value noting that whereas the above displays the usual coverage, some folks with the Citi AAdvantage Enterprise Card are eligible for a restricted time provide. Eligible cardmembers can primarily double dip — not solely does the licensed person earn one Loyalty Level per greenback spent, however the major cardmember additionally earns one Loyalty Level per greenback spent.

Now, that is technically solely accessible to pick accounts, so that you’ll have to examine your electronic mail to see when you’re eligible for this. At present, that is accessible by December 31, 2025 (although it has been prolonged up to now, and who is aware of, possibly it’ll be prolonged once more).

Actually, this can be a fairly profitable promotion. For instance, when you have a certified person who spends $200K on a card, each the first cardmember and licensed person would obtain 200,000 Loyalty Factors, sufficient for Govt Platinum.

Once more, it’s attainable not everyone seems to be eligible for this, however I consider the provide is at the least fairly broadly focused, as I’ve acquired a number of reviews from readers indicating that they’re eligible. Personally, that is how I’m engaged on qualifying for AAdvantage standing this 12 months.

I can’t assist however marvel if this coverage would possibly even stick round, on condition that many major cardmembers won’t be a fan of the Loyalty Factors solely being awarded to licensed customers, plus the emphasis that so many card issuers have on rising their enterprise card pockets share.

American enterprise card licensed person logistics

There are sometimes questions on licensed customers logistics on the Citi AAdvantage Enterprise Card. How do you add licensed customers? When you’ve added a certified person, how do you really add their AAdvantage quantity, to make sure they get the licensed person rewards? Let me deal with these questions…

The way to add licensed customers to the cardboard

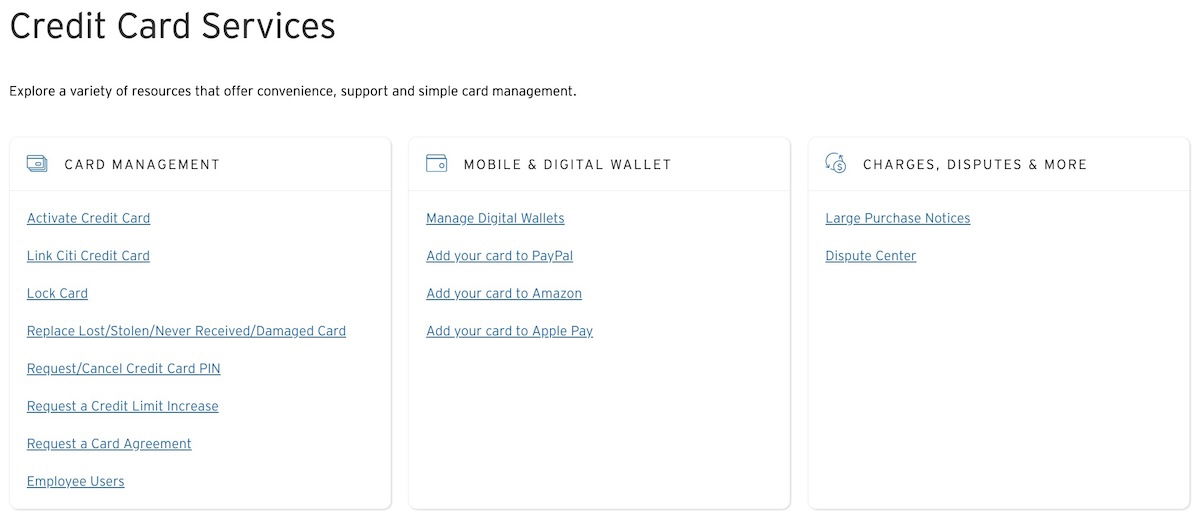

First, how do you add licensed customers to the Citi AAdvantage Enterprise Card? That is no totally different than just about another enterprise card, so it’s not too difficult. There are two methods to take action:

- After you submit your software, you’ll have the choice of including licensed customers

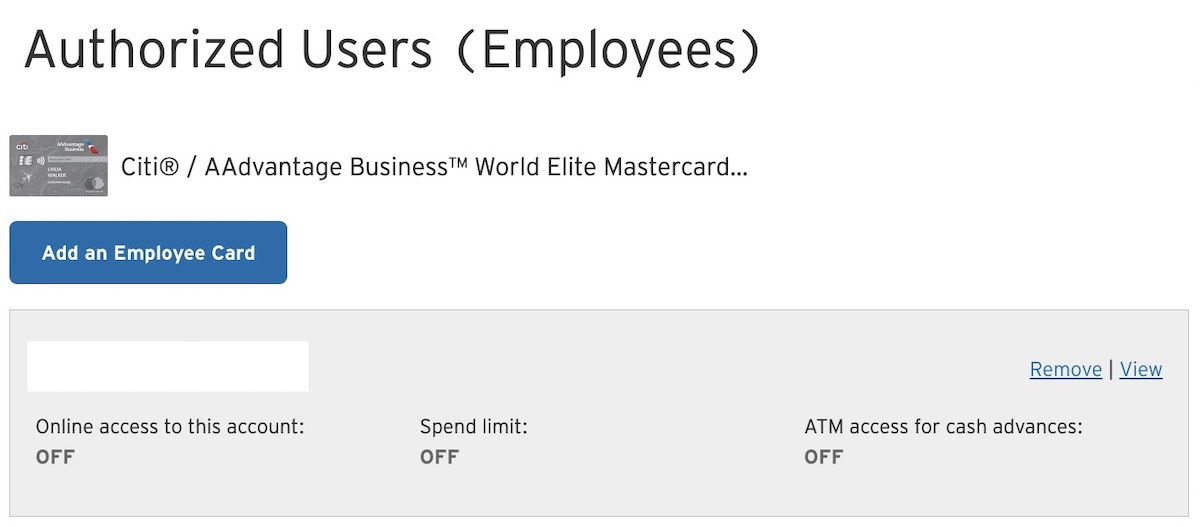

- If you wish to add licensed customers after opening your card, simply log into your Citi account on-line, click on on the “Companies” heading, then the “Credit score Card Companies” immediate, after which within the “Card Administration” part, choose “Worker Customers,” after which “Add an Worker Card”

The way to hyperlink licensed person AAdvantage account data

Right here’s the commonest query associated to this card. If you add a certified person to the Citi AAdvantage Enterprise Card, how do you really hyperlink their AAdvantage account info in order that Loyalty Factors credit score to them, since AAdvantage account data isn’t requested when including licensed customers?

This confused me once I added a certified person, and I felt like buyer assist at each Citi and AAdvantage Enterprise couldn’t give me a transparent reply as to what to anticipate. So I’m pleased to report again with my expertise.

Lengthy story quick, some period of time after you add a certified person, they’ll obtain an electronic mail both welcoming or inviting them to the AAdvantage Enterprise program (it’s important to present an electronic mail deal with whenever you add a certified person, in order that’s the place the e-mail goes). This electronic mail would possibly come days after you add a certified person, or it might come a full billing cycle (or extra) later.

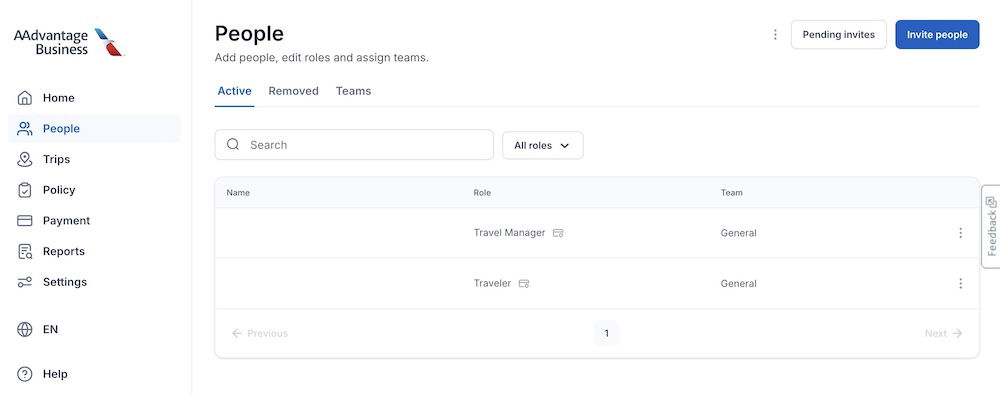

When the first cardmember logs into their AAdvantage Enterprise account (separate from their private AAdvantage account or Citi account), they could then see that licensed person listed within the “Individuals” part. Particularly, you’ll need to search for the cardboard brand subsequent to their title.

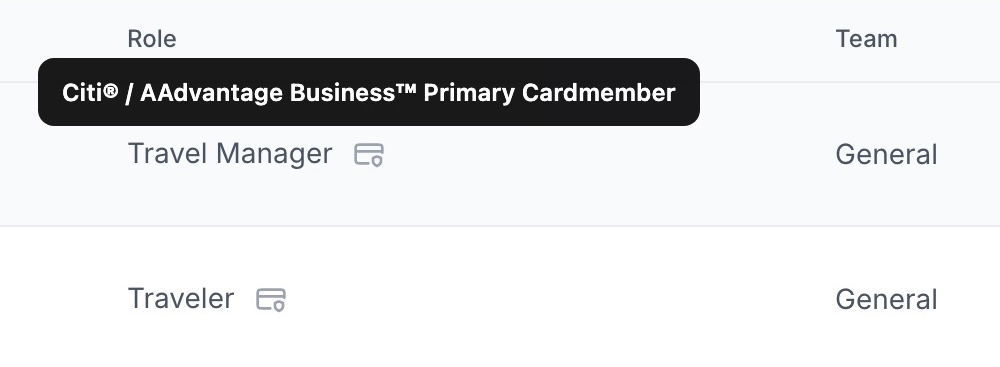

Within the “Position” part, the first cardmember might be listed because the “Journey Supervisor.”

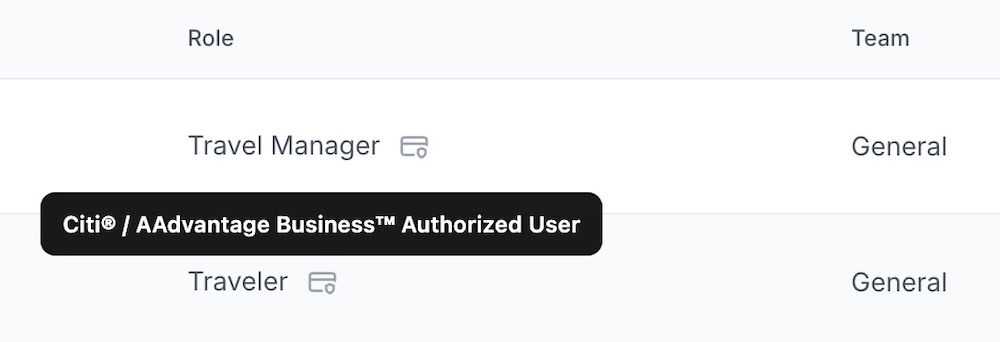

In the meantime the licensed person might be listed because the “Traveler.”

If the licensed person doesn’t robotically present up listed there, examine the “Pending invitations” part on the prime proper, and you might even see them listed there. You understand that every thing with the licensed person is linked appropriately when the cardboard brand seems subsequent to their title.

Let me emphasize a few factors about this, as somebody who grew to become a bit pissed off with the method:

- There’s no level in attempting to hurry the method, so it might take weeks for the licensed person to get the welcome electronic mail, so simply be affected person

- It was defined to me that even all spending previous to that course of being efficiently accomplished will nonetheless have Loyalty factors submit appropriately, so don’t fear about that

Backside line

The Citi AAdvantage Enterprise Card takes an uncommon strategy to rewarding licensed customers. Approved person spending earns Loyalty Factors for the licensed person, moderately than the first cardmember. In the meantime the AAdvantage miles earned from spending go to the central AAdvantage Enterprise account, and might then be allotted to the AAdvantage account of any worker (or the enterprise proprietor), as desired.

Nevertheless, there’s a restricted time promotion that many are eligible for, which primarily permits folks to double dip, and earn Loyalty Factors each for the licensed person and first cardmember. I believe that’s one thing which may curiosity many (together with me!).

What do you make of the licensed person rewards construction on this card?

Supply hyperlink