Bought glorious credit score? These are one of the best bank cards for you

You could be accepted for a number of the greatest rewards bank cards when you’ve got an honest credit score rating. Nevertheless, having a wonderful credit score rating can unlock entry to probably the most rewarding premium playing cards, greater credit score strains and decrease rates of interest.

A superb credit score rating is usually outlined as 760 or greater.

Many of the greatest bank cards for shoppers with glorious credit score are journey bank cards that earn transferable factors currencies or rewards for a particular loyalty program, however we have additionally included a few cash-back playing cards.

This is what we advocate.

Finest bank cards for glorious credit score

With glorious credit score, you’ve a great opportunity of approval for any bank card, as long as you comply with the utility guidelines for the varied banks. These are one of the best bank cards for numerous forms of spending and advantages, which we’ll cowl intimately beneath:

One of the best bank cards for glorious credit score

American Specific® Gold Card: Finest for eating rewards

Welcome bonus: Earn 60,000 Membership Rewards factors after you spend $6,000 in purchases within the first six months of card membership. Plus, obtain 20% again on eligible purchases made at eating places worldwide throughout the first six months of card membership, as much as $100 again. Nevertheless, remember to verify the CardMatch Software to see in the event you’re focused for the next welcome bonus (supply topic to alter at any time).

Rewards fee: Earn 4 factors per greenback at eating places (together with takeout and supply within the U.S., on as much as $50,000 of those purchases per yr, then 1 level per greenback), 4 factors per greenback at U.S. supermarkets (on $25,000 of those purchases per yr, then 1 level per greenback), 3 factors per greenback on flights booked straight with airways or amextravel.com and 1 level per greenback on different purchases. TPG’s August 2024 valuations place American Specific Membership Rewards at 2 cents apiece.

Annual charge: $325 (see charges and charges)

Each day Publication

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Who ought to apply: If you would like an Amex card that makes it simple to earn Membership Rewards on on a regular basis bills resembling eating places and groceries at U.S. supermarkets, that is undoubtedly a card to contemplate. Nevertheless, in the event you’re in search of an Amex Membership Rewards card that earns bonus factors on all kinds of journey bills, you might be higher off with the American Specific® Inexperienced Card.The data for the Amex Inexperienced Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

For extra particulars, take a look at our full card overview for the Amex Gold.

Apply right here: American Specific® Gold Card

Blue Money Most well-liked® Card from American Specific: Finest cash-back card for fuel, groceries, and streaming

Welcome bonus: Earn a $250 assertion credit score after you spend $3,000 in purchases in your new card throughout the first six months.

Rewards fee: Earn 6% money again at U.S. supermarkets (on as much as $6,000 yearly, then 1%) and choose U.S. streaming providers, 3% on transit and at U.S. fuel stations and 1% on all the things else.

Annual charge: $0 intro annual charge for first yr, then $95 (see charges and charges)

Who ought to apply: The Blue Money Most well-liked Card has bonus classes which can be well-aligned with many shoppers. With many individuals spending an honest quantity on streaming providers, incomes 6% on this comparatively uncommon bonus class can present strong worth. Plus, you may earn $360 again on purchases at U.S. supermarkets annually in the event you attain the $6,000 spending cap; afterward, you’ll earn 1% again on these purchases.

You will additionally earn 3% money again on commuting bills involving fuel and transit (which incorporates taxis, ride-shares, tolls, trains, buses and extra). Though the cardboard doesn’t earn Membership Rewards factors, it gives a easy approach to earn rewards on frequent on a regular basis spending classes.

For extra particulars, take a look at our full card overview for the Blue Money Most well-liked.

Apply right here: Blue Money Most well-liked® Card from American Specific

Capital One Enterprise Rewards Credit score Card: Finest for rewards with fixed-rate and switch associate choices

Welcome bonus: Earn 75,000 bonus miles if you spend $4,000 on purchases within the first three months from account opening. Plus, get $250 to make use of on journey booked via Capital One Journey inside your first cardholder yr.

Rewards fee: Earn 5 miles per greenback spent on lodges, trip leases, and automobile leases booked via Capital One Journey and a pair of miles per greenback on different purchases. TPG’s August 2024 valuations place Capital One miles at 1.85 cents apiece.

Annual charge: $95 (see charges and charges)

Who ought to apply: The Capital One Enterprise is a good card in the event you’re in search of simplicity and versatile redemptions. You recognize you are getting a minimum of 2 miles per greenback on each buy, so that you needn’t fear about how a purchase order will code. The miles you earn can then be used to take away eligible journey purchases out of your bank card invoice or they are often transferred to one in every of Capital One’s switch companions. As an added perk, you may additionally get an announcement credit score of as much as $100 each 4 years on your World Entry or TSA PreCheck utility charge, which is not a profit generally discovered on low-fee playing cards.

This card is usually marketed as a newbie card, however anybody can make the most of the cardboard’s rewards construction and advantages. Inexperienced persons typically benefit from the simplicity of utilizing the Enterprise, however consultants can put it to use as an awesome card for non-bonus spending. TPG’s founder, Brian Kelly, even mentioned the Capital One Enterprise was the one card he’d hold if he might solely hold one card.

For extra particulars, take a look at our full card overview for the Capital One Enterprise.

Apply right here: Capital One Enterprise Rewards Credit score Card

Capital One Enterprise X Rewards Credit score Card: Finest for rewards and perks for licensed customers

Welcome bonus: Earn 75,000 bonus miles if you spend $4,000 on purchases within the first three months from account opening.

Rewards fee: Earn 10 miles per greenback on lodges and automobile leases booked through Capital One Journey, 5 miles per greenback on flights and trip leases booked through Capital One Journey and a pair of miles per greenback on different purchases. TPG’s August 2024 valuations put Capital One miles at 1.85 cents apiece.

Annual charge: $395 (see charges and charges)

Who ought to apply: The Enterprise X card has the identical welcome supply and earns the identical sort of Capital One miles because the Enterprise card. The distinction comes within the annual charge ($395, as a substitute of $95 (see charges and charges) and the plethora of perks added to the Enterprise X. Together with reimbursement on your World Entry or TSA PreCheck utility charge, you may take pleasure in a $300 annual journey credit score with Capital One Journey and 10,000 bonus miles in your account anniversary.

The true advantages include including a number of licensed customers on the account(see charges and charges), as they may take pleasure in these perks that are not reserved only for the first account holder: complimentary entry to Capital One lounges and Plaza Premium lounges and complimentary Hertz President’s Circle standing*.

*Upon enrollment, accessible via the Capital One web site or cell app, eligible cardholders will stay at upgraded standing degree via December 31, 2024. Please word, enrolling via the traditional Hertz Gold Plus Rewards enrollment course of (e.g. at Hertz.com) won’t robotically detect a cardholder as being eligible for this system and cardholders won’t be robotically upgraded to the relevant standing tier. Further phrases apply.

For extra particulars, take a look at our full card overview for the Capital One Enterprise X.

Apply right here: Capital One Enterprise X Rewards Credit score Card

Chase Sapphire Most well-liked Card: Finest for journey rewards with a low annual charge

Welcome bonus: Earn 60,000 bonus factors after you spend $4,000 on purchases within the first three months from account opening.

Rewards fee: Earn 5 factors per greenback on journey booked via Chase Journey℠, 5 factors per greenback on Lyft (via March 2025), 3 factors per greenback on eating, choose streaming providers and on-line grocery retailer purchases (excludes Goal, Walmart and wholesale golf equipment), 2 factors per greenback on all journey not booked via the Chase journey portal and 1 level per greenback on all the things else.

Annual charge: $95

Who ought to apply: The Chase Sapphire Most well-liked is among the greatest newbie journey playing cards obtainable. Plus, it gives a sign-up bonus value $1,230 based mostly on TPG’s August 2024 valuations. The Chase Sapphire Most well-liked earns Chase Final Rewards factors, which you’ll be able to redeem for 1.25 cents every via the Chase Final Rewards portal. Or, you may switch your factors to one in every of Chase’s airline or lodge companions after which redeem via these applications.

Should you’re in search of a strong journey rewards card with journey protections however cannot fairly justify the $550 annual charge on the Chase Sapphire Reserve, the Chase Sapphire Most well-liked is a good choice.

For extra particulars, take a look at our full card overview for the Chase Sapphire Most well-liked.

Apply right here: Chase Sapphire Most well-liked

Chase Sapphire Reserve: Finest for journey rewards with premium journey protections

Welcome bonus: Earn 60,000 factors after you spend $4,000 on purchases within the first three months of account opening.

Rewards fee: Earn 10 factors per greenback on lodges and automobile leases bought via Chase Journey, 10 factors per greenback on eating purchases via the Chase Final Rewards portal, 10 factors per greenback on Lyft rides via March 2025, 5 factors per greenback on flights bought via Chase Journey, 3 factors per greenback on all different journey (excluding the $300 journey credit score) and eating purchases worldwide and 1 level per greenback on all the things else.

Annual charge: $550

]Who ought to apply: The Chase Sapphire Reserve is among the prime premium journey rewards playing cards obtainable. Though latest modifications to the cardboard have upset some cardholders, the cardboard stays a staple in lots of wallets because of robust incomes charges on journey and its top-shelf journey protections.

The Chase Sapphire Reserve earns worthwhile Chase Final Rewards factors and gives perks together with an annual $300 journey credit score, Precedence Cross lounge entry, a TSA PreCheck/World Entry utility charge credit score each 4 years, a minimum of one complimentary yr of DashPass membership via DoorDash and a formidable array of journey protections. All of those perks and advantages make the Chase Sapphire Reserve an awesome choice for frequent vacationers. However, if you cannot fairly justify the $550 annual charge, you might discover that the Chase Sapphire Most well-liked Card is a greater match.

For extra particulars, take a look at our full card overview for the Chase Sapphire Reserve.

Apply right here: Chase Sapphire Reserve

Citi Double Money Card: Finest for on a regular basis incomes fee and stability transfers

Welcome bonus: Earn $200 money again after spending $1,500 within the first six months of account opening.

Rewards fee: Earn 2% again on all purchases — 1% again if you purchase purchases and 1% again when paying your invoice.

Annual charge: $0

Who ought to apply: These in search of an awesome card for on a regular basis spending — and even those that do not need to cope with bonus classes — will love this card. Double Money rewards are earned as ThankYou factors which you can redeem for money at 1 cent every or use with restricted switch choices: simply Selection Privileges, JetBlue TrueBlue and Wyndham Rewards. Should you’re available in the market for a easy card that earns versatile rewards, nonetheless, it does not get a lot better than the Citi Double Money.

For extra particulars, take a look at our full card overview for the Citi Double Money.

Apply right here: Citi Double Money Card

The Platinum Card from American Specific: Finest for premium perks and advantages

Welcome bonus: Earn 80,000 Membership Rewards Factors after you spend $8,000 on purchases throughout the first six months of card membership. Nevertheless, remember to verify the CardMatch Software to see in the event you’re focused for the next welcome bonus (supply topic to alter at any time).

Rewards fee: Earn 5 factors per greenback on airfare bought straight from airways or with Amex Journey (on as much as $500,000 of airfare purchases per calendar yr), 5 factors per greenback on pay as you go lodges booked with Amex Journey and 1 level per greenback on different purchases. TPG’s August 2024 valuations place American Specific Membership Rewards at 2 cents apiece.

Annual charge: $695 (see charges and charges)

Who ought to apply: Though the welcome bonus can present important worth — and incomes 5 factors per greenback on choose airfare and lodge bills is good — The Platinum Card from American Specific is a card that you simply hold for its advantages and perks. You possibly can earn as much as $200 in airline charge credit score, as much as $200 in Uber Money and as much as $100 in assertion credit for purchases from Saks Fifth Avenue annually. Plus, you may get entry to Centurion Lounges, Delta Sky Golf equipment* when flying Delta, Precedence Cross lounges and lots of extra lounges via Amex’s World Lounge Assortment. Enrollment is required for choose advantages.

You will additionally get computerized Marriott Gold standing and Hilton Gold standing. Plus, you may ebook distinctive lodge stays at choose properties via Amex’s Wonderful Motels and Resorts program. And, you may add three licensed customers for simply $175 per yr (see charges and charges). By way of redeeming, the American Specific Membership Rewards program has many airline and lodge companions to which you’ll be able to switch your reward factors.

For extra particulars, take a look at our full card overview for The Platinum Card from American Specific.

*Efficient February 1, 2025: Eligible Platinum Card Members will obtain 10 Visits per Eligible Platinum Card per yr to the Delta Sky Membership or to Seize and Go when touring on a same-day Delta-operated flight.

Apply right here: The Platinum Card® from American Specific

What is a superb credit score rating?

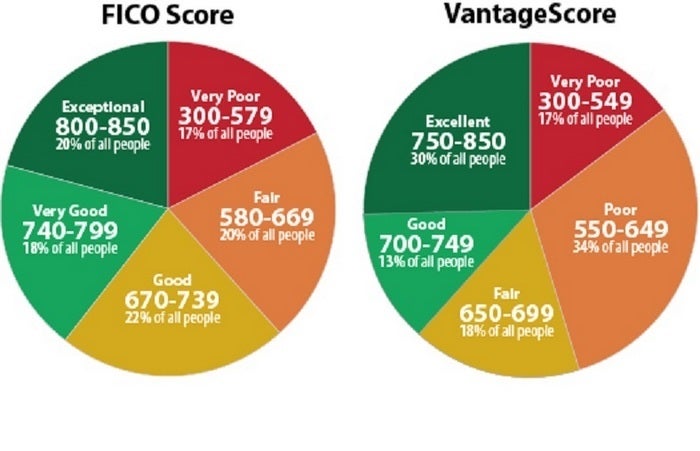

FICO Rating and VantageScore credit score scores vary from 300 to 850. A superb credit score rating is usually thought-about to be a rating that’s 760 and above.* With a credit score rating on this vary, you need to be capable of get accepted for many of the greatest rewards playing cards available on the market.

Associated: How you can verify your credit score rating without cost

*The Factors Man credit score ranges are derived from FICO® Rating 8, which is one in every of many various kinds of credit score scores. Should you apply for a bank card, the lender might use a distinct credit score rating when contemplating your utility for credit score.

However, it is necessary to appreciate that you do not have only one credit score rating. There are three principal credit score reporting businesses (Experian, Equifax and TransUnion) in addition to two major strategies for calculating credit score scores (FICO Rating and VantageScore). So, you may possible have barely totally different credit score scores from one credit score reporting company to a different.

For extra particulars, see our information to how credit score scores work.

Associated: Why your credit score rating could also be totally different relying the place you look

What bank cards are solely obtainable when you’ve got glorious credit score?

There are two forms of playing cards which can be typically solely obtainable when you’ve got superb or glorious credit score:

Amex playing cards with no preset spending limits

These playing cards aren’t truly bank cards. Amex playing cards like The Platinum Card® from American Specific and the American Specific® Gold Card do not include a credit score restrict or preset spending restrict such as you’re used to with bank cards. As an alternative, purchases are accepted on a case-by-case foundation.

Which means, within the incorrect fingers, they may very well be very harmful. Somebody might spend tens of 1000’s of {dollars} on these playing cards earlier than Amex caught on and began declining the fees. To cease this from taking place, Amex will typically solely approve candidates with glorious credit score.

Associated: Selecting one of the best American Specific bank card for you

Premium bank cards

Even when they arrive with a set spending restrict, you may count on to face stricter approval necessities for the ever-growing listing of premium bank cards. These playing cards supply worthwhile perks and are typically marketed towards greater spenders who, in flip, want a bigger credit score restrict. To be trusted with excessive spending capabilities, these playing cards usually require you to have a excessive credit score rating.

Associated: Why a $500+ per yr bank card is not loopy

Tricks to preserve glorious credit score

FICO and VantageScore scores are designed to foretell the chance that you’ll develop into 90 days late on any of your credit score obligations throughout the subsequent 24 months. So, briefly, to preserve glorious credit score you need to keep away from strikes that will enhance the perceived chance that you’ll develop into much less financially steady throughout the subsequent two years. However, you needn’t work towards an ideal 850 rating.

To take care of glorious credit score, you need to typically proceed to pay your payments on time, hold your debt-to-credit ratio low, keep away from closing any accounts you’ve got stored open for a very long time and keep away from opening an extreme quantity of latest accounts inside a brief interval. Should you’re trying to preserve your glorious credit score, you must also verify your credit score rating commonly.

Associated studying: 8 largest components that affect your credit score rating

Backside line

Having glorious credit score can assist you be accepted for a number of the greatest premium rewards bank cards, however glorious credit score may unlock numerous different advantages. For instance, greater credit score scores can typically assist you to qualify for decrease rates of interest in your mortgage.

That is simply another reason why we at TPG consider your credit score historical past is of the utmost significance. And in the event you take care of it nicely, you may be nicely in your approach to one of many playing cards listed above.

Associated: How a lot cash can good credit score actually prevent?

For charges and charges of the Amex Platinum card, click on right here.

For charges and charges of the Amex Gold card, click on right here.

For charges and charges of the Blue Money Most well-liked, click on right here.