Bilt Hints At Credit score Card Modifications, Factors For Mortgages, And Extra

Within the miles & factors world, many people are accustomed to the Bilt Mastercard® (assessment), which is a precious no annual payment card that lets you pay your hire by bank card and earn rewards, even when your landlord doesn’t ordinarily permit no-fee bank card funds.

Bilt presents nice worth for members, although I do know many people have been curious how sustainable the enterprise mannequin is. The corporate’s valuation retains rising (into the a number of billions), however progress and a excessive valuation don’t essentially translate to profitability.

Bilt has this week printed a roughly 1,700-word letter that it additionally despatched to members, signed by the corporate’s CEO. It’s attention-grabbing on a couple of ranges:

- It hints at modifications coming to the Bilt Mastercard

- It teases new alternatives to earn factors, together with for mortgages and extra

- It explains Bilt’s enterprise mannequin, and the way the corporate makes cash

What I can’t work out is that if this letter is genuinely supposed to be as optimistic because it sounds, or if that is merely hinting at main (destructive) modifications to the bank card, given the rocky relationship between Bilt and Wells Fargo.

Bilt plans modifications to its Wells Fargo bank card

Bilt’s co-branded bank card is issued by Wells Fargo, and a number of other months in the past we realized how Wells Fargo is reportedly dropping $10 million monthly on this product. As cardmembers know, you may earn factors for paying hire at no further price. Right here’s what we realized concerning the economics of the cardboard, on the time:

- Wells Fargo pays Bilt a 0.8% payment on all hire transactions, despite the fact that Wells Fargo isn’t amassing any interchange charges from landlords (Wells Fargo is paying Bilt since Bilt points rewards to members for these transactions)

- Wells Fargo pays Bilt $200 every time {that a} new card account is issued, which is analogous to what you’ll discover for co-brand agreements with airways and resorts

- Wells Fargo had projected that round 65% of buy quantity on the Bilt Mastercard could be non-rent bills, producing interchange payment income; the fact is inverted

- Wells Fargo projected that round 50-75% of purchases charged to the cardboard would carry over month-to-month, producing curiosity expenses, whereas the fact is as an alternative 15-25%

In different phrases, Wells Fargo is dropping cash on the settlement. So it’s value noting how the letter repeatedly nearly tries to downplay the significance of the cardboard, noting that solely 15% of Bilt members have the cardboard:

- “Whereas our award-winning cobrand bank card has acquired a lot consideration, it stays only one a part of our enterprise”

- “In our first two years, the Bilt Mastercard gave us a bridge to rewarding prospects on hire funds whereas we constructed one thing a lot greater”

- “With steerage from business legends Ken Chenault (former American Categorical CEO and Bilt Chairman) and Phillip Riese (former President of American Categorical Shopper Card), we’re constructing in the direction of Bilt Card 2.0”

- “This subsequent evolution of our card program would concentrate on tiered choices that higher serve completely different member wants whereas delivering enhanced worth by way of new advantages on housing spend and our neighborhood community”

It’s additionally attention-grabbing how Bilt mainly throws Wells Fargo underneath the bus, accusing Wells Fargo of probably not providing the “assist” that Bilt wants:

“I’ve been studying and passing alongside your suggestions and requests for the present Wells Fargo issued-and-operated Bilt card program. We all know you need extra premium choices – and in addition methods to earn factors in your mortgage funds. We additionally hear the challenges a lot of you could have had with approval charges, credit score line sizes, and the necessity for core tech options like licensed customers, pay over time, and auto-pay integrations. A few of you could have talked about that your credit score limits are too low to cowl greater than a month or two of hire, leaving little room to take full benefit of the cardboard’s advantages – particularly contemplating the typical FICO for these members is above 750. We hear you loud and clear. These are all issues that require assist from our issuing financial institution accomplice, and we’re actively engaged on options.”

We’ll see how this evolves, however I can’t think about it is going to be excellent news for cardmembers. In any case, the cardboard issuer is dropping cash on the product, and that’s not sustainable in the long term. However basically describing the cardboard as “a bridge” for the primary two years doesn’t give me an entire lot of confidence.

Bilt additionally emphasizes how one can earn factors on paying hire even if you happen to don’t have a Bilt Mastercard. That’s true, although take into accout how a lot much less rewarding it’s. Fairly than incomes one level per greenback spent, you earn a complete of 250 factors monthly for on-time funds, and provided that you reside at a Bilt Alliance community property. That’s objectively value possibly a couple of {dollars} (which is best than nothing, however not a lot to get enthusiastic about).

Bilt needs to supply factors for mortgage funds

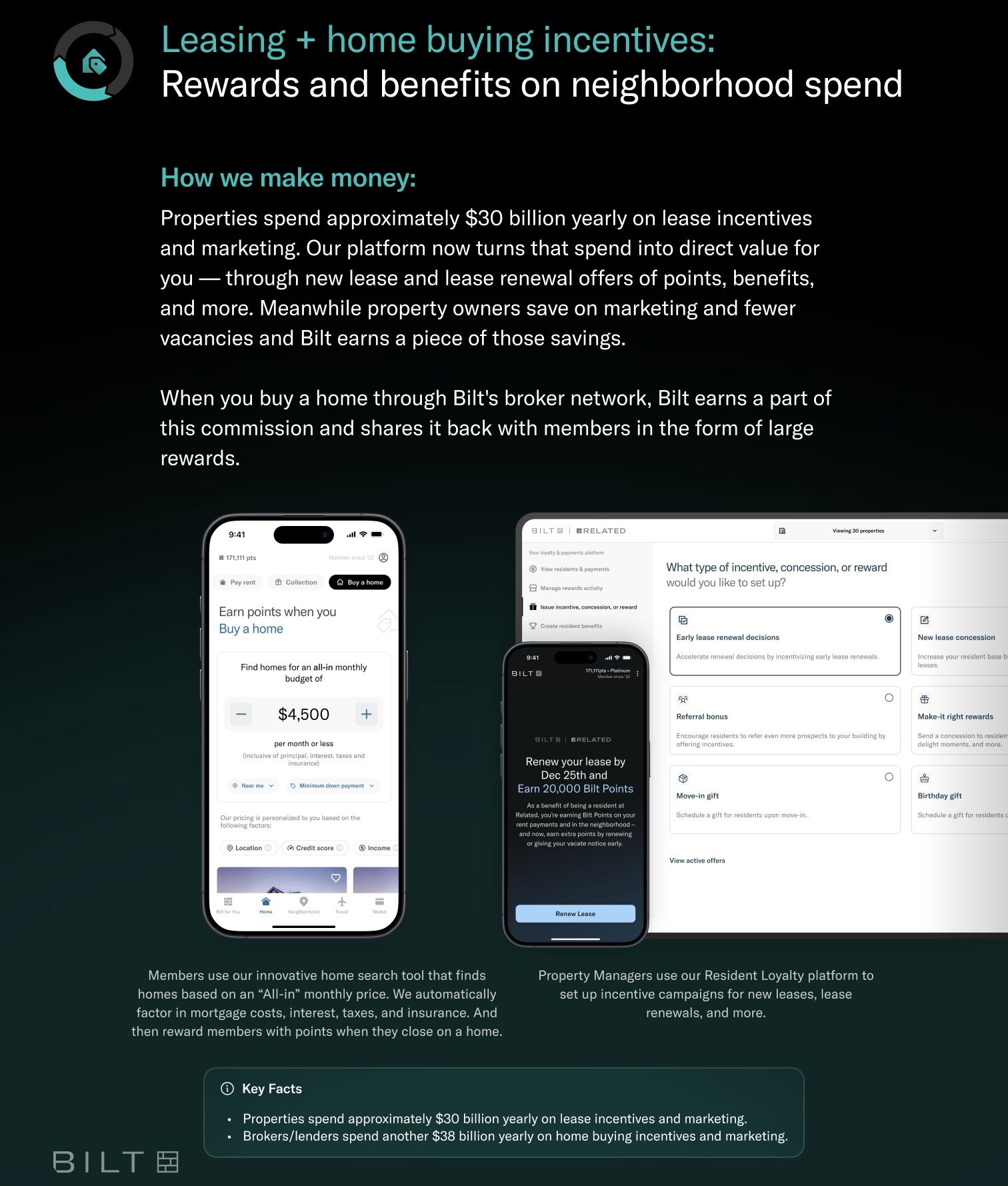

The letter goes on to clarify that beginning in 2025, Bilt will begin providing alternatives to earn factors on mortgage funds. Now, we don’t know what is going to appear like, and I wouldn’t essentially anticipate it to be as profitable because the alternatives to earn factors for hire if in case you have a co-branded bank card. Fairly on the contrary, I’d be prepared to wager that it received’t be that profitable. However nonetheless, one thing is best than nothing.

Bilt additionally plans to develop alternatives to earn rewards on hire funds, whether or not utilizing Bilt’s bank card or one other card, although we now have no further particulars past that.

Bilt explains its enterprise mannequin, type of

The primary a part of the letter of Bilt is devoted to explaining how Bilt’s enterprise mannequin works, and the way it’s basically three interconnected companies. The letter mentions that whereas the bank card has acquired quite a lot of consideration, it’s only one a part of the enterprise, and that the corporate’s three strong and interconnected companies kind “the most important housing rewards platform within the nation.”

To summarize this in essentially the most fundamental method doable (after which you may learn the slides under for extra particulars):

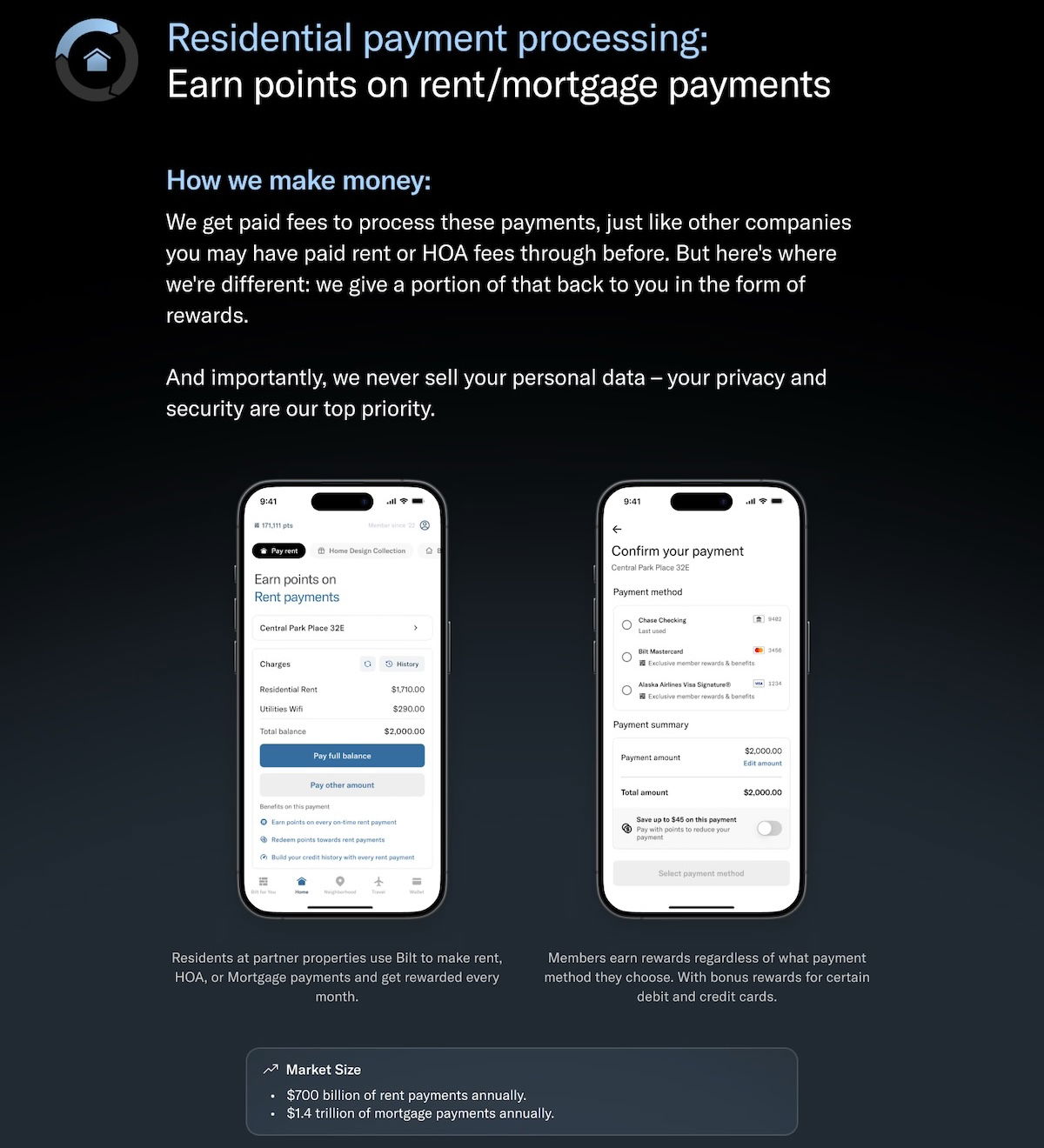

- One a part of the corporate’s enterprise is residential cost processing, as $700 billion in hire funds are processed in the US yearly; Bilt will get paid a payment for processing these funds, and passes on a few of these rewards to members

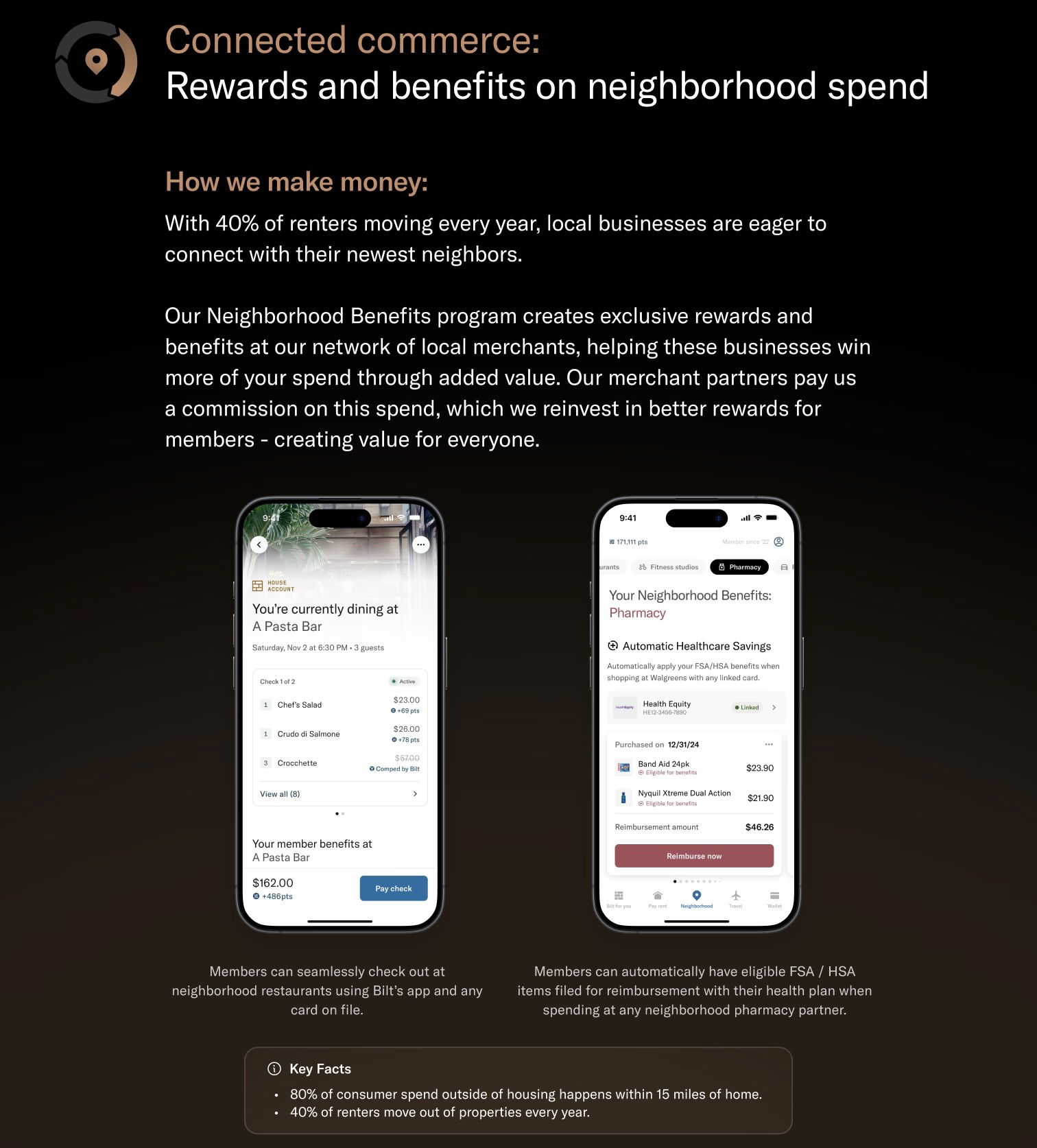

- One other a part of the corporate’s enterprise is related commerce, whereby Bilt will get a fee when folks dine at sure eating places, journey with Lyft, get prescriptions refilled at Walgreens, and so forth.; then members earn some rewards

- The final a part of the corporate’s enterprise mannequin is leasing and residential shopping for incentives, whereby the corporate is ready to earn money from the incentives that each property managers and brokers spend as a way to get shoppers

There’s no denying that these are all doubtlessly large income streams, and Bilt has the benefit of getting scaled each its membership base and its community of accomplice properties. Nevertheless, I believe it’s fairly noteworthy how Bilt mainly doesn’t contemplate a co-branded bank card to be the core of its enterprise.

Whereas there’s worth to Bilt basically, unarguably essentially the most enticing side for shoppers is the bank card, since that doubtlessly unlocks essentially the most rewards.

Backside line

Bilt has despatched a letter to members explaining the way it makes cash, how modifications are coming to the bank card, and the way the corporate hopes to supply extra alternatives to earn factors beginning in 2025.

Studying between the strains, what stands out to me essentially the most is that main bank card modifications could also be coming sooner reasonably than later. If there are modifications, I’ve a tough time imagining the core worth proposition shall be nearly as good as it’s now, having the ability to earn one level per greenback on hire funds with a no annual payment card.

What do you make of this letter from Bilt?

Supply hyperlink