Amex Platinum Card $400 Resy Eating Credit score: Suspiciously Straightforward To Use

Hyperlink: Study extra about American Specific Platinum Card®

The American Specific Platinum Card® (assessment) has lately undergone a serious refresh. With this, we’ve seen the cardboard get an $895 annual price (Charges & Charges), which is shattering information amongst premium playing cards. Nonetheless, for as soon as, I’d say this card refresh is definitely legitimately optimistic, and I’m having rather a lot simpler of a time justifying the cardboard’s annual price than previously, regardless of the $200 enhance.

Specifically, I very a lot admire the brand new credit which have been added. On this publish, I’d prefer to focus particularly on the as much as $400 annual Resy credit score, since I do know there are some questions in regards to the logistics of utilizing this, because it’s (virtually) confusingly straightforward to redeem.

Fundamentals of the Amex Platinum Card $400 Resy credit score

Whereas the Amex Platinum Card probably presents 1000’s of {dollars} of credit, there are phrases and circumstances related to every of them. I’d argue that one of many best perks to maximise is the annual $400 Resy credit score. For these not acquainted, Resy is a restaurant reservation platform, which has nicely over 10,000 eating places nationwide in its portfolio. Amex truly acquired the corporate in 2019, so it belongs to the cardboard issuer.

The Amex Platinum Card presents as much as $400 in Resy credit yearly, within the type of a $100 credit score every calendar quarter. To present the easy abstract upfront, all it’s important to do is register, use your card at an eligible Resy restaurant, and you then’ll be reimbursed.

There’s no want to order your restaurant by way of Resy, you don’t should let the restaurant know you’re utilizing your profit, and there’s nothing else particular it’s important to do. So so long as a restaurant is considered one of the ten,000+ that belongs to Resy, you’re good. You possibly can even use it for takeout, so long as you’re paying straight with the restaurant.

Now, to share some extra particular phrases:

- Registration is required previous to utilizing the profit

- That is solely out there on the non-public model of the cardboard, and never the enterprise model of the cardboard

- Spending by the first cardmember or approved customers qualifies towards this credit score, however there’s just one credit score per main account

- You possibly can obtain as much as $100 in assertion credit every quarter, and that may be primarily based on spending in a single or a number of transactions, and you’ll solely be reimbursed as a lot as you spend

- Eligible Resy purchases embody purchases made straight from U.S. eating places that provide reservations by way of the Resy web site or app

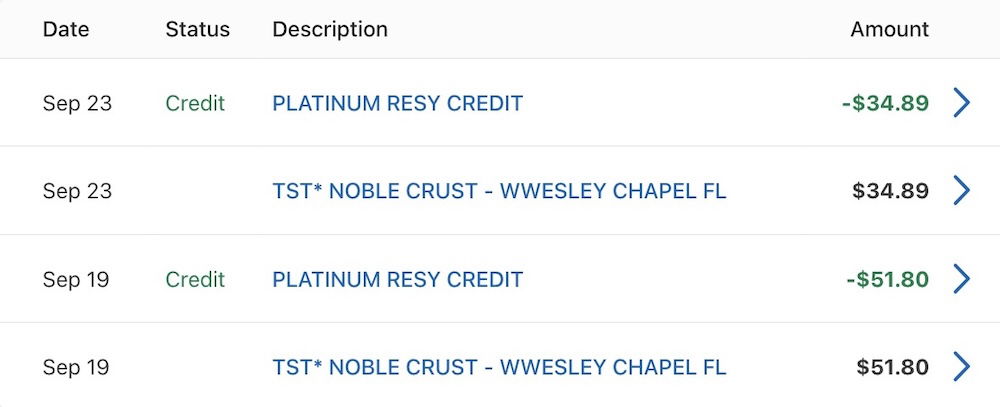

- It may possibly take as much as eight weeks for the credit score to publish to the eligible account, however usually it’ll publish a lot quicker than that

On the subject of registering, simply log into your on-line account for the Amex Platinum Card, click on on the “Rewards & Advantages” tab, and discover the “$400 Resy Credit score” part.

There you’ll discover all of the phrases, and also you’ll additionally see the enrollment button. You’ll additionally obtain an electronic mail confirming enrollment.

Primarily based on my experiences (and the expertise of relations), the credit score usually posts in a matter of days.

The Resy credit score is price near face worth, in my view

We regularly consult with some premium playing cards as “coupon books,” given the variety of credit they provide, the hoops it’s important to leap by way of to redeem them, and the way in which they’re damaged up. With that in thoughts, I’ve gotta say, the $400 Resy credit score on the Amex Platinum Card is a breath of contemporary air, and one thing I think about to be price near face worth.

Admittedly all shoppers are totally different, so no credit score goes to be priceless for everybody. Like, in the event you don’t dine out or stay in a small city with out Resy eating places, you then may need to exit of your solution to maximize it. Nonetheless, in the event you dine out with some frequency and stay in a serious metropolis, I’d say that is price fairly near face worth.

The way in which I view it, the most important catch with this credit score is that the Amex Platinum Card isn’t ordinarily top-of-the-line playing cards for eating spending, provided that that’s not a bonus class for that on the cardboard. So for me, it’s about remembering to make use of the cardboard as soon as per quarter for a eating buy.

I get pissed off by this type of stuff if we’re speaking about some tremendous small credit score, however for $100, I’m joyful to recollect to do this. Additionally remember the fact that if in case you have a costlier eating expertise, you’ll be able to usually break up your buy between a number of playing cards.

Personally, I’d mainly view the chance value of this perk as being the rewards I’m forgoing by not incomes multiple level per greenback on that eating buy.

I’m curious in regards to the economics of the $400 Resy credit score

Unrelated to the precise worth of this perk, I’d be fascinated to know what the economics are of this profit. A bunch of premium card perks these days are service provider funded, which is to say that the service provider covers a lot of the price, in change for gaining access to an prosperous client base.

Within the case of the Amex Platinum Card $400 Resy credit score, Resy is owned by Amex, and the credit score is being redeemed at any of 10,000+ unbiased eating places. My common assumption is that the intent with this perk is twofold:

- To more and more drive folks to utilizing the Resy platform for reservations, because it’s owned by Amex

- To get folks to place their eating spending on the Amex Platinum Card extra persistently, with the idea being that in the event you begin utilizing it for eating as soon as per quarter, possibly you’ll begin utilizing it extra persistently

That being mentioned, $400 per cardmember is a fairly large funding to make on that entrance. I can’t think about that particular person eating places are in any means on the hook when these credit are redeemed (or are they?), so I’d be fascinated to know what the accounting on this seems to be like.

It’s a bit totally different than some kind of a resort credit score, as you see on many playing cards, the place the logic is a bit more easy — the bank card firm offers you a resort credit score, and hopes you’ll e-book a way more costly resort, since they’re performing as a web based journey company, and obtain a fee.

Of all of Amex’s credit, the $400 Resy credit score is the one which appears most beneficiant and maybe extra expensive, by way of direct funding by Amex and its subsidiaries. I’m curious if others have a distinct tackle that.

Backside line

The Amex Platinum Card presents 1000’s of {dollars} price of credit, and I’d argue that one of the crucial priceless is the annual $400 Resy credit score. Registration is required, and the credit score can be utilized in increments of $100 quarterly. However past that, there actually aren’t many hoops to leap by way of. Simply discover a taking part Resy restaurant, spend cash there in your card, and you’ll obtain a press release credit score. You don’t even should e-book by way of Resy.

What’s your tackle the Amex Platinum Card $400 Resy credit score, and what’s your finest guess as to the economics?

The next hyperlinks will direct you to the charges and charges for talked about American Specific Playing cards. These embody: American Specific Platinum Card® (Charges & Charges).

Supply hyperlink