Bilt Backtracks: Two Methods To Earn Rewards, Up To 1.25x Factors On Housing

Hyperlink: Apply or improve your present card to the no annual payment Bilt Blue Card, $95 annual payment Bilt Obsidian Card, or $495 Bilt Palladium Card

A number of days in the past, Bilt introduced huge adjustments, together with particulars of three new bank cards, plus a whole overhaul to how rewards could be earned for housing funds. One grievance that individuals had was that the brand new housing rewards system was extremely advanced. So Bilt has acted rapidly to deal with that, and I feel many individuals will come out forward right here.

The observe to members from Bilt Founder & CEO Ankur Jain

Bilt has simply despatched the next electronic mail to members, explaining adjustments which are already being made to the brand new system for rewarding housing funds:

Over the previous few days, I’ve spent a whole lot of time studying our members’ emails, DMs, and notes. Many had been considerate and passionate. Some had been annoyed. All had been truthful.

I really feel extremely fortunate to guide an organization with members who care this deeply.

On one hand, there have been document purposes for the playing cards, and I’m excited for members to get them. Nevertheless, I’ve additionally seen actual and affordable confusion in regards to the new worth proposition—particularly round lease and mortgage factors. That’s on me, and we’re fixing it.

Let me be clear and upfront: Bilt cardholders won’t ever be charged a payment to earn rewards on housing funds.

There’s additionally an essential actuality behind how we ship the richest rewards potential. The extra members use the cardboard for on a regular basis spend, the extra distinctive worth we are able to sustainably present throughout the Bilt ecosystem. It’s most likely not a shock to any of you, but when members solely buy 4 bananas and earn free lease factors, it doesn’t permit us to maintain such a wealthy worth proposition for everybody.

With all that in thoughts, we’re introducing a brand new, less complicated choice to earn fee-free rewards on lease and mortgage: now as much as 1.25X on every cost.

You’ll now be capable of select one of many two choices for the way you need to be rewarded on housing funds with the brand new Bilt Card 2.0. The core advantages of every card are usually not altering. That is solely an replace to the way you earn rewards on housing funds.

Possibility 1:

A easy, fee-free technique to earn rewards on housing.

- Pay your full lease or mortgage each month with no transaction payment

- Earn factors on housing mechanically in lieu of incomes Bilt Money

- The extra you employ your card for on a regular basis spend, the upper your factors multiplier on housing, now as much as 1.25x:

Factors on Housing

Minimal on a regular basis spend as a % of month-to-month lease / mortgage (Instance of $2,000 lease)

0.5x factors

Spend a minimum of 25% of month-to-month lease ($500)

0.75x factors

Spend a minimum of 50% of month-to-month lease ($1,000)

1x factors

Spend a minimum of 75% of month-to-month lease ($1,500)

1.25x factors

Spend the identical or extra as your month-to-month lease ($2,000)

You’ll see your progress to every tier clearly within the app every month.

Similar to at this time, should you don’t hit the minimal spend requirement, you continue to earn 250 factors per thirty days. Bilt Card 2.0 additionally removes the 100,000 lease level cap that existed with Card 1.0, so now you can earn limitless factors on housing funds.

Possibility 2:

In case you desire the unique, fee-free construction we launched Card 2.0 with, it’s nonetheless out there for you:

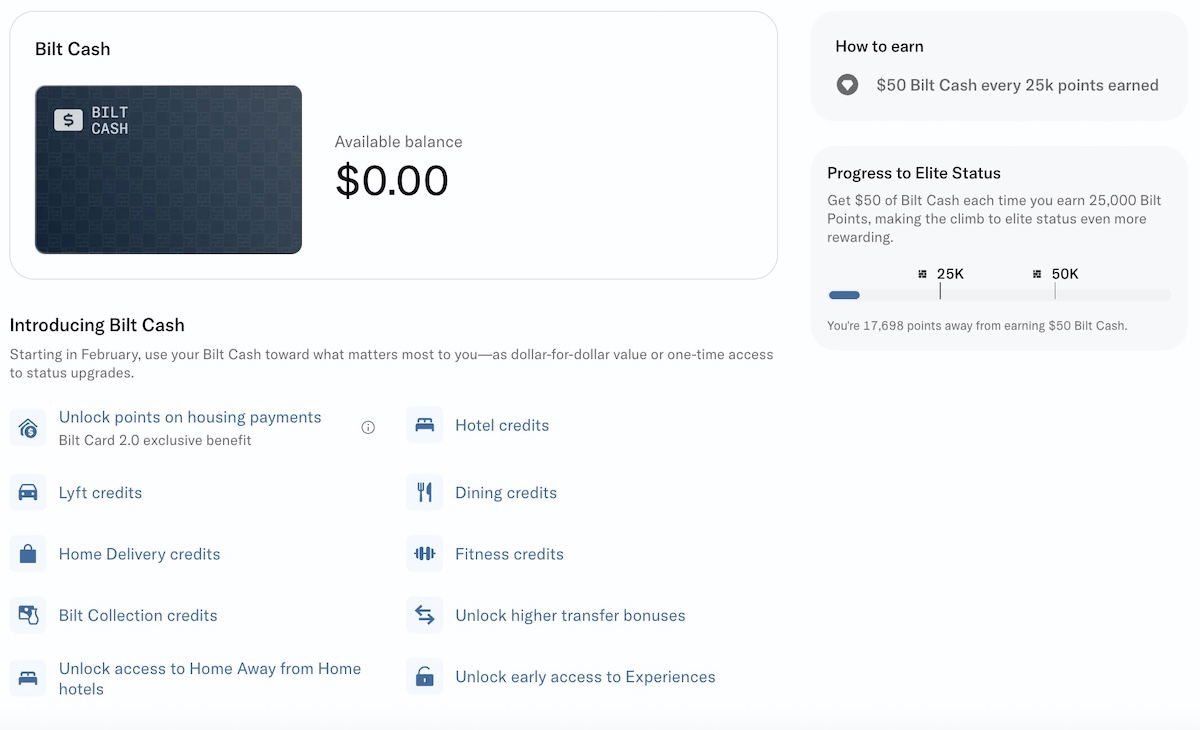

- Earn 4% again in Bilt Money on on a regular basis purchases, along with base factors. Consider Bilt Money as “select your personal reward”.

- Pay your full lease or mortgage each month with no transaction payment

- You should use as little or as a lot of your Bilt Money to extend the whole factors you earn on housing that month and you don’t ever pay something out of pocket.

- You can even redeem Bilt Money dollar-for-dollar for month-to-month credit throughout the Bilt ecosystem (with month-to-month, merchant-specific caps), or for unique advantages like greater switch bonuses and particular entry to experiences.

The extra you employ your card for on a regular basis spend, the extra Bilt Money you earn. We’ll proceed including new methods to spend Bilt Money because the ecosystem grows.

You select the choice that works one of the best for you whenever you activate your card. You’ll be able to change at any time, and your alternative will take impact the next month. And, each choices include the identical wealthy on a regular basis level earnings and premium card advantages you noticed at Card 2.0 launch.

We transfer quick at Bilt. Which means we received’t all the time get every thing proper the primary time, however I learn your whole suggestions and we’ll alter rapidly after we miss. I do know that for a few of you, no rationalization of change will absolutely exchange what you really liked in regards to the card 1.0 mannequin–I perceive that. On the identical time, I’m genuinely enthusiastic about what this mannequin sustainably permits going ahead: supplying you with the richest rewards on lease, mortgages and every thing else.

I’ve additionally included an FAQ under to reply a few of the different questions I’ve been listening to.

We’re grateful to maintain constructing this with you. Thanks for being a Bilt Member.

Ankur

There are nonetheless many unknowns, however these are optimistic updates!

I commend Bilt for making adjustments to its new program so rapidly. I’m just a little confused how they didn’t discover the brand new system complicated internally previous to launching the entire thing, however that’s a special story. For that matter, I fear that giving individuals two selections (one in all which is fairly advanced) doesn’t essentially simplify issues that a lot.

That being mentioned, that is unarguably nice information, as I see it. As I’ve defined, I’ve picked up the Bilt Palladium Card, which presents 2x factors on on a regular basis spending. As I see it, that probably makes this one of the vital rewarding playing cards on the market for non-bonused, on a regular basis spending. With the Bilt Money idea, you may earn as much as 1x factors on housing funds.

So the excellent news is that should you had been planning on placing a major quantity of spending on the cardboard (which may make sense independently), now you can earn as much as 1.25x factors in your housing cost, fairly than 1x factors. That’s 25% extra rewards on housing, and that’s nice.

Now, the massive wild card right here continues to be which of the 2 earnings choices is healthier, since we don’t know the total particulars of how Bilt Money could be redeemed. The thought is that you simply earn 4% again on all bank card spending within the type of Bilt Money, and that Bilt Money can be utilized to offset charges on housing rewards, or in any other case “dollar-for-dollar” for different rewards. That latter choice sounds too good to be true, which is why there are such a lot of questions.

Backside line

Bilt not too long ago introduced main adjustments, that are based mostly on the idea of redeeming Bilt Money for rewards on housing funds. The brand new system was little question advanced and left many confused, which is why we’re already seeing Bilt backtrack considerably.

Bilt is now providing a second choice for incomes rewards for housing funds, the place the multiplier of housing rewards that you simply earn is predicated on how a lot you spend on the cardboard. The excellent news is that should you spend as a lot as your housing cost, you may earn 1.25x factors, which is sort of profitable. I feel many people will doubtless wait on the small print of Bilt Money redemption choices to determine which makes probably the most sense.

What do you make of those Bilt adjustments?

Supply hyperlink