Why I Determined On The Bilt Palladium Card, And How My “Utility” Went

Hyperlink: Apply for a Bilt bank card, whether or not you’re a brand new or current cardmember

Bilt has introduced large modifications, together with the introduction of three bank cards in partnership with Cardless, plus an all-new system for being rewarded for lease, which is predicated on the Bilt Money forex.

Nearly all the things about Bilt is altering, for higher or worse, and I coated all these particulars in a earlier put up. On this put up, I’d prefer to share my private technique after having digested all of this info, together with the cardboard I made a decision on, how my software went, and my general ideas.

Why I made a decision to “improve” to the Bilt Palladium Card

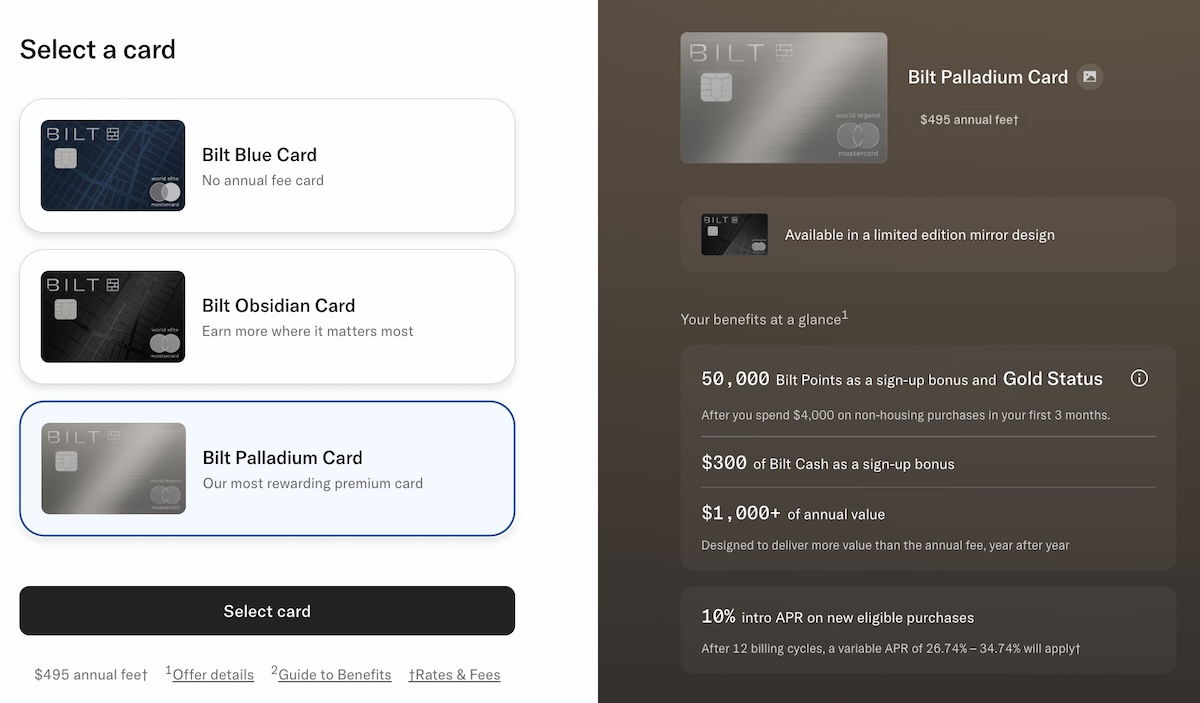

Within the earlier put up, I coated the main points of the three new Bilt bank cards, so I don’t wish to go over all of that once more. Lengthy story quick, I believe the no annual charge Bilt Blue Card and $95 annual charge Bilt Obsidian Card are type of non-starters, and it’s laborious to get enthusiastic about them, particularly in comparison with the previous Bilt Card, and particularly compared to the aggressive panorama.

In the meantime I believe the $495 Bilt Palladium Card is the product that’s most price contemplating. Why? For one, the cardboard has a welcome bonus of fifty,000 bonus factors and Bilt Gold standing after spending $4,000 inside three first three months (on non-housing purchases), plus $300 Bilt Money upon approval.

We’ve by no means seen a Bilt card have a proper welcome bonus earlier than, and that’s completely price making the most of, as the opposite two playing cards don’t supply any factors with the bonus. At a minimal, the cardboard is price giving a strive for a yr.

Past that, what intrigues me in regards to the card is straightforward — it gives 2x Bilt factors on on a regular basis spending, which is fairly unbelievable. Bilt factors are tremendous helpful, as they are often transfered to Alaska Atmos Rewards, World of Hyatt, and a wide range of different packages.

Whereas we’ve seen some transferable factors playing cards supply 2x factors, I believe with the ability to earn Bilt factors at that fee is unbelievable, and doubtless beats the opposite choices.

The icing on the cake is that’s that you just’re incomes 4% again in Bilt Money on all of your spending. Whereas there are extra questions than solutions about different makes use of of Bilt Money, on probably the most primary degree, you need to use that Bilt Money to pay your lease or mortgage with no charge whereas incomes factors.

$3 in Bilt Money is price 100 Bilt factors in your whole lease or mortgage funds, on the fee of 1x factors. That’s not precisely easy, so simply to present an instance (on the excessive aspect, for straightforward math), let’s say you spend $100,000 per yr on the cardboard:

- You’d earn 200,000 Bilt factors, on the fee of 2x factors per greenback spent

- You’d unlock the flexibility to make $133K(ish) in lease or mortgage funds yearly on the cardboard, incomes 1x factors at no charge

- You’d earn Bilt Platinum standing, which supplies you additional advantages, like some accomplice standing perks, entry to raised Hire Day gives, and so on.

For those who spend a good quantity on bank cards, I believe it’s laborious to beat the mixture of incomes among the many most precious transferable factors at the perfect fee potential, whereas that spending additionally unlocks the flexibility to earn factors in your lease or mortgage.

At a minimal, I believe that is price giving a strive, particularly with the welcome bonus and straightforward transition. The problem will probably be determining methods to recoup the $495 annual charge over time. The cardboard does supply a Precedence Move membership, plus as much as $400 in Bilt portal lodge credit per yr (a $200 credit score semi-annually, every requiring a minimal two-night keep).

The restrictions on that lodge credit score are probably a little bit annoying, however at a minimal, I believe the cardboard is price giving a strive for a yr. As I see it, there are many excellent questions that haven’t but been answered, and which can assist me determine whether or not to maintain the cardboard past the primary yr:

- Will Bilt hold providing beneficiant Hire Day switch bonuses to journey companions, which make it a really compelling forex? For that matter, will Bilt hold all of its present switch companions, and proceed to permit factors incomes with Rakuten?

- Will Bilt let individuals pay taxes by bank card (for a charge) via different companies, or attempt to add restrictions there, to restrict spending? The up to date phrases recommend that tax funds aren’t thought-about “eligible purchases,” and I’m curious if that’s enforced, since that might make this one of many few playing cards that doesn’t reward tax funds

- How will Bilt Money truly be redeemable past offsetting the charge for lease or mortgage funds, since that hasn’t been absolutely introduced?

So yeah, I’m placing this card within the class of completely being price making an attempt, nevertheless it stays to be seen if it’s the best choice in the long term, primarily based on how issues play out. I’m additionally curious to see how a lot I truly spend on the cardboard in non-bonused classes, since that may decide how a lot of the annual charge I’m actually recouping. I would like to have the ability to spend rather a lot — and earn quite a lot of factors — for the $495 annual charge to make sense.

My expertise “making use of” for the Bilt Palladium Card

As Bilt transitions from Wells Fargo to Cardless, current cardmembers have the choice for a seamless transition. The concept is that you just’re presupposed to “pre-order” your new card by January 30, 2026, to be able to transition to the product on February 7, 2026, when the cardboard formally launches.

For those who’re an current cardmember, there’s no laborious pull whenever you apply for the brand new card, and as an alternative, there’s only a delicate pull. So except one thing completely drastic modified since your earlier software, you’re presupposed to even be authorised for the brand new card. In any case, your bank card quantity will even keep the identical as you transition to the brand new product.

With that in thoughts, let me share my expertise. After going to Bilt’s new bank card web page, I logged into my account and clicked the “Apply now” button, and I may select which card I needed. I chosen the Bilt Palladium Card.

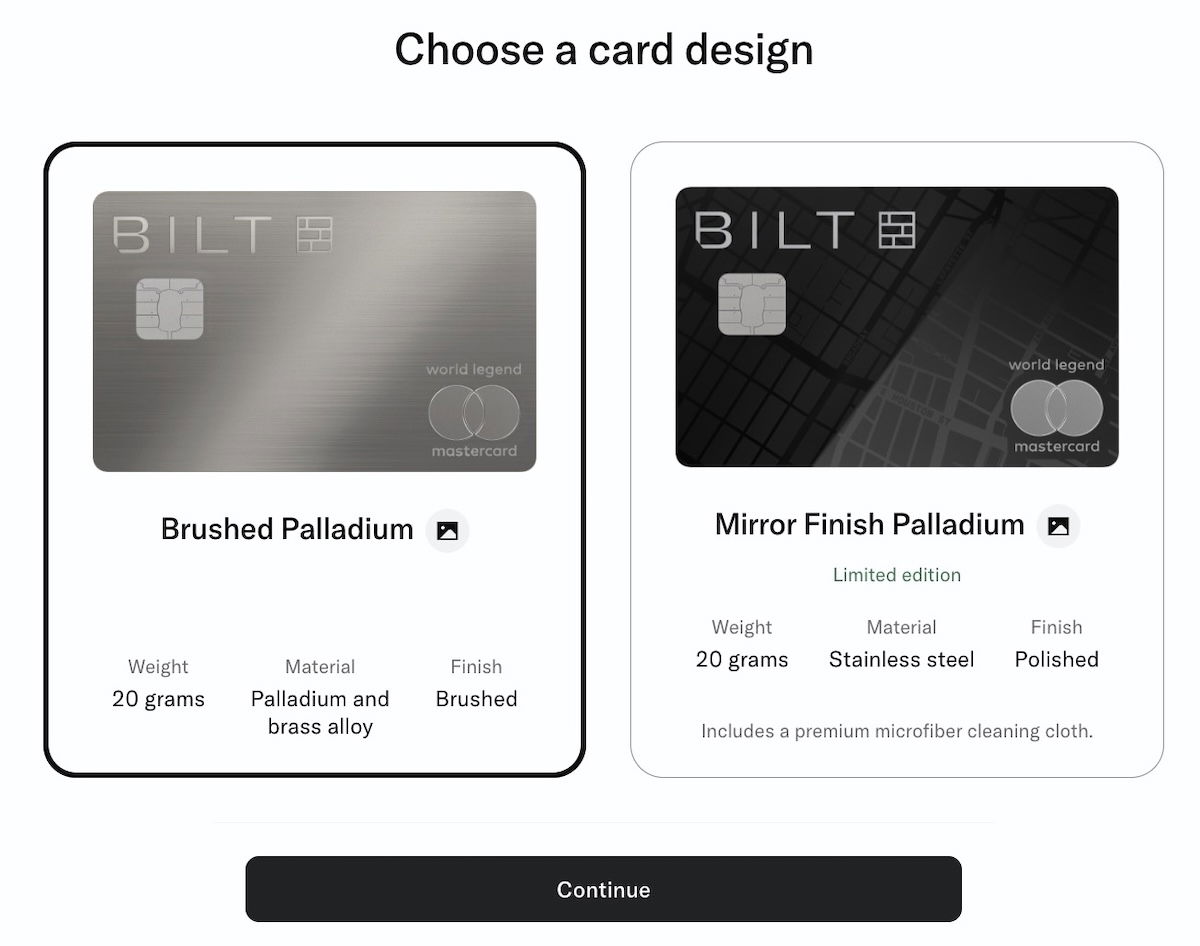

I may then select my card design, between brushed palladium or mirror end palladium.

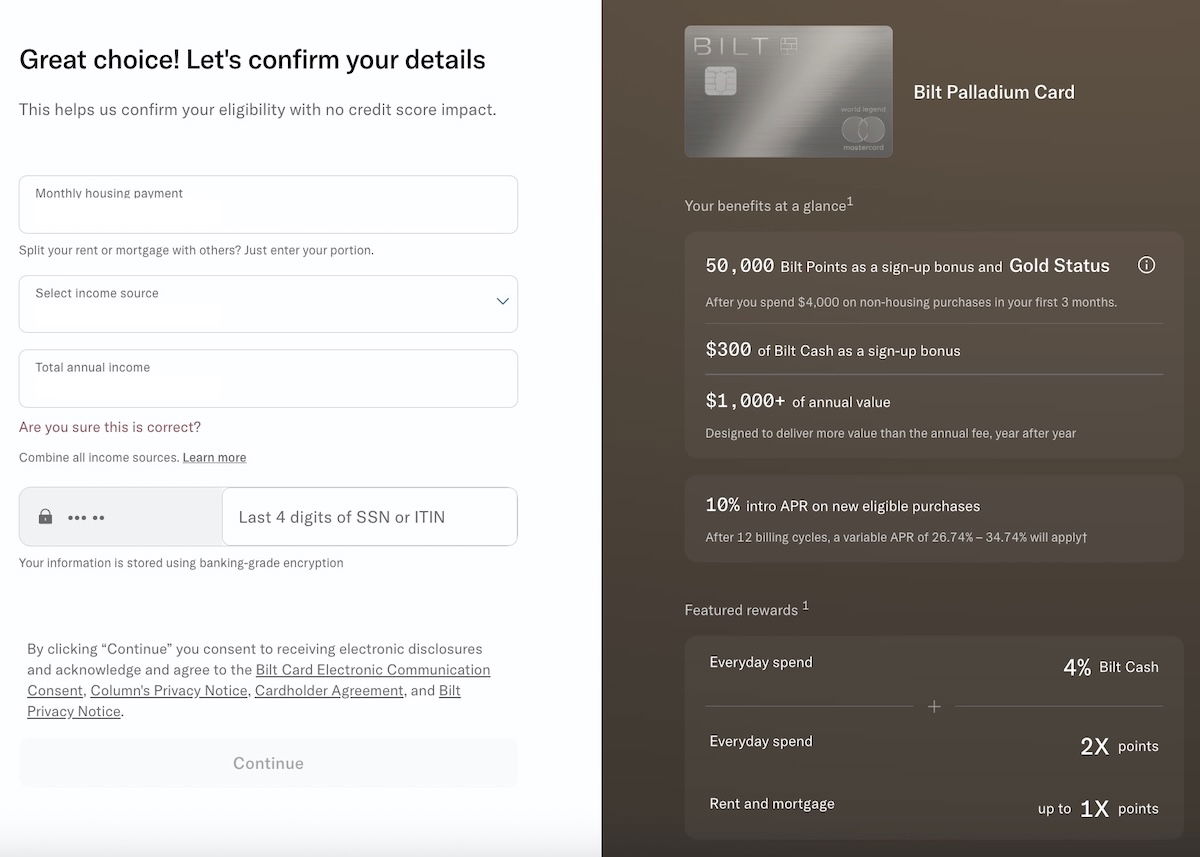

I used to be then requested to substantiate the knowledge I had supplied to Wells Fargo previously, together with my month-to-month housing fee, revenue, and so on.

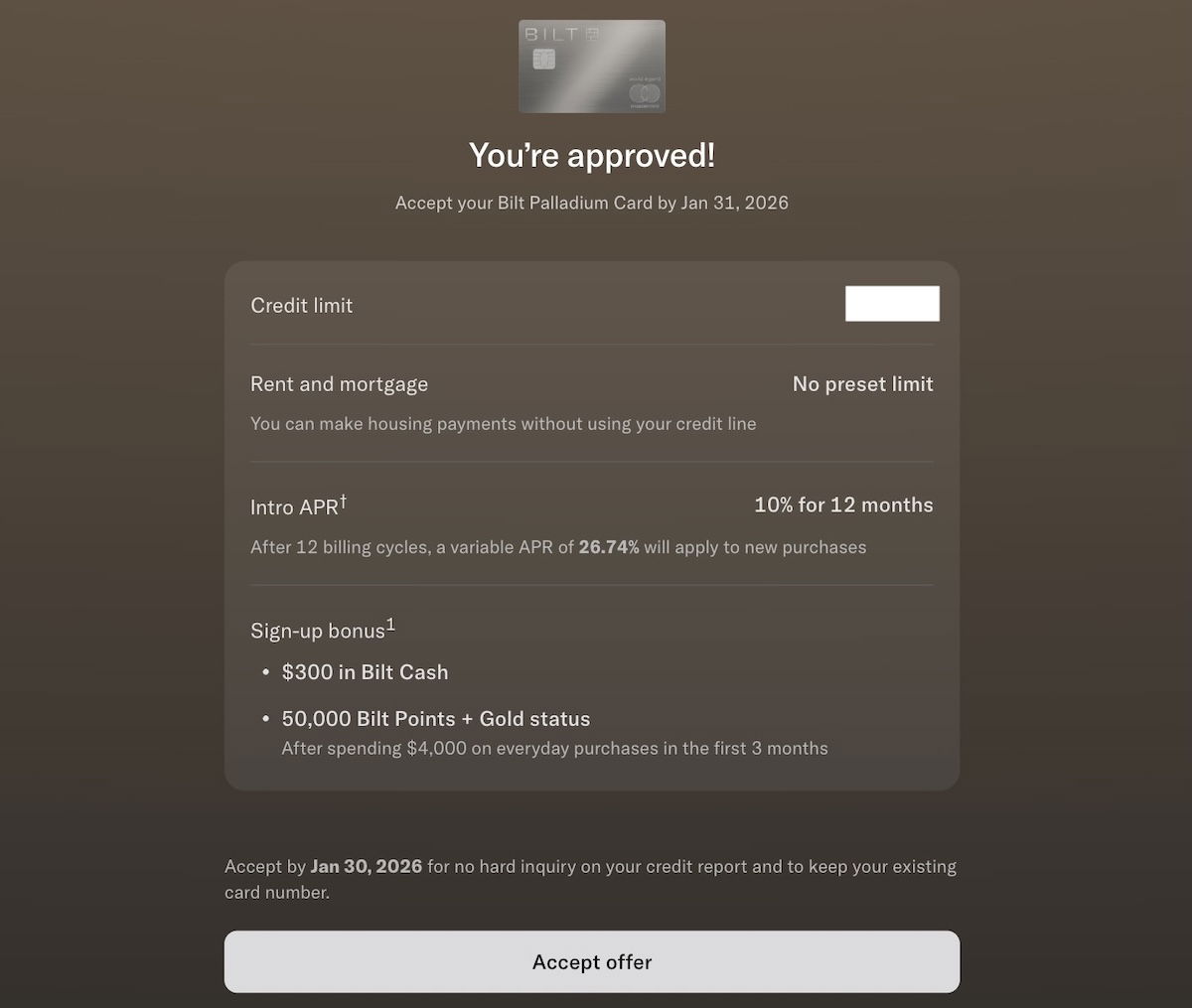

I then submitted that info and located that I used to be authorised, with a giant credit score line (although it was nonetheless about 30% smaller than my Wells Fargo credit score line, which was oddly massive). Remember that with the transition to Cardless, your lease or mortgage fee now not counts towards your credit score line, so that provides a little bit extra flexibility. I used to be requested if I needed to simply accept the supply.

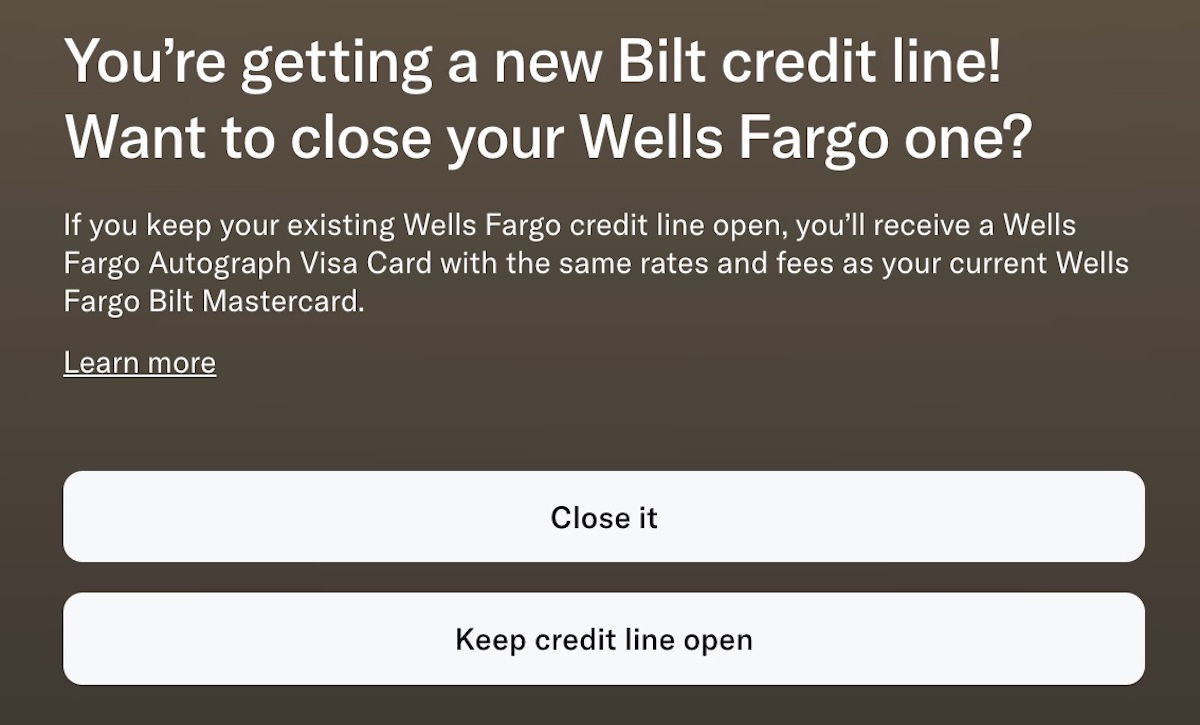

After accepting the supply, I used to be requested if I needed to maintain my Wells Fargo credit score line open, which I didn’t need, so I clicked “Shut it.”

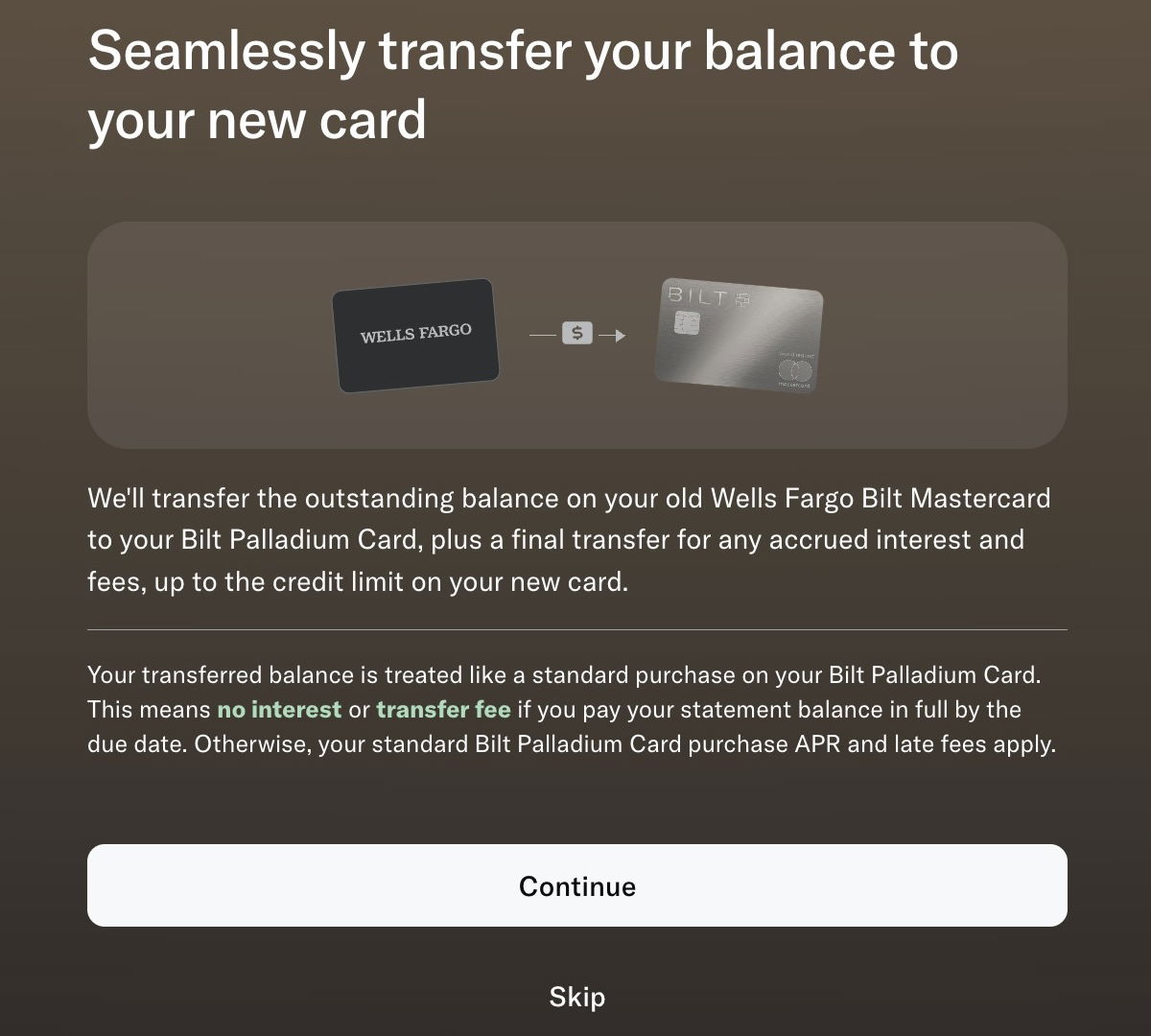

Lastly, I used to be requested if I needed to switch my stability to my new card, and I stated that I did.

All-in-all, I discovered it to be an easy course of.

Backside line

We’ve simply seen the Bilt bank card portfolio change utterly, together with a brand new system for being rewarded for lease and mortgages. If you’re going to proceed to be concerned within the Bilt ecosystem, then I believe the $495 annual charge Bilt Palladium Card is the plain alternative, assuming you spend a good quantity in your bank card, and on lease or mortgages.

It’s the one card with a considerable welcome bonus, and as I view it, that bonus greater than covers the cardboard’s annual charge for the primary yr. The largest promoting level of the cardboard is that it earns 2x factors on all spending, which I’d argue makes it among the finest playing cards on the market for on a regular basis spending, given the worth of Bilt factors.

Nevertheless, there are just a few unknowns right here, so for now I’m merely viewing this as a card that I’m giving a strive for a yr, after which I’ll determine on my long run technique primarily based on how issues play out.

How are you fascinated with which Bilt card makes probably the most sense, and which did you determine on, if any?

Supply hyperlink