Citi AAdvantage Globe Card Software Expertise: No Instantaneous Approval, However…

Hyperlink: Be taught extra concerning the Citi® / AAdvantage® Globe™ Mastercard®

The Citi® / AAdvantage® Globe™ Mastercard® (assessment) is the model new Citi American AAdvantage card. For the reason that product simply launched, I figured I’d apply, and on this publish, I’d wish to report again with my expertise. Whereas I ended up getting permitted, it wasn’t fairly an on the spot course of.

Why I utilized for the Citi AAdvantage Globe Card

The Citi AAdvantage Globe Card has a $350 annual price, so it’s the mid-range card within the Citi AAdvantage portfolio. One main incentive to select up this card is that it’s providing an enormous welcome bonus of 90,000 AAdvantage miles after spending $5,000 inside 4 months.

Past that, although, the cardboard provides a number of perks that probably make it value holding onto. Many individuals will recognize the primary checked bag free, most popular boarding, and 4 annual Admirals Membership passes.

For individuals who are extra frequent flyers with American, there are another perks as properly, that may assist offset the annual price. For one, the cardboard provides as much as 15,000 bonus Loyalty Factors per 12 months, along with those that you simply earn for spending. This consists of 5,000 bonus Loyalty Factors for each 4 American segments flown, as much as 3 times per elite 12 months.

The cardboard additionally provides a number of credit and different advantages, together with as much as $100 again yearly on American inflight purchases, as much as $100 yearly in “Splurge Credit,” and a $99 annual home companion fare. I’m determining how precisely the cardboard will match into my card portfolio in the long run, however I positively assume it’s a card that’s value giving a strive.

Citi AAdvantage Globe Card software restrictions

Eligibility for the Citi AAdvantage Globe Card is actually simple. The standard Citi bank card software restrictions apply, together with you can be permitted for at most one Citi card each eight days, and at most two Citi playing cards each 65 days.

On high of that, the bonus isn’t out there to those that have acquired a brand new account bonus on this actual card previously 48 months. Fortuitously since this card is model new, just about everybody ought to be eligible for it.

Eligibility is unrelated to having every other American Airways bank cards, although, whether or not private or enterprise, and whether or not issued by Citi or Barclays. So you possibly can decide up this card (and earn the bonus) even you probably have the Citi® / AAdvantage® Govt World Elite Mastercard® (assessment), Citi® / AAdvantage Enterprise™ World Elite Mastercard® (assessment), and so forth.

Citi AAdvantage Globe Card software course of & approval

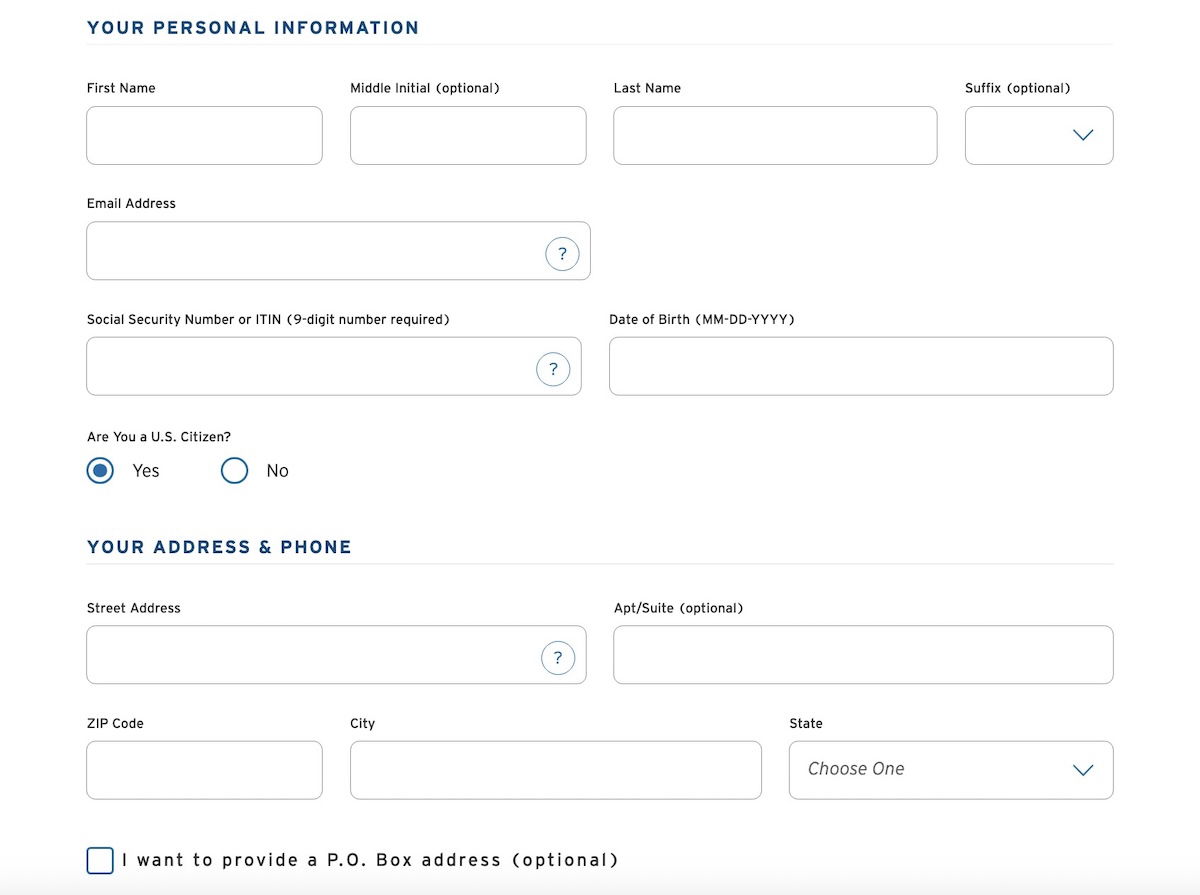

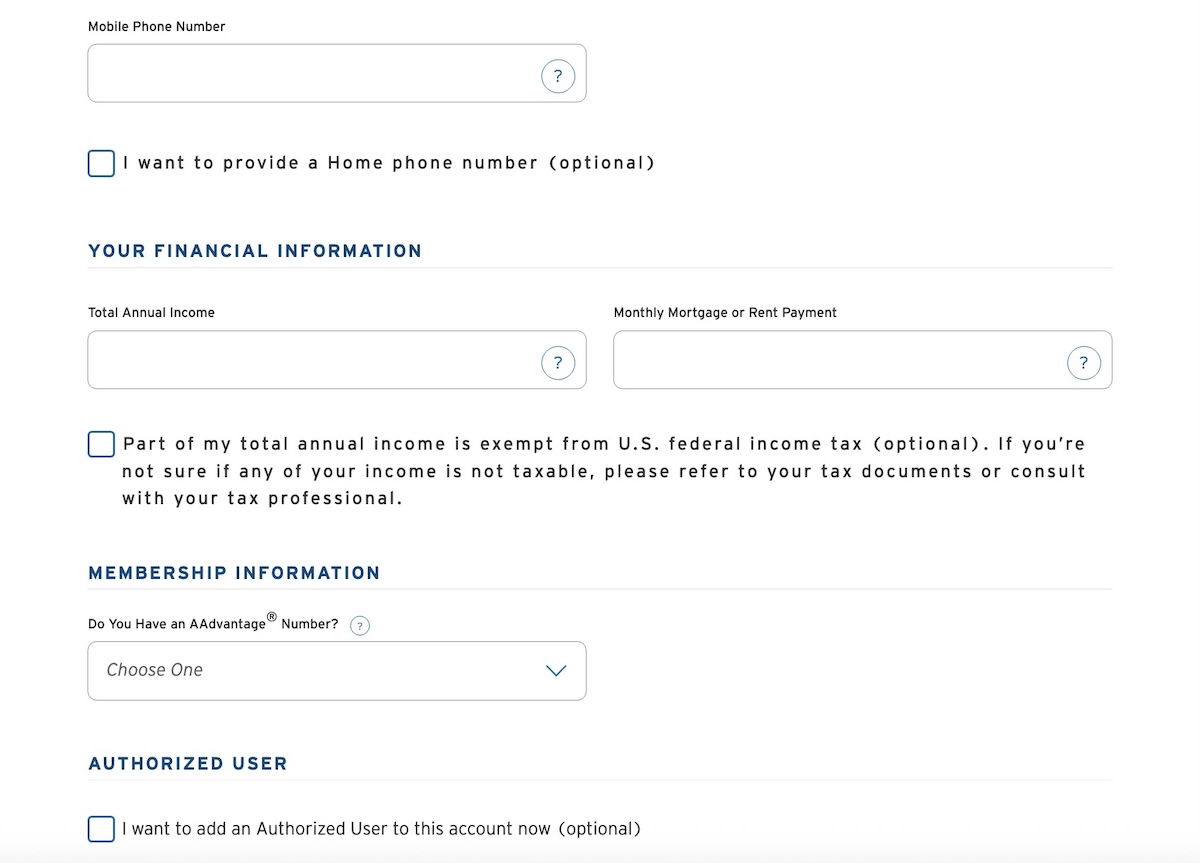

The Citi AAdvantage Globe Card on-line software course of is simple, and consists of only one web page. It’s shorter than functions with most different card issuers. It asks for private particulars — identify, date of beginning, social safety quantity, handle, cellphone quantity, revenue, and so forth. You probably have an present Citi account, you even have the choice to log-in, and that can then pre-fill many particulars.

On the finish of the appliance, you’ll be requested on your American AAdvantage quantity, so that you’ll after all wish to enter that. Not solely is that the place all of your miles shall be deposited, however it’s additionally the place your Admirals Membership passes shall be deposited, as that’s an ongoing card perk.

I’ve to be trustworthy, I used to be curious if I’d be permitted or not. I solely lately utilized for the Citi Strata Elite℠ Card (assessment), and after I was permitted for that, I bought solely a $5,000 credit score restrict, which is the minimal credit score restrict one can get on the cardboard whereas being permitted.

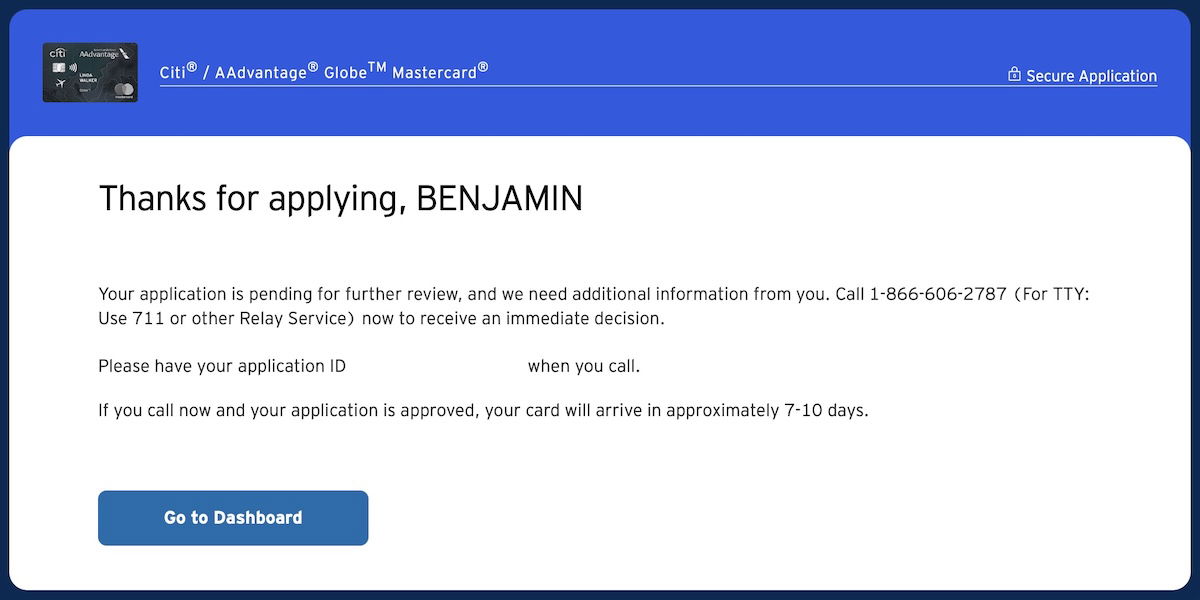

That’s as a result of I’ve a few different Citi playing cards which have large credit score traces, together with the Citi® / AAdvantage® Govt World Elite Mastercard® (assessment). So upon submitting my software, I used to be thanked for making use of, and was given a quantity to name, together with an software ID.

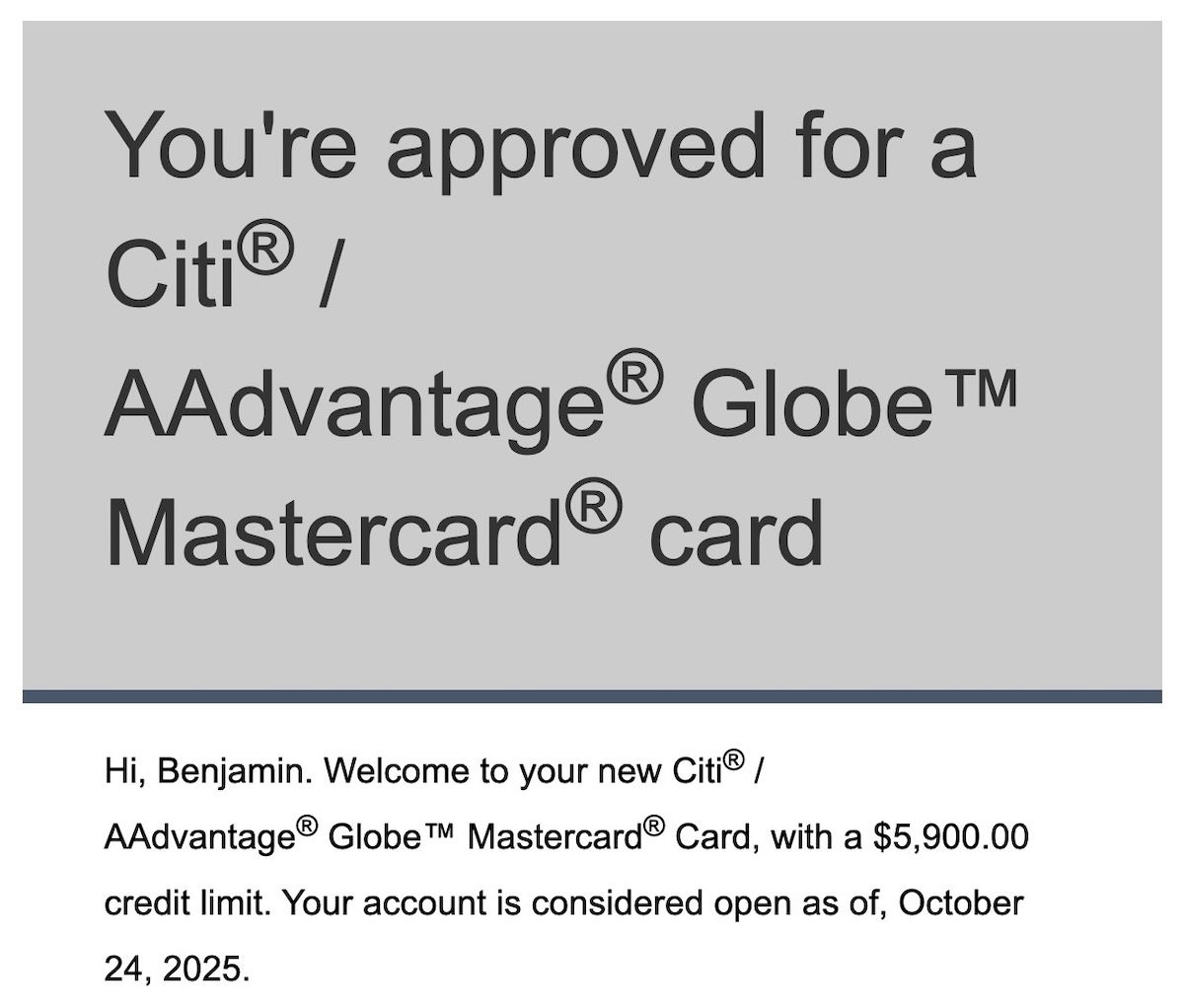

I phoned up, and was linked to a pleasant agent. She had no questions for me, however requested to have a few minutes to assessment my software. After a short maintain, she congratulated me for being permitted, with a credit score line of $5,900. I thanked her, and likewise instantly acquired an e-mail confirming my account approval.

I figured I’d have to maneuver round a few of my credit score line, so I used to be really shocked that wasn’t the case. Curiously, she known as me again a few minutes later, mentioning that she noticed I had lots of credit score on my different Citi playing cards, and requested if I wished to maneuver a few of it over to this card. So I did that, and moved over an additional $10,000 in credit score from one other card.

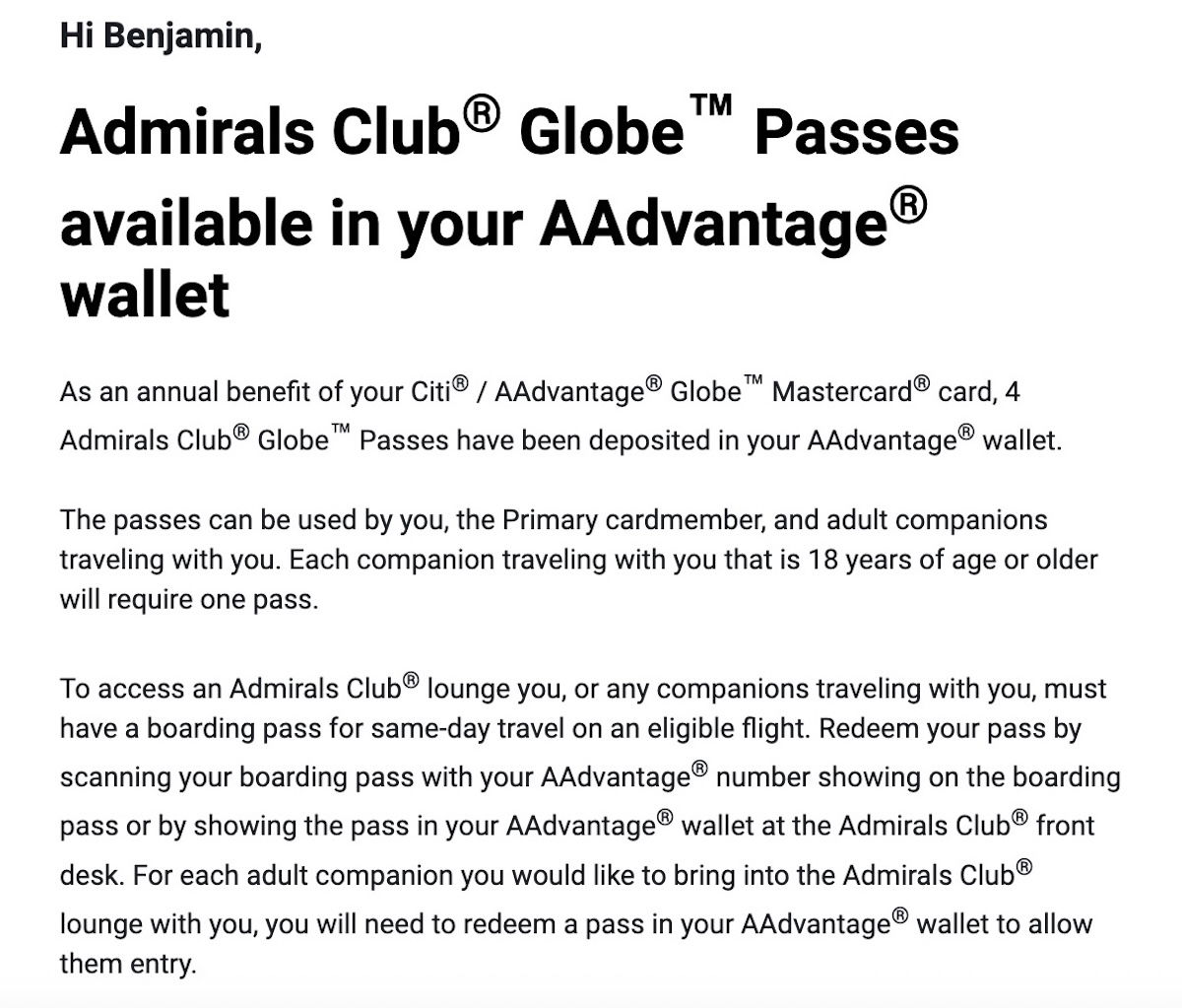

By the best way, I additionally immediately acquired an e-mail confirming that the Admirals Membership passes had already been deposited in my AAdvantage account. So if you’re making use of shortly earlier than a visit and get on the spot approval, that’s nice information.

Backside line

The Citi AAdvantage Globe Card lately launched, and I figured I ought to apply for the cardboard to report again. I bought permitted, although it wasn’t on the spot, presumably as a result of I have already got lots of excellent credit score with Citi. Fortuitously after a fast cellphone name, all the things was taken care of.

The Citi AAdvantage Globe Card has a restricted time welcome bonus that makes it value making use of for, and between the as much as 15,000 bonus Loyalty Factors, as much as $100 in annual American inflight credit, as much as $100 annual Splurge Credit score, and so forth., I feel I could make the maths on this card work.

For those who’ve utilized for the Citi AAdvantage Globe Card, what was your expertise like?

Supply hyperlink