Citigold Credit score Card Annual Price & Subscription Rebates: Value It?

We’re used to airline and lodge elite standing, however nearly the entire main banks even have their very own elite tiers of kinds, for individuals who keep a minimal steadiness of belongings with the financial institution. On this put up, I’d like to speak briefly about Citi’s elite program of kinds, often called Citigold, particularly in gentle of the renewed curiosity within the Citi ThankYou program.

Lengthy story quick, Citigold can prevent cash on Citi annual charges, and unlock some extra perks. Let me begin with a little bit of background, as a result of I feel some disclaimers are essential.

My common philosophy on financial institution “elite standing”

Banks like Chase and Citi have particular packages for individuals who keep a sure steadiness of belongings with them. Clearly the final objective with these packages is for banks to have the ability to set up nearer relationships with prospects, and to get you to speculate your cash with certainly one of their advisors, because the banks cost charges for this administration.

Nevertheless, usually talking, all belongings you maintain with a financial institution depend towards the minimal required for standing. This consists of when you do your individual investing by means of their instruments, and even when you transfer your retirement account to certainly one of these banks.

I’m in fact not a monetary planner, or something, however I’ll share my ideas and method:

- You completely shouldn’t maintain money in a checking account with a low rate of interest merely to qualify for certainly one of these tiers, and also you additionally shouldn’t make investments with certainly one of their advisors merely to unlock these perks, except you in any other case see worth on this

- Personally, I’m a reasonably conservative investor, and I principally identical to to purchase complete market index funds, after which typically do my very own investing for issues I really feel assured about

- Since my investments aren’t “managed,” I’ve the pliability to maneuver them round to no matter financial institution I’d wish to, so I attempt to see what advantages I can squeeze out of that

- Observe that typically banks provide money bonuses when you switch a specific amount of belongings to them, so some individuals may discover that to be worthwhile, however I additionally like simply having an account that gives me long run worth, with out shifting issues round

Alongside these traces, I not too long ago moved a few of my retirement investments over to Citi, and unlocked the Citigold tier. Let me clarify why others who’re into miles & factors may wish to contemplate doing the identical.

Citigold & Citigold Non-public Consumer perks & advantages

Citigold has just a few completely different tiers of membership, however I wish to focus particularly on two tiers:

- Citigold is the commonest elite tier, which requires having $200,000 in belongings with the financial institution

- Citigold Non-public Consumer is the extra unique elite tier, which requires having $1,000,000 in belongings with the financial institution

These quantities are primarily based on eligible linked deposit, retirement, and funding accounts, no matter whether or not they’re unbiased or managed by Citi. Citi usually has vital money bonuses for individuals who transfer belongings to the financial institution, so maintain an eye fixed out for these, and so they could make it much more profitable to get a Citigold account.

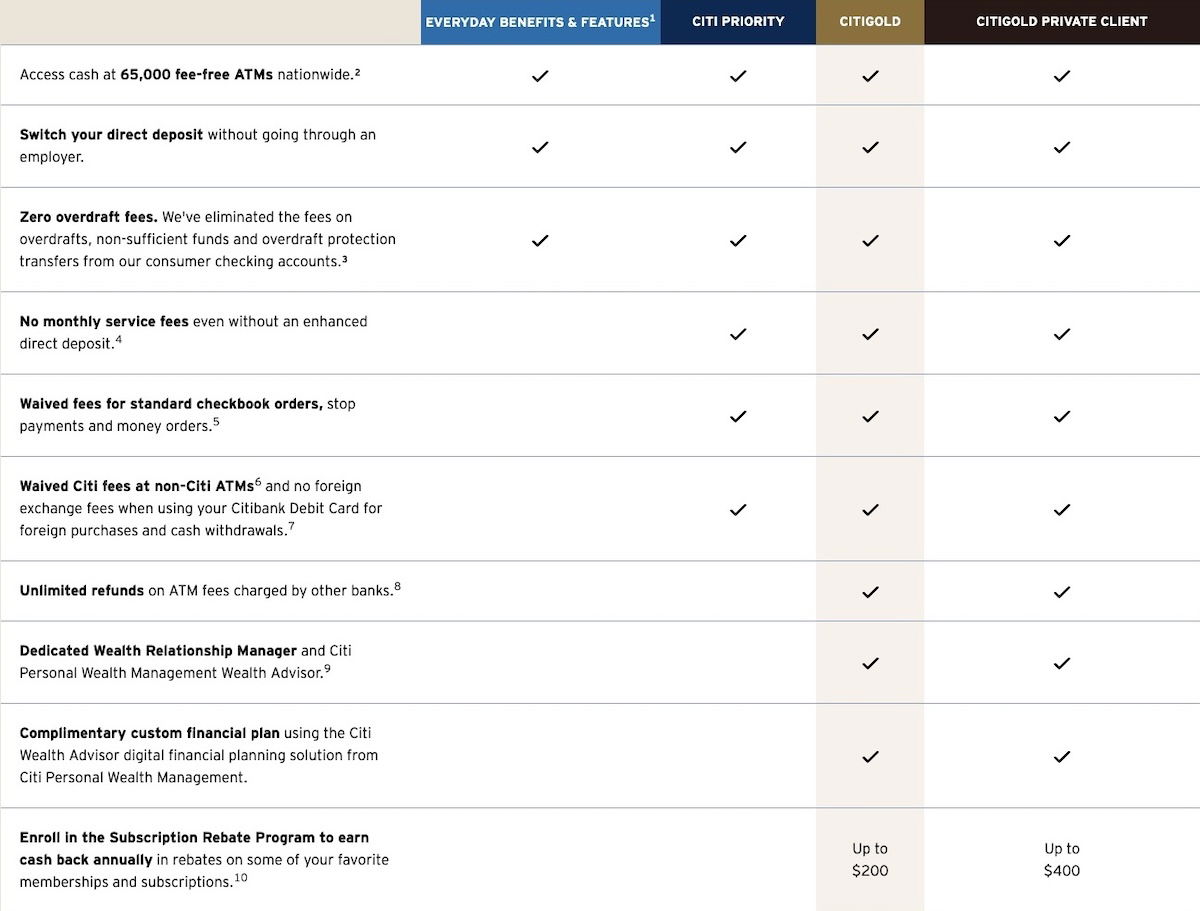

What Citi most generally tries to advertise about that is all of the price waivers you obtain with Citigold, starting from fee-free ATMs, to no month-to-month service charges, to zero overdraft charges, to waived charges for checkbook orders, and many others.

Nevertheless, for these of us into bank cards, there are two specific perks that I wish to name out…

Citigold $145 bank card annual price rebate

Citigold shoppers obtain a $145 banking relationship annual credit score. This is applicable particularly to Citi’s most premium, excessive annual price playing cards, together with the Citi Strata Elite℠ Card (assessment), Citi® / AAdvantage® Govt World Elite Mastercard® (assessment), and (discontinued) Citi Status Card.

The best way this works, when you’re a Citigold shopper and the first cardmember on certainly one of these playing cards, you obtain a $145 annual credit score towards your annual price. The important thing issues to know are that you should have Citigold standing on the date your annual price is charged. Moreover, it might take as much as three billing cycles after the annual price is charged for the credit score to put up.

So in case you have a number of playing cards, that gives some constant financial savings, and may doubtlessly make the mathematics on some bank cards work a lot better. Let me emphasize that this solely works on the above three playing cards, so that you couldn’t use these credit for decrease annual price playing cards.

Citigold $200 subscription rebate credit score

Citigold shoppers obtain a further “good as money” rebate, which can also be value caling out. Particularly, this can be a subscription rebate credit score, and it’s $200 yearly for Citigold members, and $400 yearly for Citigold Non-public Consumer members.

You must enroll for this, and then you definately simply want to make use of your Citibank debit card because the cost technique along with your most well-liked service provider. Eligible retailers embrace Amazon Prime, Costco, International Entry, Hulu, Spotify Premium, and TSA PreCheck.

Technically, the subscription rebate credit score can solely be used towards full priced memberships or subscriptions bought on-line, aside from Costco (the place purchases can be made by telephone or in retailer), and TSA PreCheck (the place purchases at enrollment facilities qualify). Anecdotally, I’ve additionally heard of some non-subscriptions crediting, however that’s not one thing you may depend on.

Backside line

Citigold is Citi’s particular banking tier for individuals who have at the very least $200,000 in belongings with the financial institution. The nice factor is that this could embrace retirement accounts, self make investments accounts, and many others. Whereas Citi usually highlights how this gives waived banking charges and entry to a devoted advisor, there are different perks value protecting in thoughts.

Citigold prospects can obtain a $145 rebate on choose premium Citi playing cards, and in addition obtain a $200 annual subscription rebate credit score, legitimate for issues like Amazon Prime and Costco memberships.

This isn’t some unimaginable program that’s going to vary your life, nevertheless it’s at the very least good to get some worth from parking your investments with one financial institution over one other. At the least that’s my opinion.

Are there every other Citigold prospects, and in that case, what has your expertise been like? Are there every other superior hidden perks I’m lacking with different banks?

Supply hyperlink