American AAdvantage Vs. Citi ThankYou Credit score Playing cards: Which Are Higher?

It’s an thrilling time for the Citi ThankYou ecosystem, as we’ve not too long ago seen American AAdvantage added as a switch associate, plus we’ve seen the launch of some new playing cards.

For individuals who use American’s co-branded bank cards for his or her spending, I feel one widespread query is whether or not it is smart to as an alternative use Citi ThankYou bank cards, after which switch these factors to American AAdvantage. On this submit, I’d like to speak about that in a bit extra element, because it’s one thing I’m fascinated about as nicely…

American AAdvantage bank cards earn Loyalty Factors

American AAdvantage has the Loyalty Factors system for incomes elite standing, whereby the elite standing you earn relies completely on what number of Loyalty Factors you rack up in a membership yr. For instance, AAdvantage Gold standing requires 40,000 Loyalty Factors, whereas AAdvantage Government Platinum standing requires 200,000 Loyalty Factors.

Arguably the simplest technique to earn Loyalty Factors is with bank card spending. Each greenback spent on an eligible co-branded AAdvantage bank card earns one Loyalty Level. This contains playing cards just like the Citi® / AAdvantage® Government World Elite Mastercard® (assessment), Citi® / AAdvantage Enterprise™ World Elite Mastercard® (assessment), and so on.

So you will have tons of people that spend cash on American’s co-branded bank cards particularly to earn standing. After all in addition they earn AAdvantage redeemable miles, however there’s no denying that in the event you take the Loyalty Factors out of the equation, different playing cards doubtlessly have way more profitable rewards buildings.

Citi ThankYou bank cards have higher rewards buildings

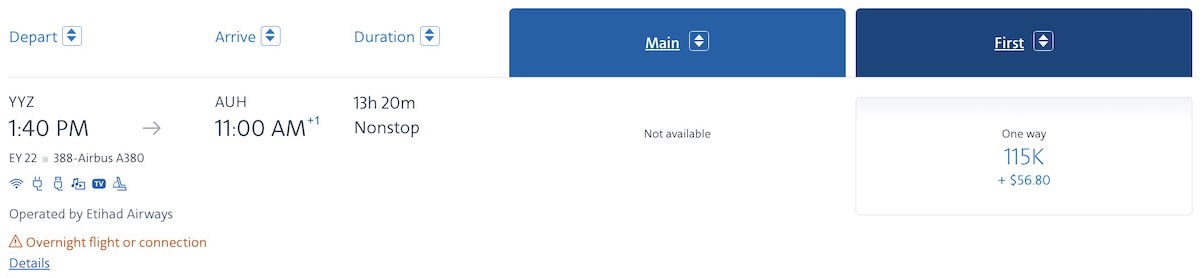

Previously, co-branded American playing cards had been the one environment friendly technique to earn AAdvantage miles with bank card spending. Nonetheless, due to a latest change, it’s now doable to switch Citi ThankYou factors to American AAdvantage at a 1:1 ratio, assuming you will have the Citi Strata Elite℠ Card (assessment) or Citi Strata Premier® Card (assessment).

Assuming you will have a kind of playing cards, then you may pool all of your Citi ThankYou factors, and switch all of them to American AAdvantage at that ratio. For instance, this additionally implies that rewards earned on the Citi Double Money® Card (assessment) could possibly be moved to AAdvantage, assuming you will have the cardboard along side one of many above.

It is a fairly unbeatable no annual charge card — it gives 1x ThankYou factors if you make a purchase order, and 1x ThankYou factors if you pay for that buy, which means you may earn as much as 2x ThankYou factors per greenback spent, after paying the invoice. There aren’t any co-branded American playing cards that earn you greater than 1x AAdvantage miles on non-bonused spending.

There’s merely no denying that you just’re going to rack up AAdvantage miles at a a lot faster fee by the Citi ThankYou ecosystem, moderately than by American AAdvantage. Equally, a number of the premium playing cards have nice bonuses classes. The Citi Strata Premier Card has useful bonus factors classes, and gives 3x factors on eating and eating places, gasoline stations and EV charging, supermarkets, airfare, and accommodations.

The catch is that in the event you transfer Citi ThankYou factors to American AAdvantage, these factors transfers don’t qualify as Loyalty Factors. So actually, the query turns into about your relative valuation of AAdvantage redeemable miles vs. AAdvantage Loyalty Factors.

What’s one of the best ways to go about doing the mathematics on this?

I’d argue that the way in which American AAdvantage has joined Citi ThankYou is fairly sensible, when it comes to avoiding cannibalizing its personal bank card enterprise an excessive amount of.

Whereas there’s a bit extra nuance to it, these trying to earn American AAdvantage miles for bank card spending now have a fairly simple query. For each greenback spent (and after paying the invoice), would you moderately earn:

- 1x AAdvantage miles and 1x Loyalty Factors per greenback spent, with a co-branded American card

- Or a minimal of 2x AAdvantage miles per greenback spent, together with numerous different bonus classes which can be extra profitable

The chance value for spending on American’s co-branded bank cards has lengthy been there. Nonetheless, the comparability is now extra direct than ever earlier than, since you may earn the identical mileage forex, simply at a a lot sooner fee.

There’s no proper or fallacious reply, although I’ll say that I feel folks usually irrationally pursue airline elite standing, even supposing its worth has decreased massively through the years. That’s primarily as a result of airways have gotten higher at monetizing top notch, so it has grow to be a lot more durable to snag a complimentary elite improve to top notch.

Let’s say you’d spend $200,000 per yr on an American card to earn Government Platinum standing. Let’s say you’d earn 200,000 AAdvantage miles on that spending, and let’s say you may in any other case earn a minimal of 400,000 AAdvantage miles by as an alternative spending on Citi ThankYou playing cards.

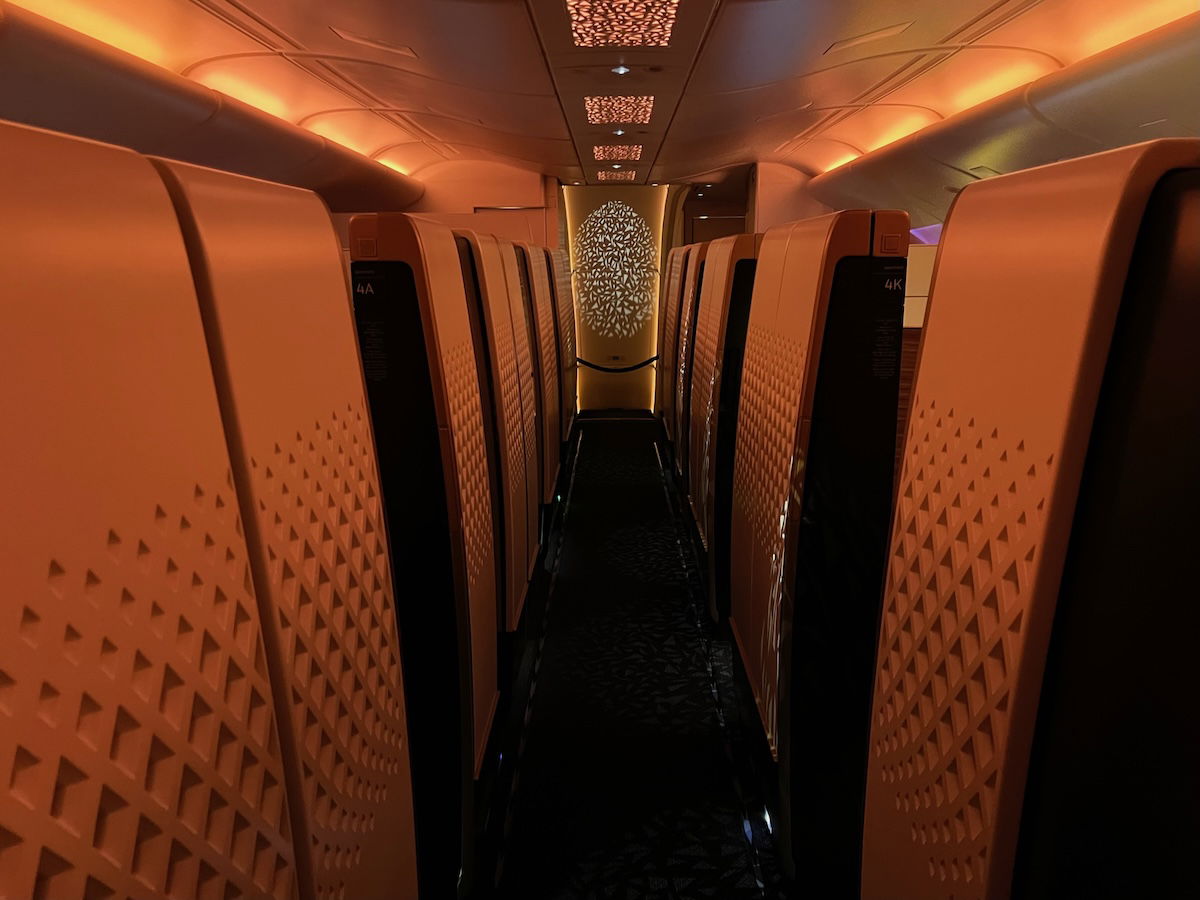

The query turns into, what number of miles would you pay for Government Platinum standing, and what are you actually getting for that? Alternatively, the incremental further miles that you just earn by Citi ThankYou can be almost sufficient for a roundtrip Etihad A380 top notch ticket from Toronto to Abu Dhabi.

That’s a fairly superior incremental perk, no? That claims nothing of the truth that incomes Citi ThankYou factors provides you a lot extra flexibility, since you should use them for all types of different redemptions as nicely.

I feel usually folks overvalue the perks of elite standing, whereas undervaluing the potential worth of the factors and miles that they’re forgoing by selecting to spend their technique to standing.

Now, whereas that’s my take, let me really admit my very own quasi irrationality. I had AAdvantage Government Platinum standing for 14 years, and I lastly dropped down from that standing this yr. It’s not that I’m not able to finishing the bank card spending. As a substitute, I simply couldn’t deliver myself to spend with such a chance value, as a result of the perks of the standing had been restricted.

I discovered only a few upgrades to be clearing, and I sometimes managed to safe a premium cabin seat at an affordable value, whether or not with miles, or as a reduced money improve.

That being stated, I’m not completely over standing. I really do worth oneworld Emerald standing immensely, even perhaps irrationally. That’s as a result of I really like all of the wonderful lounges and precedence providers that provides when flying with different oneworld airways.

So I’ve up to date my technique to be extra environment friendly:

- I’m now simply pursuing AAdvantage Platinum Professional standing, moderately than Government Platinum standing; that requires 125,000 Loyalty Factors, moderately than 200,000 Loyalty Factors

- I’m solely qualifying for standing each two years; the elite membership yr begins in March, so I’m entrance loading my spending on American playing cards round that point to earn standing as quickly as doable, which is then legitimate by the tip of February two years later, earlier than beginning the method over once more

In different phrases, my objective has gone from incomes 200,000 Loyalty Factors yearly, to as an alternative incomes 125,000 Loyalty Factors each second yr.

For all that further spending, I’d moderately use a card that maximizes my return on spending, just like the Citi Double Money Card. In spite of everything, I take pleasure in Etihad’s A380 top notch greater than I take pleasure in being the third particular person to overlook an improve on an El Paso to Dallas flight.

Backside line

With Citi ThankYou factors now being transferable to American AAdvantage, the direct alternative value of spending on American’s bank cards has elevated. That being stated, Citi ThankYou factors don’t earn you American Loyalty Factors.

So the query comes all the way down to how a lot you worth further redeemable AAdvantage miles vs. Loyalty Factors. For these trying to earn American miles, there’s a robust case to be made for utilizing a mixture of the Citi Strata Premier Card and Citi Double Money Card to maximise rewards.

Positive, that spending may not earn you standing, however everybody ought to take into consideration what incremental perks they’re really getting from standing, in comparison with how they might redeem further miles for good journey experiences.

To American flyers, has your bank card spending technique modified because of the Citi ThankYou scenario?

Supply hyperlink