My Chase Sapphire Reserve Enterprise Software Approval Expertise

Hyperlink: Apply now for the Sapphire Reserve for EnterpriseSM

The Sapphire Reserve for EnterpriseSM (overview) is Chase’s new premium enterprise card. Whereas the cardboard has a steep $795 annual charge, there are many causes to contemplate choosing up this card, together with a fully huge welcome bonus of 200,000 Final Rewards factors after spending $30,000 inside the first six months.

I made a decision to use for this new card, and need to report again with my expertise. I simply couldn’t flip down the large incentive to use, plus figured I’d give the cardboard’s worth proposition a spin.

Primary Sapphire Reserve Enterprise utility restrictions

Eligibility for the Sapphire Reserve Enterprise, together with for the welcome provide, is unrelated to which different Chase playing cards you might have. That’s a serious incentive to select up this card over one of many different choices.

For instance, you’re eligible for the welcome provide even if in case you have the non-public model of the cardboard, the Chase Sapphire Reserve® Card (overview). You’re additionally eligible for the welcome provide if in case you have one other Chase enterprise card, just like the Ink Enterprise Most well-liked® Credit score Card (overview).

As a matter of truth, the cardboard doesn’t even have any “as soon as in a lifetime” language, or something related, within the provide phrases. So in concept, you would possibly even be eligible for the cardboard (together with the provide) a number of instances.

Past that, Chase has pretty few constant restrictions in the case of approving folks for enterprise playing cards. Chase is understood for the 5/24 rule, although that’s not persistently enforced. I simply wouldn’t advocate making use of for multiple Chase enterprise card each 30 days, however even that isn’t a strict restrict.

Sapphire Reserve Enterprise utility course of

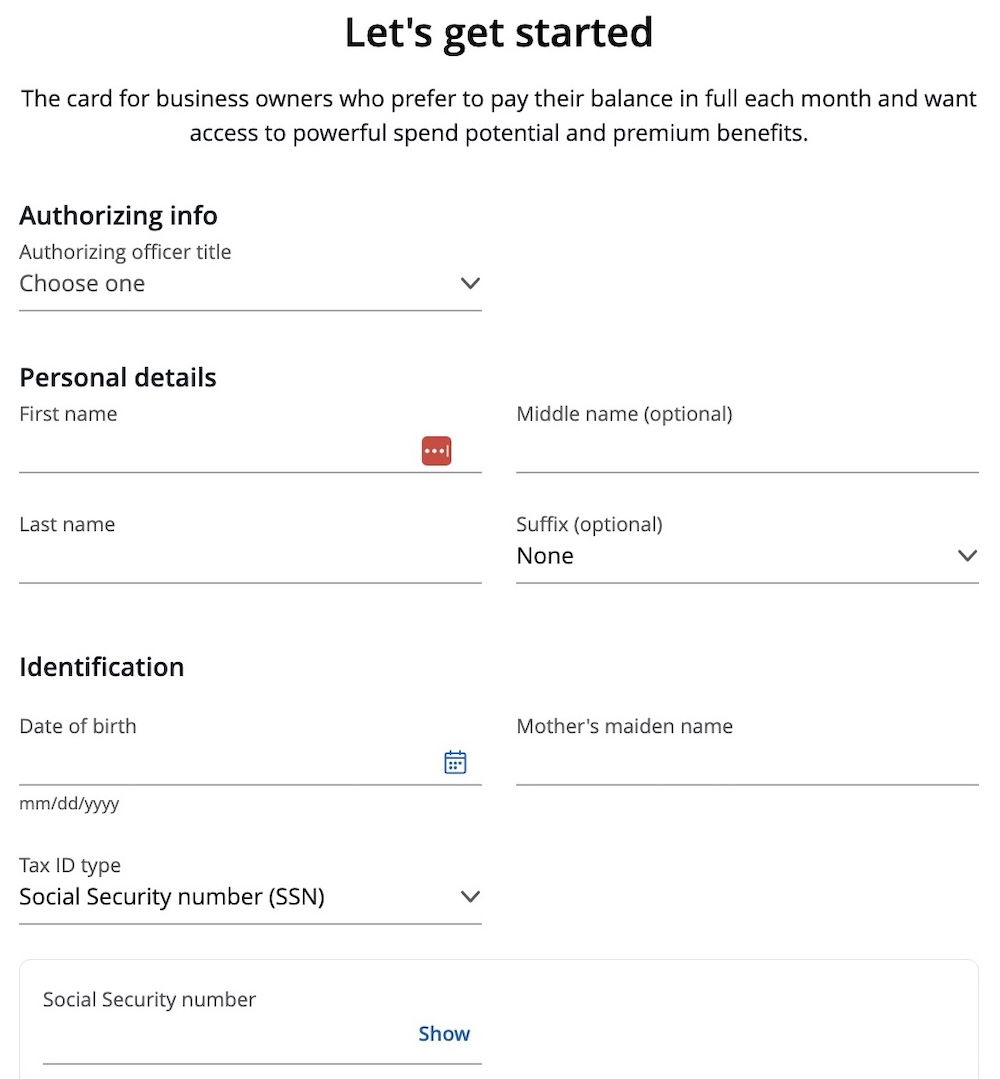

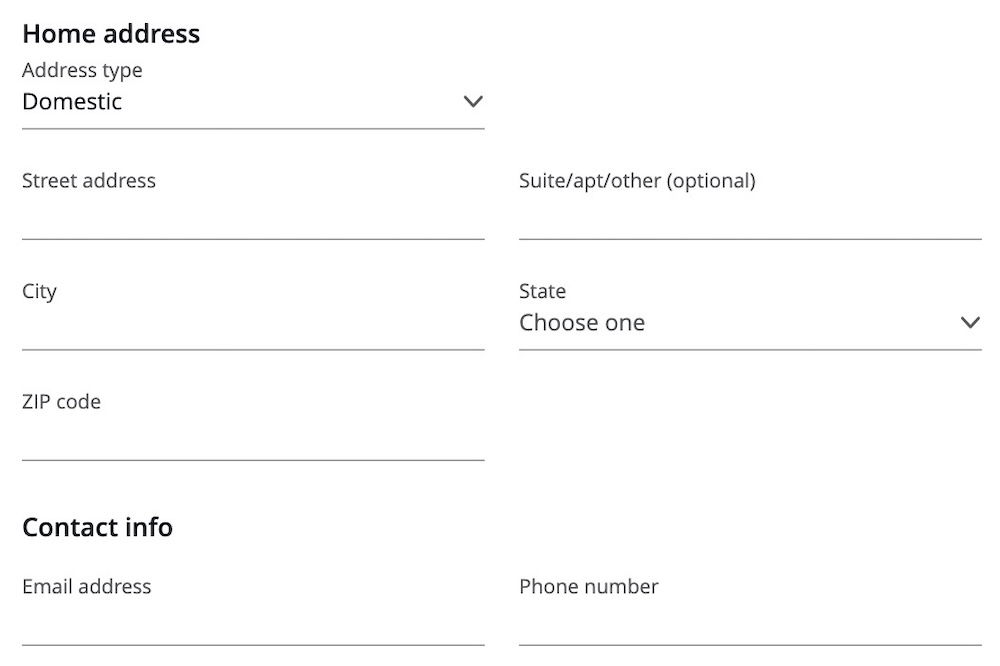

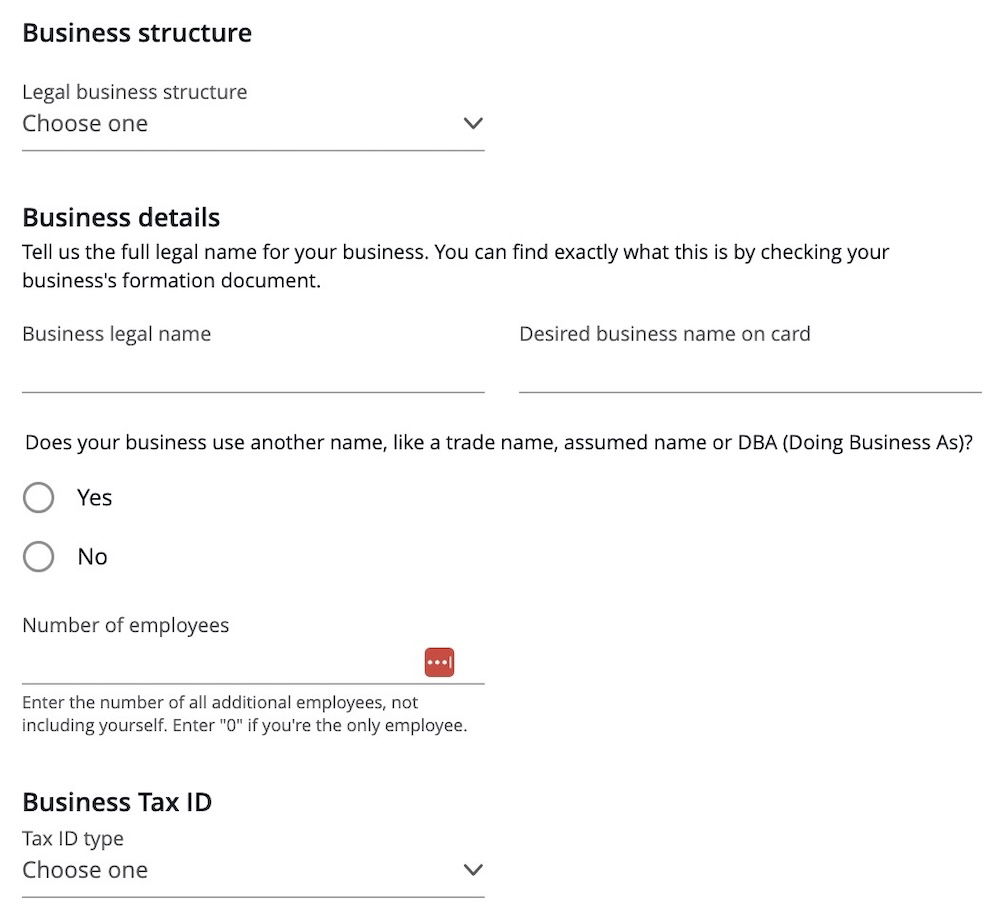

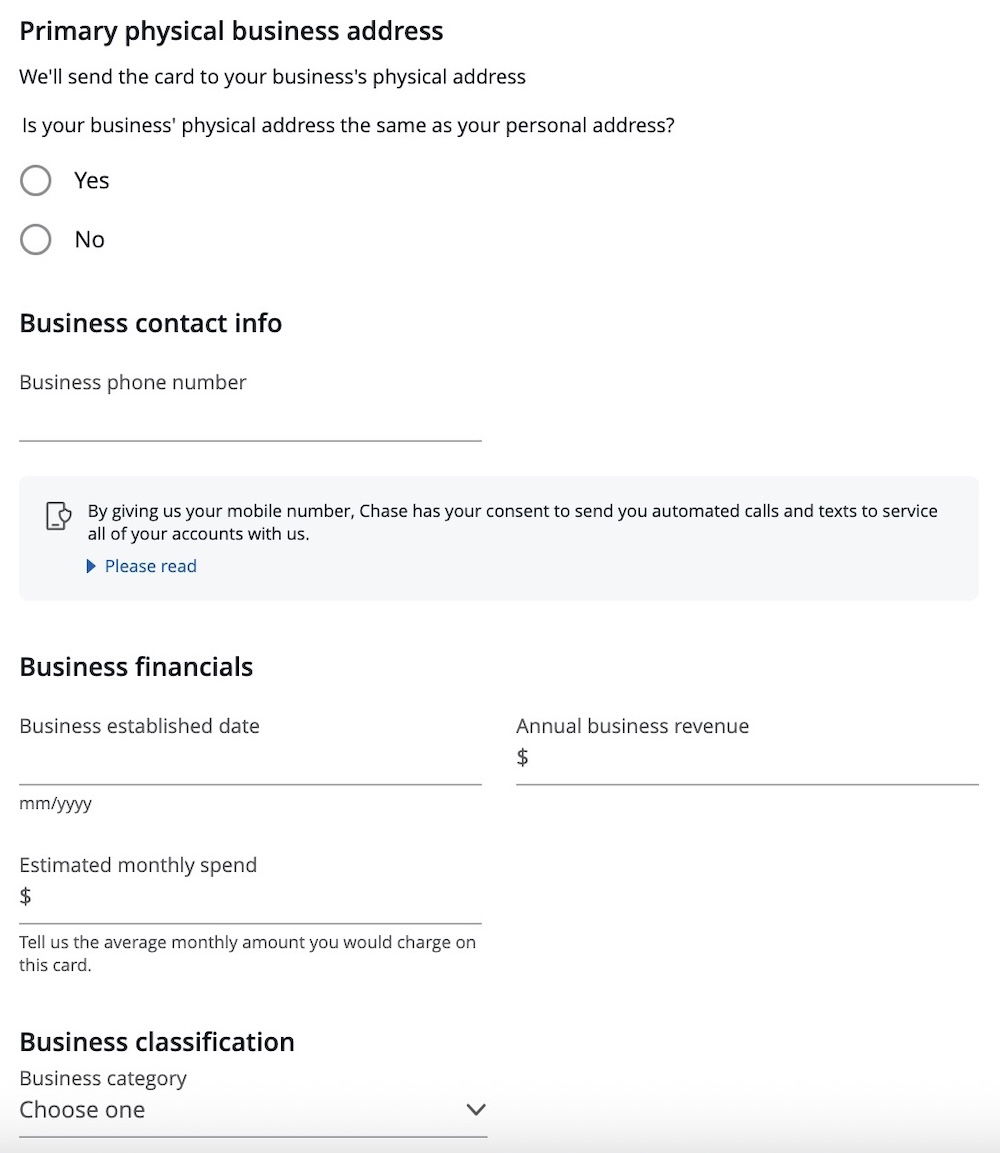

The Sapphire Reserve Enterprise utility course of is fairly simple, and consists of only one steady web page.

The primary part asks primarily for private data, much like what you’d anticipate to offer when making use of for a private bank card. We’re speaking issues like identify, tackle, social safety quantity, earnings, and many others.

The second a part of the applying asks for enterprise particulars, together with the authorized enterprise construction, enterprise identify, enterprise institution date, enterprise earnings, and many others.

Take into account that you possibly can apply for this card as a sole proprietorship, wherein case you need to use your social safety quantity because the enterprise tax ID. In the event you’re contemplating this, see my information to making use of for Chase enterprise playing cards with a sole proprietorship.

Sapphire Reserve Enterprise on the spot approval

After submitting my utility for the Sapphire Reserve Enterprise, I used to be delighted to seek out that I used to be immediately permitted, with an enormous credit score line no much less. Traditionally, I haven’t been immediately permitted for too many Chase enterprise playing cards, in order that was a pleasing shock, since I used to be anticipating I’d get a pending determination.

Moreover, since I have already got a couple of Chase enterprise playing cards, I used to be questioning if I’d run into some points, and would want my credit score line lowered on one other card. However nope, the state of affairs was the most effective case state of affairs.

After all it’s onerous to know whether or not that’s simply luck or what, however remember the fact that approval and underwriting requirements aren’t all the time the identical throughout playing cards. If a card issuer is making an attempt to develop a card portfolio, it’s commonplace to see them perhaps modify approval requirements.

I can’t say for certain if that’s the case right here, although if folks have extra knowledge factors, that would definitely be useful!

My long run Sapphire Reserve Enterprise technique

The unbelievable welcome provide on the Sapphire Reserve Enterprise was positively a giant motivator for selecting up this card. I’m an enormous fan of the non-public model of the cardboard, the Chase Sapphire Reserve, so in the long term, I’m going to wish to determine if one or each playing cards make sense for me.

In the interim, no less than giving the cardboard a attempt is a no brainer. Whereas the cardboard has a really excessive annual charge, it provides credit that may assist offset that, with the $300 annual journey credit score being the simplest of the bunch to make use of. Then there are issues like a terrific rewards construction, lounge entry, and extra.

Nonetheless, given the overlapping advantages with the non-public model of the cardboard, it’s going to take me a while to determine which card is the higher worth for me in the long term. On the plus facet, I’ve no less than a yr to determine, so I’ll make sure to report again.

Backside line

The Sapphire Reserve Enterprise is Chase’s model new premium enterprise card. The cardboard is providing an enormous welcome bonus, and I do know it’s a product that many individuals are eligible for. I simply utilized, and was delighted to seek out that I used to be immediately permitted, which doesn’t usually occur for me with Chase enterprise playing cards.

I’m trying ahead to giving this card a shot, and seeing the way it matches into my card portfolio. Particularly, I can’t argue with the huge welcome provide, which is a serious incentive to select up this product.

In the event you’ve utilized for the Sapphire Reserve Enterprise, what was your expertise like?

Supply hyperlink