Chase Ink Enterprise Card Rewards: Factors Or Money?

Chase is understood for its portfolio of Ink Enterprise bank cards, that are among the many greatest enterprise playing cards on the market. These embrace the Ink Enterprise Most well-liked® Credit score Card (evaluate), Ink Enterprise Premier® Credit score Card (evaluate), Ink Enterprise Money® Credit score Card (evaluate), and Ink Enterprise Limitless® Credit score Card (evaluate).

On this submit I wished to handle the one query that I get probably the most typically about these playing cards, which pertains to what sort of rewards these playing cards earn. Do they earn money again, journey rewards, or each?

I can completely perceive the confusion, on condition that the playing cards have totally different advertising (with some selling journey rewards and others selling money rewards), one card has “Money” within the title, and so forth. There’s fairly a little bit of nuance to this, so let me deal with this in a bit extra element.

Chase Ink Enterprise card rewards simplified

There are 4 Chase Ink Enterprise playing cards, and so they have three totally different sorts of rewards buildings. To be clear, I’m not speaking concerning the bonus classes or return on spending provided by the playing cards, however somewhat this submit is particularly concerning the forms of rewards that these playing cards provide.

Do they provide factors that may be redeemed towards journey, do they provide money again, or do they provide the flexibleness for both? Throughout these 4 playing cards, you’ll discover three totally different insurance policies:

Let me talk about every of those playing cards in a bit extra element under, to higher clarify that…

The Chase Ink Most well-liked earns journey rewards

The $95 annual price Ink Enterprise Most well-liked® Credit score Card is arguably probably the most profitable card within the portfolio. This can be a journey rewards card, plain and easy, and it accrues Final Rewards factors. What this implies is that:

In order you possibly can see, the Ink Enterprise Most well-liked is a journey rewards card within the true sense, with the choice to redeem for money at a suboptimal worth.

The Chase Ink Premier earns money again

The $195 annual price Ink Enterprise Premier® Credit score Card is without doubt one of the greatest money again playing cards available on the market, because it provides a flat 2.5% money again on purchases of over $5,000 (in any other case you earn at the least 2% money again). This can be a true money again card:

- You’ll see that rewards submit to your account as factors (2.5x factors per greenback on purchases of $5,000 or extra, and a minimal of 2x factors per greenback on different purchases)

- Every level can then be redeemed for one cent, whether or not you favor money again, a present card, or no matter else; you would possibly as nicely redeem your rewards for money, since there’s no different option to get outsized worth

- There’s no choice to pool your factors with these of different Chase playing cards to extend their worth; so you possibly can’t switch the purpose to Chase Final Rewards airline or lodge companions, or redeem at an elevated price by means of the Chase Journey Portal

Whereas the Ink Enterprise Premier is an incredible money again card, it’s probably the most restrictive Chase Ink Enterprise card in relation to with the ability to mix rewards. So that you’ll solely wish to get this card for those who’re actually trying to earn money again.

The Chase Ink Money & Limitless earn money again or journey rewards

The no annual price Ink Enterprise Money® Credit score Card and Ink Enterprise Limitless® Credit score Card are each nice merchandise, as they provide a rewarding return on spending. The playing cards additionally are inclined to trigger probably the most confusion in relation to their rewards buildings.

On the floor, these are money again playing cards. You’ll see the playing cards marketed as providing money again, each by way of the welcome bonuses (which might be someplace round $750 or $900), and by way of the return on spending (which might be wherever from 1-5%).

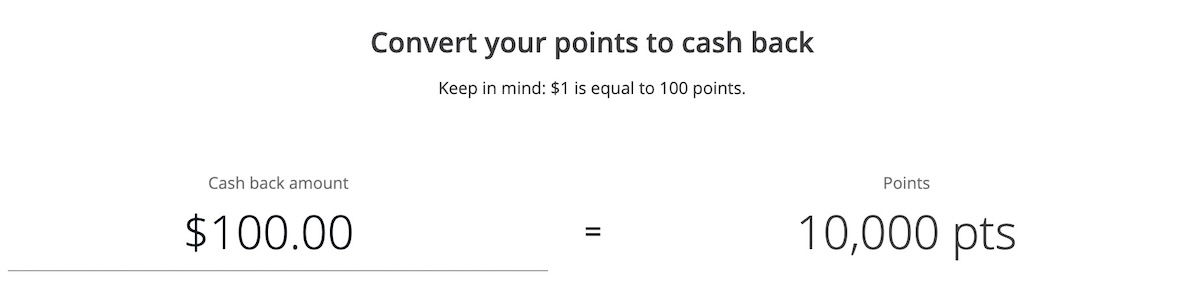

In actuality, every cent money again posts to your account as one level, after which you possibly can redeem these factors for assertion credit or different money equivalents. In different phrases, $100 in accrued money again would present in your account as 10,000 factors, and will then be redeemed at any level for $100.

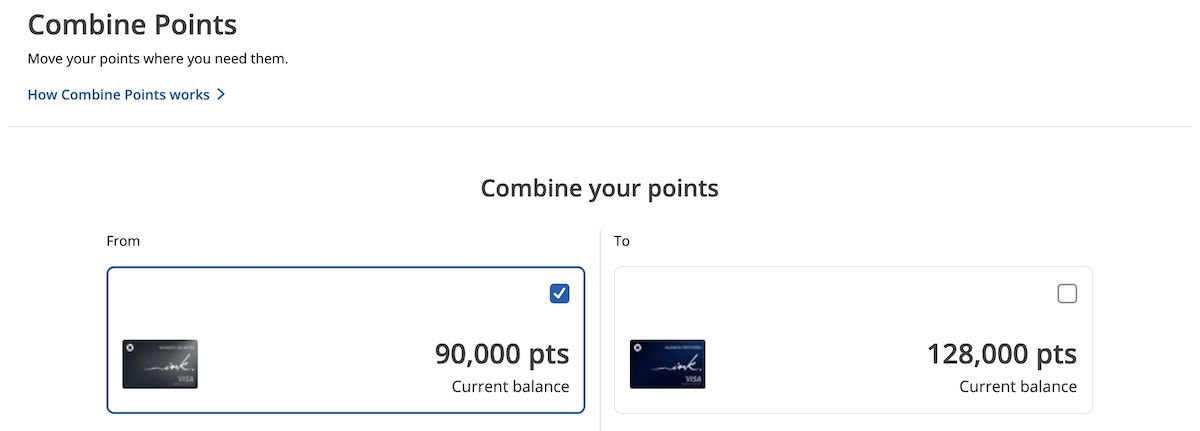

However that is additionally the place these playing cards get attention-grabbing. In contrast to on the Ink Enterprise Premier® Credit score Card, rewards on the Ink Enterprise Money® Credit score Card and Ink Enterprise Limitless® Credit score Card might be transformed into “premium” Final Rewards factors, which might be redeemed at the next worth.

Any of the next three playing cards would let you redeem all of your factors earned on these playing cards at the next worth:

In case you have the Ink Enterprise Money® Credit score Card or Ink Enterprise Limitless® Credit score Card at the side of a type of playing cards, immediately your factors are rather more useful. At a minimal, you possibly can redeem on the following charges by means of the Chase Journey Portal:

That will increase the worth of your factors by 25-50% proper there, and you may probably get much more worth out of your factors by transferring them to one of many Final Rewards airline or lodge companions (which is my most well-liked redemption). You may switch factors instantly by means of your on-line account, and you may examine how to try this right here.

Backside line

Chase Ink Enterprise playing cards are glorious, although it may be laborious to make sense of which playing cards earn which rewards, given how the playing cards are structured. Hopefully the above is a helpful rundown for anybody who was confused, although to summarize:

Any questions?