Hilton Aspire Card $200 Flight Credit score: How It Works

Hyperlink: Apply now for the Hilton Honors American Categorical Aspire Card

The Hilton Honors American Categorical Aspire Card (evaluate) is likely one of the most useful resort bank cards on the market, because of all the nice perks the cardboard affords.

Whereas the cardboard has a steep $550 annual charge, I discover that to be simple to justify, because of advantages like Hilton Honors Diamond standing, an annual free night time reward, a $400 annual resort credit score, a $200 annual flight credit score, and extra.

On this publish, I wished to take a better have a look at how the cardboard’s $200 annual flight credit score works. Whereas this profit (annoyingly) must be used quarterly, I discover it fairly simple to make use of, so I wished to go over these particulars.

Particulars of the Hilton Aspire Card $200 flight credit score

The Hilton Aspire Card affords as much as $200 in flight assertion credit each calendar 12 months, within the type of a $50 quarterly credit score. As you’d count on, there are some phrases to pay attention to:

- The $200 credit score is damaged down right into a $50 quarterly credit score, so you should utilize one in January by means of March, one in April by means of June, one in July by means of September, and one in October by means of December

- The credit score applies towards airfare purchases made straight with an airline, or by means of amextravel.com

- To be eligible for the profit, the airfare buy have to be for a scheduled flight on a passenger provider

- The credit score can’t be utilized towards ticket change or cancelation charges, or flight purchases made by means of third events

- It could actually take 8-12 weeks after an eligible buy for the assertion credit score to publish, although in apply they’ll sometimes publish sooner than that

- Eligible purchases might be made by both the essential card member or a certified consumer, although you continue to solely get a complete of as much as $200 in credit per 12 months

- There’s no registration required to make the most of this, so long as you make the right eligible purchases with the cardboard

How I take advantage of the Hilton Aspire Card $200 flight credit score

The Amex airline charge credit score on merchandise like The Platinum Card® from American Categorical (evaluate) might be troublesome to make use of, on condition that it particularly excludes airfare, and solely applies to airline charges, which many people don’t spend a lot on. By comparability, the credit score on the Hilton Aspire Card is superior, because it’s particularly legitimate for airfare.

Now, the catch is that I attempt to maximize my factors on airfare purchases, so I don’t simply need to buy all my airfare on the Hilton Aspire Card. So, what’s my technique? Nicely, every quarter, I simply ebook a really low-cost ticket (of a minimum of $50) with the Hilton Aspire Card, after which I obtain the $50 quarterly credit score.

With airways these days not having change charges (a minimum of for non-basic financial system tickets, in most conditions), I may all the time cancel that ticket after which financial institution it as a credit score towards one other ticket that I’d ebook. Since I fly American most, that’s the airline with which I find yourself utilizing the credit score.

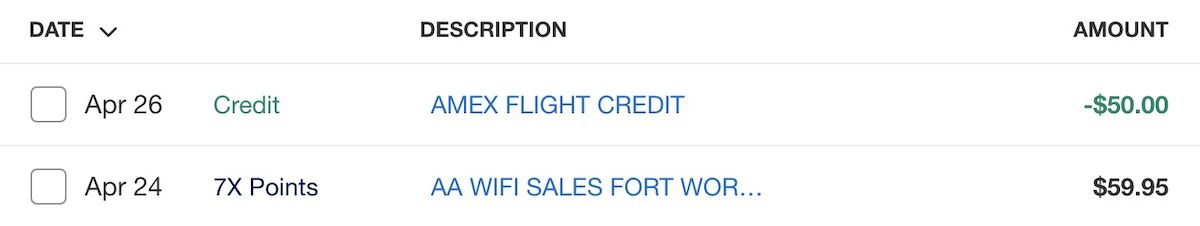

By the way in which, it wasn’t my intention, however I’ll share one other means I’ve used this credit score. I’ve my the Hilton Aspire Card connected to my American AAdvantage profile (since I ebook a ticket with the Hilton Aspire a minimum of as soon as per quarter).

I by accident began billing my month-to-month Wi-Fi subscription for American to the cardboard, and seen that additionally bought reimbursed beneath the flight credit score. I can’t assure that may work for everybody, however that’s good to know as effectively.

Clearly in an excellent world, this credit score wouldn’t need to be redeemed quarterly, however then once more, we’re fairly used to Amex credit being damaged up.

To me, this is likely one of the perks that helps justify the $550 annual charge on the cardboard. The way in which I view it, the Hilton resort credit score and flight credit score helps to offset a lot of the annual charge, whereas the annual free night time reward and Hilton Honors Diamond standing are what actually make this card particular, and what provide outsized worth.

Backside line

The Hilton Aspire Card affords many invaluable advantages, and amongst these is a $200 annual flight credit score. It is a quarterly credit score, so that you rise up to a $50 assertion credit score each three months that may be utilized towards an eligible flight buy.

I simply find yourself placing an affordable flight buy onto this card as soon as per quarter. Ideally it’s for a flight I truly take, although in any other case I simply purchase a ticket with some flexibility (which most tickets have these days), after which I can all the time financial institution the credit score towards one other flight.

What has your expertise been with utilizing the Hilton Aspire Card $200 flight credit score?