Is it potential to have too many factors? How TPG recommends a reader redeem 35 million miles

You may take into account a 100,000-point welcome bonus on a brand new bank card to be an enormous haul, and it’s, however not all factors balances are created equal.

Enterprise homeowners with vital month-to-month enterprise bills may discover they’re incomes factors even quicker than they’ll redeem them with the appropriate bank card.

Previously, we have seen some spectacular level balances from readers (and even TPG staffers), however this may be the most important but.

This is how one can spend hundreds of thousands of bank card factors.

Can you may have too many journey rewards?

TPG reader Larry M. contacted us searching for some recommendation on how one can use his factors. He is been amassing Membership Rewards factors via his American Categorical playing cards for over 13 years and want to e book a cruise utilizing them.

Larry at the moment has a staggering 27 million Membership Rewards factors, in addition to 3.8 million Hilton Honors factors, 1.8 million Marriott Bonvoy factors and a couple of.8 million American Airways AAdvantage miles.

He earned most of these on The Enterprise Platinum Card® from American Categorical. He often redeems round 1 to 1.5 million factors for journey annually.

He particularly requested what number of factors it might take to pay for a $10,000 cruise with the Amex Enterprise Platinum versus the Chase Sapphire Reserve® or one other card that TPG recommends.

The best way to maximize hundreds of thousands of bank card rewards

The Factors Man founder, Brian Kelly, shared his recommendation in his current weekly publication:

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

You may get the perfect worth for these Amex factors when utilizing them for airfare — whether or not transferring to airline companions or via Pay with Factors utilizing your Amex Enterprise Platinum card to get the 35% rebate on sure flights.

That stated, Amex factors usually are not nice when redeeming for cruises. By way of Amex Journey you are solely getting round 0.7 cents per level.

There aren’t any good cruise bank cards, so neglect that. What you really want is a strong cash-back cost card — ideally one with no preset spending restrict or a big credit score line (since you spend so much). Many playing cards provide 2% again on all purchases with out worrying about any bonus classes.

Let’s do the maths on this — for each $1 million you spend, you are going to get $20,000 in money again. You need to use that money again to purchase cruises, rental automobiles, you identify it. In distinction, 1 million Amex factors, if you redeem for a cruise, could be value $7,000. So, you’d get practically 3 times the worth by spending on a 2% cash-back card.

I feel it is time to cease placing all of the spending on the Amex and begin incomes money again. The factor with money again versus factors is you could make investments the money and it will possibly develop over time. Your Amex factors steadiness is just not growing in worth over time.

So use your stockpile of Amex factors for flights and resort factors for motels, and use your money again for every part else.

Let’s break down a few of Brian’s recommendation:

- The Enterprise Platinum Card from American Categorical affords American Categorical Journey’s Pay with Factors function, which lets you obtain a 35% rebate if you use factors towards first- and business-class flights on any airline and economy-class flights in your chosen airline. The 35% rebate is capped at 1 million factors again per calendar yr. If Larry have been searching for a simple option to redeem his factors, maybe to hitch a cruise departing from Europe or Asia, he may simply redeem his Membership Rewards factors for 1.54 cents every with out worrying about switch companions or award availability.

- Whereas Larry may e book cruises utilizing his Amex factors, this isn’t a good way to make use of them as he would solely obtain 0.7 cents per level in worth.

- Relatively than incomes hundreds of thousands of factors he could not simply be capable to use, Larry may take into account a enterprise bank card that earns beneficiant money again, which he may use to pay for any cruise he wished. Whereas it won’t be as attractive because the Enterprise Platinum Card, Larry may take into account the Capital One Spark Money Plus, which affords a sign-up bonus of $1,200 after you spend $30,000 within the first three months of card membership with an annual price of simply $150 (see charges and costs) — which is waived if you spend $150,000 on the cardboard in a yr. Plus, he’d earn a limiteless 2% money again on each buy, all over the place — with no limits or class restrictions. 1,000,000 {dollars} spent on this card annually would earn Larry $20,000 in money again (plus the $1,200 welcome bonus), sufficient to pay for 2 luxurious cruises annually.

Associated: Greatest enterprise bank cards of 2024

Different redemption choices

If Larry have been to modify to a cash-back bank card, he nonetheless has an eye-watering variety of Membership Rewards factors he may use. Whereas his focus is on cruises, he has so many factors he may simply take into account another journey.

Listed here are some suggestions:

- Fly a household of 4 in enterprise class round-trip to Europe for 400,000 Membership Rewards factors by transferring them to Air France-KLM’s Flying Blue program and utilizing the versatile calendar search to search out availability throughout the yr.

- Larry may switch Membership Rewards to Singapore Airways’ KrisFlyer program to fly a household of 4 to and from Singapore in enterprise class on the world’s longest flight, reserving extra available Benefit awards for 287,000 factors per particular person (so simply over 1 million Amex factors). That might be even cheaper if he is capable of finding saver-level awards — although these are usually fairly scarce on this route.

- With that many Amex factors, it is unlikely Larry would ever have to fly economic system once more. Nonetheless, transferring his Membership Rewards to British Airways Govt Membership would enable him to e book flights to Hawaii from simply 16,000 Membership Rewards every method on American and Alaska Airways from the West Coast. Home first-class flights value a better 42,000 Avios every method, but when he can discover availability, this might nonetheless be an important redemption choice.

Larry additionally has practically 3 million American miles, and with the AAdvantage program’s swap to dynamic pricing for AA-operated flights, Larry’s steadiness might be shortly swallowed up. Just some long-haul journeys along with his household may do it, because it’s commonplace to see 400,000 AAdvantage miles per flight in premium cabins.

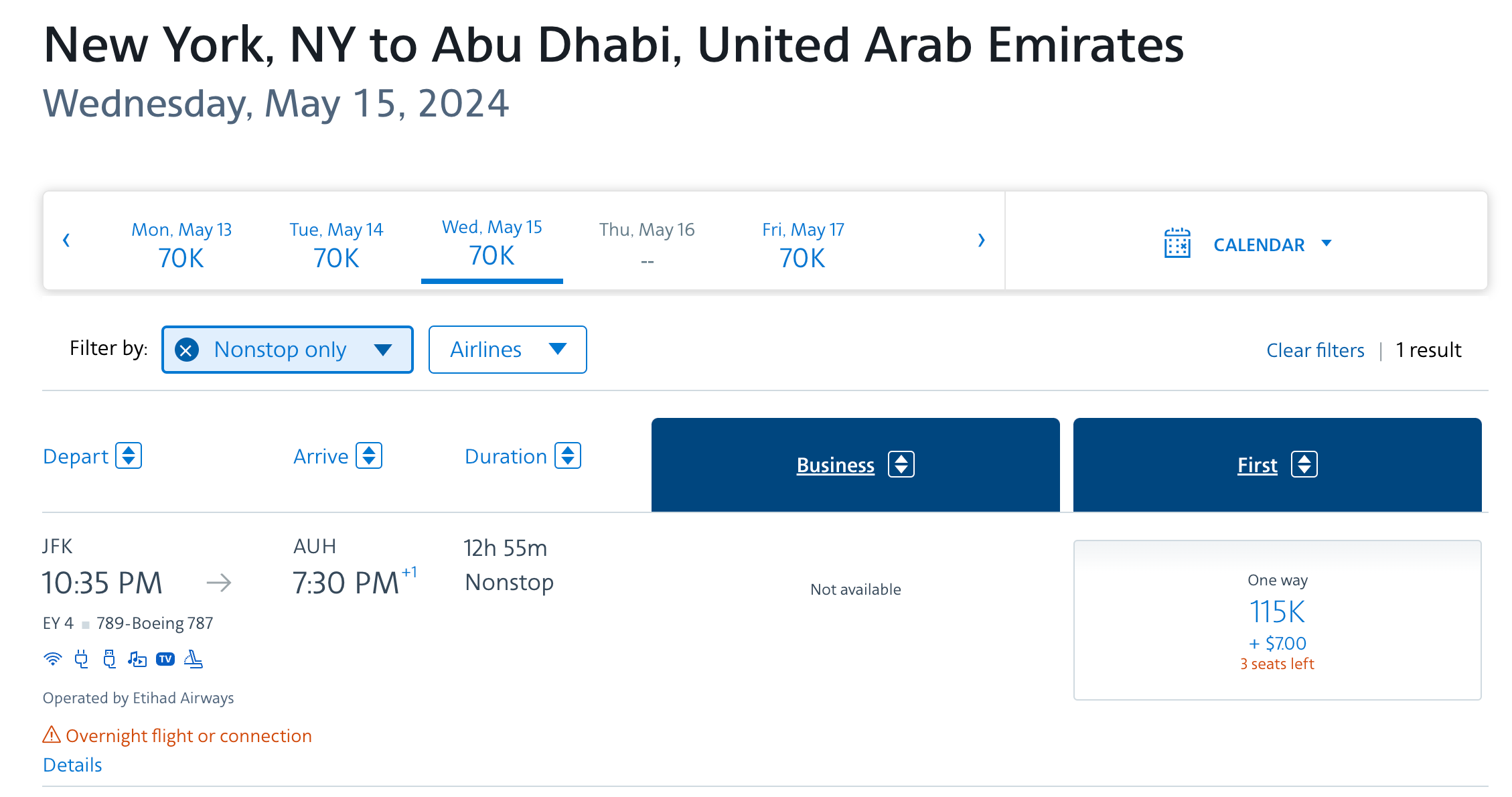

Happily, AA has, for now, retained an award chart for flights operated by associate airways. Whereas British Airways ought to usually be averted because of its excessive carrier-imposed surcharges to Europe, there are many nice offers to be discovered if Larry can e book both effectively prematurely or on the final minute on the likes of Japan Airways, Iberia, Etihad Airways and Qatar Airways.

Larry additionally has seven-figure balances of resort factors. Listed here are a few of our favourite makes use of of Hilton Honors and Marriott Bonvoy factors.

Greatest journey bank cards to earn factors and miles

Whilst you will not earn 35 million factors from a single welcome bonus, it is easy to earn a number of priceless factors and miles with the appropriate journey bank card. Listed here are a few of our favorites providing nice welcome bonuses proper now:

Any of those may enable Larry’s balances to develop even additional.

Backside line

Larry’s factors downside is an envious one to have. He already has a lifetime of Membership Rewards factors, with not less than 1,000,000 further factors rolling in yearly.

Whereas he may get nice worth utilizing his current Membership Rewards factors to e book flights to place to and from the cruises he likes to take via his Enterprise Platinum’s Pay with Factors function, reserving cruises this manner is not a good way to make use of his eight-figure steadiness.

As an alternative, he may take into account a cash-back card that may earn him 2% on each buy. He may then use these rewards to e book any cruises he likes.

As for redeeming his current factors for flights or resort stays, the skies are the restrict.